IDC: China's smart glasses market grew 116.1% year-on-year in the first quarter of 2025

The Zhitong Finance App learned that according to IDC's latest “Global Smart Glasses Market Quarterly Tracking Report”, the global smart eyewear (Smart Eyewear) market shipped 1.487 million units in the first quarter of 2025, an increase of 82.3% over the previous year. Among them, the global audio and audio shooting glasses market shipped 831,000 units, up 219.5% year on year; the AR/VR market shipped 656,000 units, up 18.1% year on year. The smart glasses market still uses Meta as the main driver in the global market. In addition to the US market, it has also begun to focus on layout in the Western European market. In the first quarter of 2025, China's smart eyewear (Smart Eyewear) market shipped 494,000 units, an increase of 116.1% year over year.

Among them, the Chinese audio and audio shooting glasses market shipped 359,000 units, an increase of 197.4% over the previous year. Currently, the audio and audio shooting glasses market in China is still dominated by audio glasses products. The main players include Xiaomi, Huawei, and Jiehuan; the new Thunderbird V3 went on sale in the first quarter, driving significant growth in the audio shooting glasses market. The AR/VR market shipped 135,000 units, a year-on-year increase of 25.2%. Major players include Pico, Xreal, Thunderbird, Inmo, etc. The focus of China's AR/VR market has gradually shifted to the AR&ER market in the past two quarters. In the first quarter, the AR&ER market shipped 86,000 units, reaching 63.8%, and shipments increased by 64.0% year on year. Among them, Xreal, Thunderbird, and Seiji Meizu jointly promoted market growth.

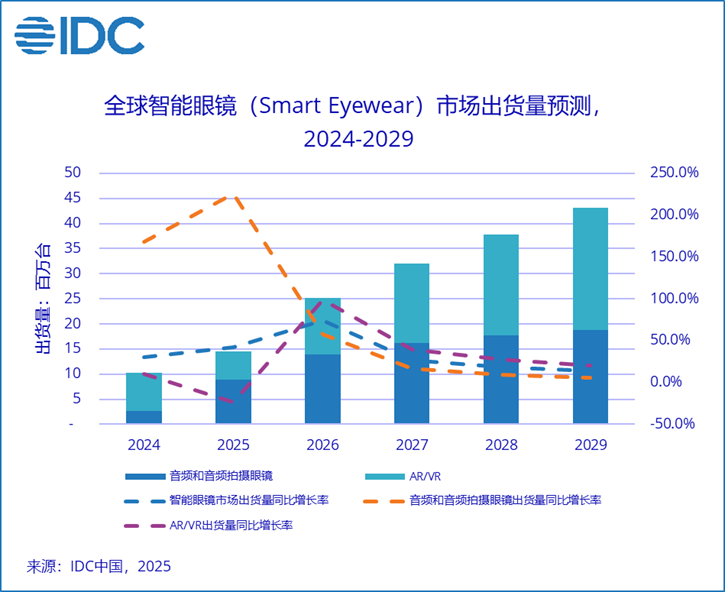

In 2025, global smart eyewear (Smart Eyewear) market shipments are expected to reach 14.518 million units, up 42.5% year on year. Of these, shipments of audio and audio shooting glasses are expected to be 8.828 million units, up 225.6% year on year; AR/VR equipment shipments are expected to be 5.69 million units, down 23.9% year on year. Among them, the decline in the AR/VR market is mainly affected by the MR market. Due to the stagnation or delay in the pace of products from important manufacturers, some shipments will be delayed from 2025 to 2026.

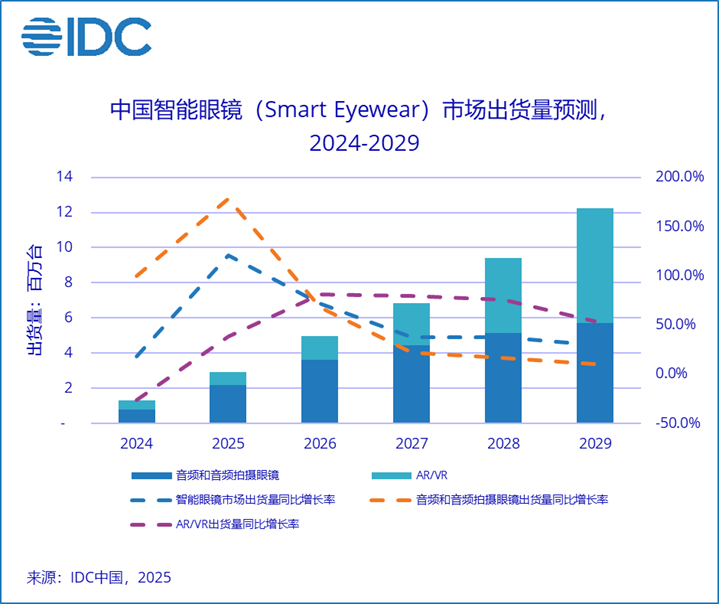

In 2025, China's smart eyewear (Smart Eyewear) market shipments are expected to reach 2.907 million units, up 121.1% year on year. Among them, shipments of audio and audio shooting glasses are expected to be 2.165 million units, up 178.4% year on year; AR/VR equipment shipments are expected to be 742,000 units, up 38.1% year on year.

In 2025, China's smart eyewear (Smart Eyewear) market will show the following development characteristics:

1. The audio shooting glasses market will welcome new players, and the market pattern will soar

Beginning in June 2025 until the end of the year, China's leading mobile phone and internet manufacturers will launch various audio shooting glasses products, which is expected to reshape the market pattern. With the support of AI's large model capabilities, audio shooting glasses give terminal devices more design space in terms of multi-modal interaction, which will bring more GUI expandability and playability to glasses-type devices with a lower market threshold when AR products are still immature in technology, cost, and supply.

2. The smart glasses market will expand more into traditional eyewear channels

Part of the growth in the audio and audio shooting glasses market in the first quarter of 2025 came from the contribution of offline channel expansion. According to IDC data, retail channel shipments in China's audio and audio shooting glasses market increased 75.3% year-on-year in the first quarter of 2025. This type of product is more similar to traditional glasses in terms of appearance, weight, and price, and myopic people are also a key target user group for this type of product, and they need to join a professional optometry process in the purchase link. This will push equipment manufacturers closer to traditional eyewear channels, such as Doctor Glasses, Formosa Glasses, etc., and will also facilitate the digital transformation of traditional eyewear channels. For AR/VR products, smart hardware manufacturers and traditional eyewear manufacturers have more advantages in offline channels, and the entry of new players has further intensified channel competition pressure on technology innovators, causing the entire AR/VR market to shift from a focus on online to a diversified omni-channel layout.

3. The main force in the AR/VR glasses market will shift to lightweight glasses, and professional-grade glasses will further develop market segments

In the second half of 2025, the explosion of the eyewear concept and the entry of head hardware manufacturers will jointly drive lightweight glasses with displays to usher in high growth. Science and technology innovators that currently have a high market share will, on the one hand, actively lay out lightweight eyewear product lines, and on the other hand, rely on their professional technology accumulation to further seize market segments. Lightweight glasses provide new consumer-grade application scenarios including all-weather companionship, light sports and health, and light business travel under the trend of gradually becoming saturated and growing slowly, bringing a new foothold to the AR/ER market. Furthermore, it also provides VR & MR manufacturers with rich technology accumulation with new ideas for commercialization and an opportunity to regain market share.

Pan Xuefei, research director at IDC China, believes that compared to Meta's accelerated pace of expansion in the global market, the development of the Chinese audio shooting glasses market in 2025 is slightly cautious. Although leading manufacturers will enter the market one after another in the second half of the year, the overall pace is still steady, and the adaptation and linkage of audio shooting glasses with AI models and software ecosystems in the Chinese market still needs to be further explored and explored.

Ye Qingqing, China market analyst at IDC, believes that 2025 is a critical turning point for the Chinese AR/VR market. After two years of continuous decline, the market finally ushered in a new growth window under the development of lightweight glasses. Market competition will become more intense, and the manufacturer pattern will change rapidly. How to make forward-looking product plans and keep up with market changes and adjustment strategies during the critical period will be a decisive factor in whether AR/VR manufacturers can win key market shares in the early stages.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal