Asian Penny Stocks With Market Caps Under US$2B To Watch

Amidst escalating geopolitical tensions in the Middle East and evolving trade dynamics, Asian markets have been navigating a complex landscape. Despite these challenges, there are still opportunities for investors seeking growth potential in less conventional areas of the market. Penny stocks, often associated with smaller or newer companies, can offer significant value when backed by strong financials and fundamentals. In this article, we explore several promising penny stocks that stand out as potential hidden gems within Asia's diverse economic environment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.92 | HK$2.38B | ✅ 3 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.22 | HK$769.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.84 | THB3B | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.16 | HK$1.8B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.445 | SGD180.35M | ✅ 3 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.19 | HK$1.99B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.30 | SGD9.05B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.179 | SGD35.66M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.14 | SGD861.46M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.64 | HK$53.16B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,154 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Beijing Jingcheng Machinery Electric (SEHK:187)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Jingcheng Machinery Electric Company Limited manufactures and sells gas storage and transportation equipment both in the People’s Republic of China and internationally, with a market cap of HK$6.10 billion.

Operations: Beijing Jingcheng Machinery Electric Company Limited has not reported any specific revenue segments.

Market Cap: HK$6.1B

Beijing Jingcheng Machinery Electric Company Limited, with a market cap of HK$6.10 billion, has recently reported Q1 2025 revenues of CNY 323.13 million and a net loss of CNY 11.91 million, reflecting an increase in losses compared to the previous year. Despite its volatile share price and negative operating cash flow indicating debt is not well covered, the company has reduced its debt-to-equity ratio over five years and maintains more cash than total debt. The management team is seasoned with an average tenure of 3.7 years, while short-term assets exceed both short- and long-term liabilities significantly.

- Click to explore a detailed breakdown of our findings in Beijing Jingcheng Machinery Electric's financial health report.

- Assess Beijing Jingcheng Machinery Electric's previous results with our detailed historical performance reports.

Chinasoft International (SEHK:354)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Chinasoft International Limited, along with its subsidiaries, offers IT solutions, IT outsourcing, and training services across several countries including China, the United States, and others; it has a market capitalization of approximately HK$12.33 billion.

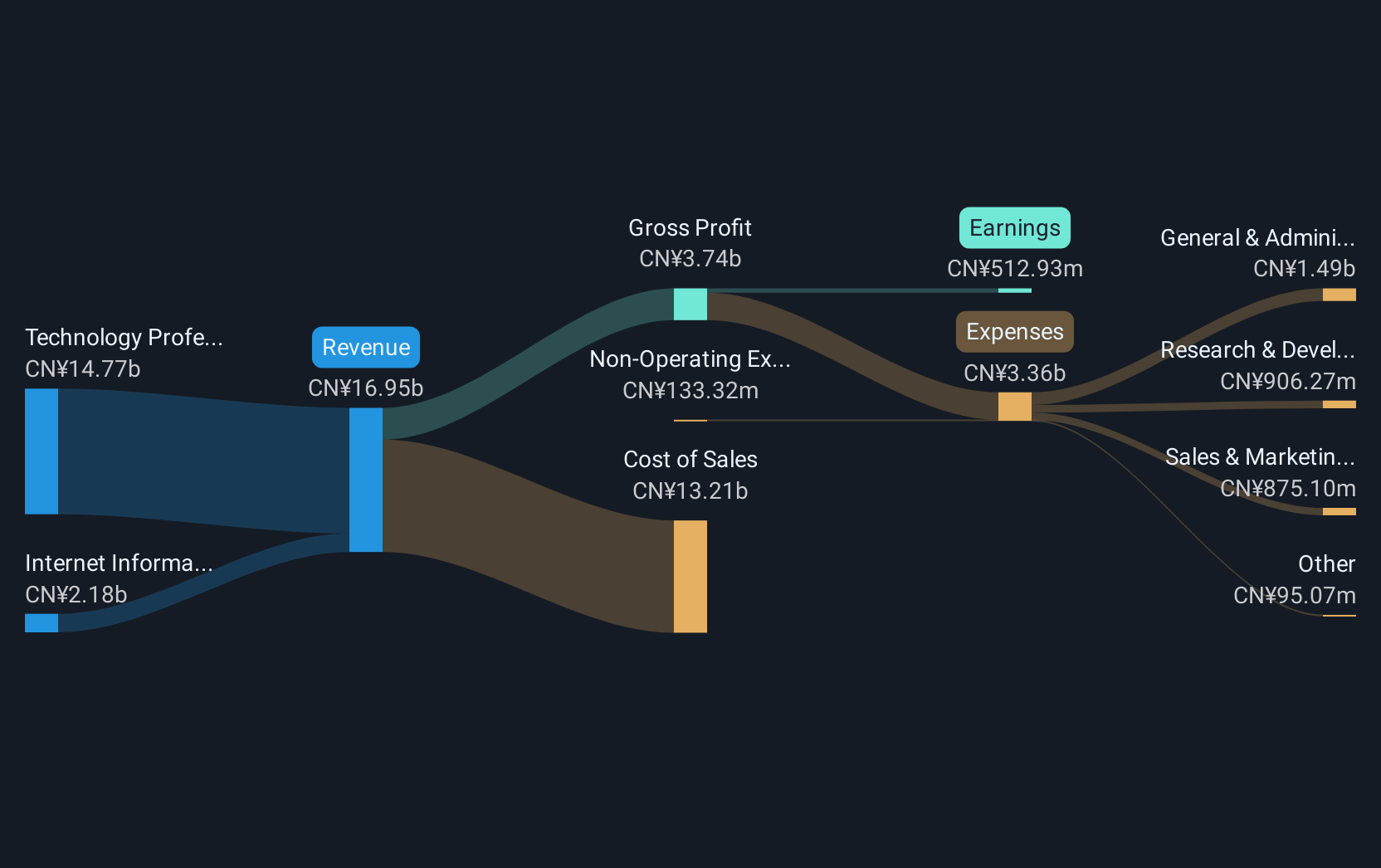

Operations: The company's revenue is primarily derived from its Technology Professional Services Group, contributing CN¥14.77 billion, and the Internet Information Technology Services Group, which adds CN¥2.18 billion.

Market Cap: HK$12.33B

Chinasoft International, with a market cap of HK$12.33 billion, is navigating the penny stock landscape with strategic initiatives and partnerships. Recent collaborations include a joint venture in Malaysia to deploy smart transportation systems and IoT solutions, leveraging its expertise in AFC systems and HarmonyOS. The company's financials show CN¥16.95 billion in sales for 2024 but declining net income at CN¥512.93 million compared to the previous year, impacted by large one-off gains of CN¥257.6 million. Despite stable weekly volatility (8%), earnings growth has been negative over the past year at -28.1%.

- Dive into the specifics of Chinasoft International here with our thorough balance sheet health report.

- Examine Chinasoft International's earnings growth report to understand how analysts expect it to perform.

Penguin International (SGX:BTM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Penguin International Limited, with a market cap of SGD259.80 million, designs, builds, owns, and operates high-speed aluminum crafts across Singapore and various international regions including East Asia, Africa, Europe, the Middle East, and Southeast Asia.

Operations: The company's revenue is primarily derived from its Shipbuilding, Ship Repairs and Maintenance segment, which accounts for SGD231.55 million, followed by Vessel Chartering at SGD48.73 million.

Market Cap: SGD259.8M

Penguin International, with a market cap of SGD259.80 million, is actively engaged in the high-speed aluminum craft sector across various regions. The company demonstrates financial stability with operating cash flow covering 33.2% of its debt and a satisfactory net debt to equity ratio of 6.3%. Despite volatile share prices recently, its earnings have surged by 112.2% over the past year, surpassing industry averages significantly. However, the dividend yield of 4.1% lacks coverage by free cash flows, indicating potential sustainability concerns. Recent board changes could influence strategic direction as Mr. Tan Poh Lee Paul joins as Non-Executive Director and Chairman of the Remuneration Committee.

- Click here to discover the nuances of Penguin International with our detailed analytical financial health report.

- Gain insights into Penguin International's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Investigate our full lineup of 1,154 Asian Penny Stocks right here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal