3 European Penny Stocks With Market Caps Under €70M To Consider

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, the pan-European STOXX Europe 600 Index recently ended 1.57% lower, with major stock indexes across Europe also experiencing declines. For investors willing to explore beyond well-known names, penny stocks—often representing smaller or newer companies—remain a relevant investment area despite being considered somewhat outdated. These stocks can offer unique growth opportunities at lower price points, especially when backed by strong financials and solid fundamentals, making them appealing options for those seeking hidden gems in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.98 | €62.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.55 | €17.01M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.04 | PLN10.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.56 | SEK216.59M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €294.77M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €33.25M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 454 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Nurminen Logistics Oyj (HLSE:NLG1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nurminen Logistics Oyj offers logistics services across Finland, Russia, Sweden, and the Baltic countries with a market cap of €87.15 million.

Operations: The company generates revenue primarily from its Transportation - Trucking segment, which accounts for €102.01 million.

Market Cap: €87.15M

Nurminen Logistics Oyj, with a market cap of €87.15 million, has recently initiated regular block train transports from the Czech Republic to Kazakhstan, enhancing its logistics services in the automotive sector. Despite a decline in first-quarter sales to €32.42 million and net income to €1.69 million compared to last year, the company maintains high-quality earnings and satisfactory debt levels with well-covered interest payments by EBIT (4.8x). While short-term assets exceed liabilities (€33.8M vs €23.5M), long-term liabilities remain uncovered by short-term assets (€37.6M). The management team is experienced, and shareholder equity has improved over five years from negative values.

- Click here and access our complete financial health analysis report to understand the dynamics of Nurminen Logistics Oyj.

- Understand Nurminen Logistics Oyj's earnings outlook by examining our growth report.

BrainCool (OM:BRAIN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BrainCool AB (publ) is a medical device company that develops, markets, and sells medical cooling systems for the healthcare sector in Sweden, with a market cap of SEK423.16 million.

Operations: The company generates SEK44.68 million in revenue from its medical products segment.

Market Cap: SEK423.16M

BrainCool AB (publ), with a market cap of SEK423.16 million, is unprofitable but shows potential in the medical device sector. Recent earnings for Q1 2025 revealed increased sales of SEK11.4 million, up from SEK9.42 million the previous year, though net losses narrowed to SEK8.35 million from SEK11.42 million. The company trades significantly below its estimated fair value and remains debt-free with short-term assets covering both short and long-term liabilities comfortably (SEK59M vs liabilities). Despite having less than a year of cash runway and an inexperienced board, BrainCool's revenue growth prospects are promising at over 100% annually according to forecasts.

- Click here to discover the nuances of BrainCool with our detailed analytical financial health report.

- Evaluate BrainCool's prospects by accessing our earnings growth report.

Polytec Holding (WBAG:PYT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Polytec Holding AG, with a market cap of €73.03 million, develops and manufactures plastic solutions for passenger cars, light commercial vehicles, commercial vehicles, and smart plastic and industrial applications through its subsidiaries.

Operations: The company generates revenue of €688.24 million from its plastics processing segment, which serves various automotive and industrial applications.

Market Cap: €73.03M

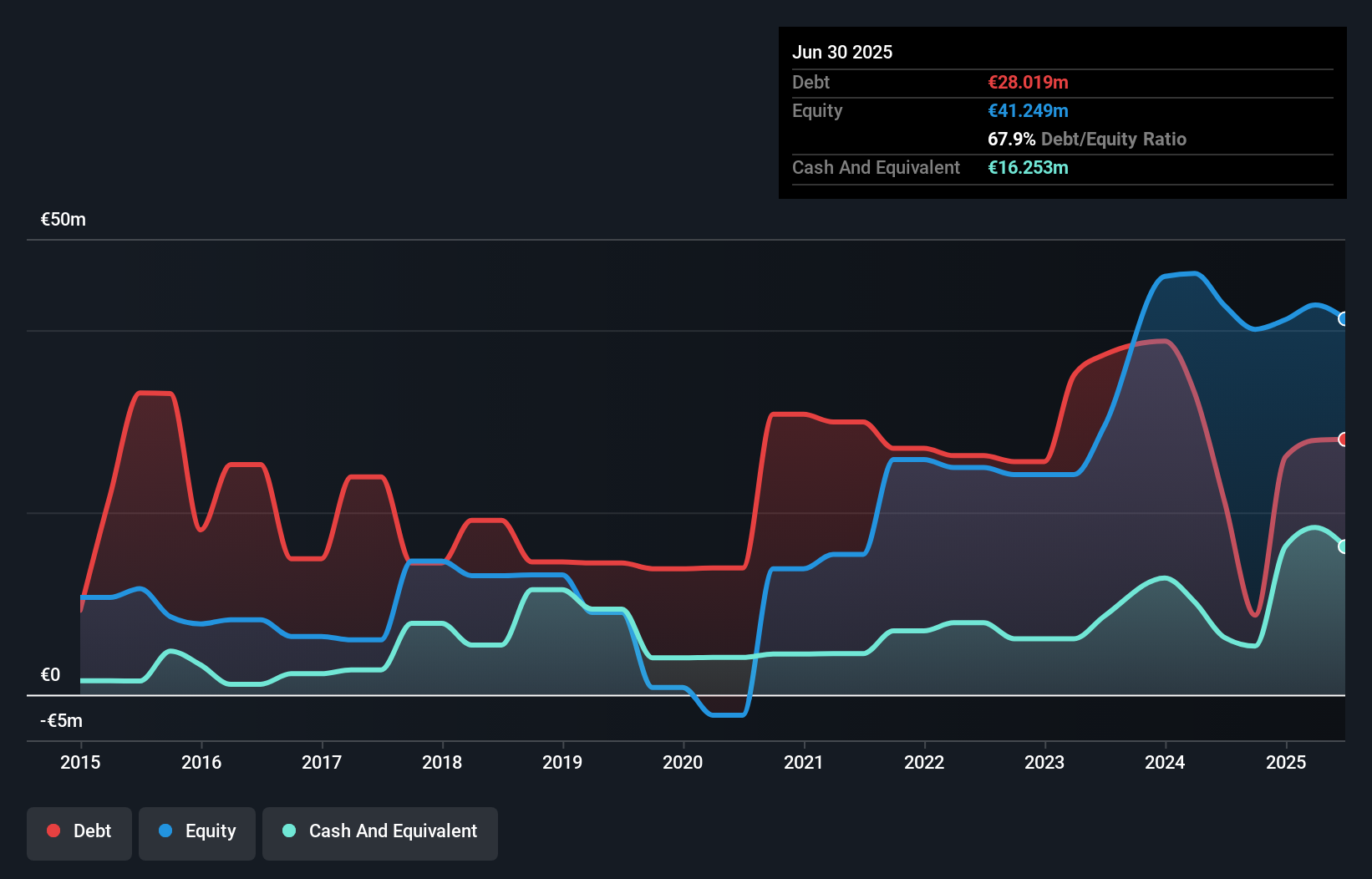

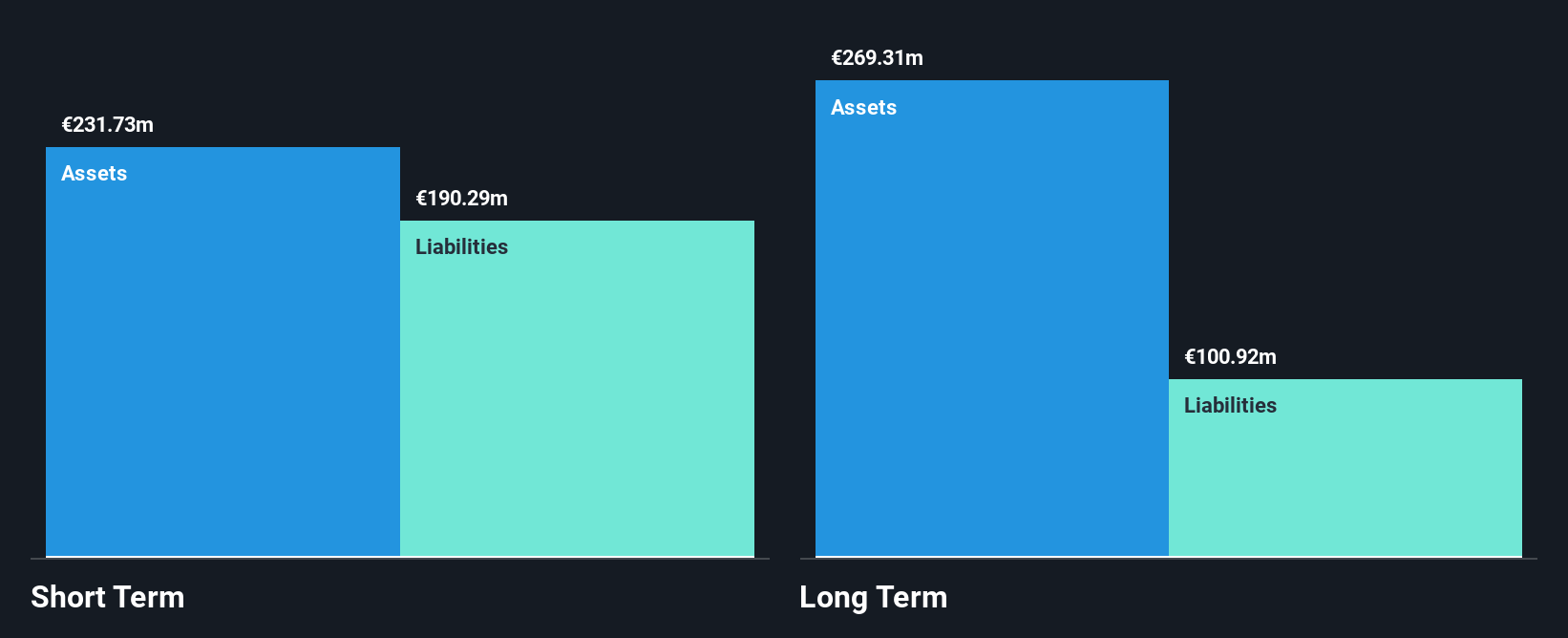

Polytec Holding AG, with a market cap of €73.03 million, recently reported Q1 2025 earnings showing sales of €181.58 million and a net income of €0.949 million, marking a turnaround from the previous year's loss. The company reaffirmed its full-year revenue guidance between €650-700 million for 2025. While Polytec's short-term assets exceed both short and long-term liabilities, its debt level remains high with interest payments not well covered by earnings (0.3x coverage). Despite being unprofitable with volatile share prices, analysts expect significant stock price appreciation and forecast an 80% annual growth in earnings.

- Jump into the full analysis health report here for a deeper understanding of Polytec Holding.

- Assess Polytec Holding's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Click here to access our complete index of 454 European Penny Stocks.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal