Hidrovias do Brasil S.A. (BVMF:HBSA3) Soars 30% But It's A Story Of Risk Vs Reward

Hidrovias do Brasil S.A. (BVMF:HBSA3) shares have continued their recent momentum with a 30% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 2.2% isn't as impressive.

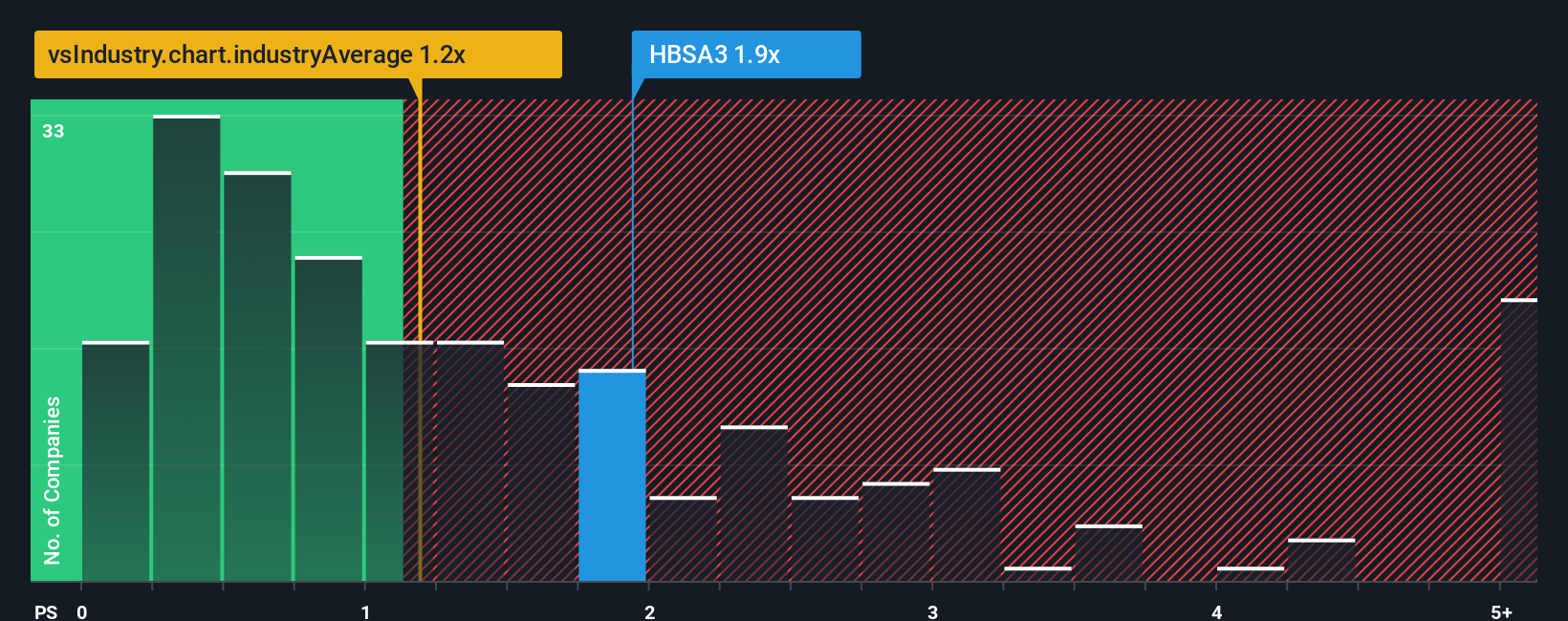

In spite of the firm bounce in price, it's still not a stretch to say that Hidrovias do Brasil's price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Shipping industry in Brazil, where the median P/S ratio is around 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Hidrovias do Brasil

What Does Hidrovias do Brasil's P/S Mean For Shareholders?

Hidrovias do Brasil has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Hidrovias do Brasil's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hidrovias do Brasil's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.8% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 49% as estimated by the five analysts watching the company. That would be an excellent outcome when the industry is expected to decline by 7.0%.

In light of this, it's peculiar that Hidrovias do Brasil's P/S sits in-line with the majority of other companies. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What Does Hidrovias do Brasil's P/S Mean For Investors?

Its shares have lifted substantially and now Hidrovias do Brasil's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hidrovias do Brasil currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Hidrovias do Brasil with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal