General Mills (NYSE:GIS) Considers Selling Haagen-Dazs Stores In China

General Mills (NYSE:GIS) is contemplating the sale of its Haagen-Dazs ice cream stores in China, a move driven by sales challenges in the region and aimed at enhancing operational efficiency. Over the past week, the company's stock price was relatively flat, moving in conjunction with broader market trends. The market itself rose by 1.3%, buoyed by easing inflation concerns and positive developments in U.S.-China trade relations. Despite General Mills' internal strategic considerations, these broader market shifts seem to have exerted more influence on its share price stability during this period.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The potential sale of Haagen-Dazs ice cream stores in China by General Mills could impact the company's narrative by streamlining operations and reallocating resources more effectively. This move might support the company's focus on enhancing operational efficiency, yet it also reflects the challenges faced in the Chinese market. This could suppress short-term revenue growth but may align with General Mills' long-term strategy of focusing on core segments. Over the past five years, General Mills has delivered a total return of 3.97%, including share price and dividends. In the last year, however, the company underperformed both the US Food industry, which declined by 3.1%, and the broader US Market, which gained 12.8%.

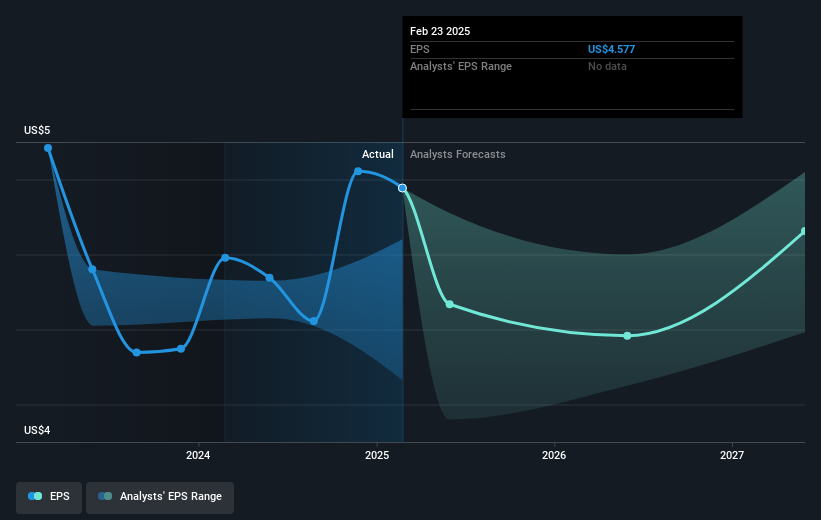

With a current price target of US$62.48, the existing share price of US$58.06 suggests a modest upside of 7.1%. This relatively minor discrepancy indicates a perception of fair valuation by analysts. The potential impact of the Haagen-Dazs store sale, combined with other strategy shifts, might adjust revenue and earnings forecasts. General Mills faces existing challenges like the possible Yoplait closure and changing consumer behaviors. These factors, coupled with planned reinvestments, may lead to a projected annual revenue decrease of 0.4% and tighter profit margins over the next three years. These dynamics illustrate the complex environment in which General Mills operates, balancing short-term hurdles with long-term growth ambitions.

Gain insights into General Mills' historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal