US stock outlook | Futures of the three major stock indexes fell sharply, and US CPI hit hard in May

Pre-market market trends

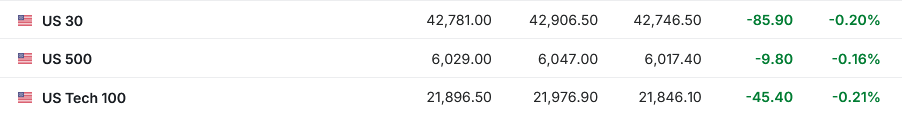

1. On June 11 (Wednesday), the futures of the three major US stock indexes fell sharply before the US stock market. As of press release, Dow futures were down 0.20%, S&P 500 futures were down 0.16%, and NASDAQ futures were down 0.21%.

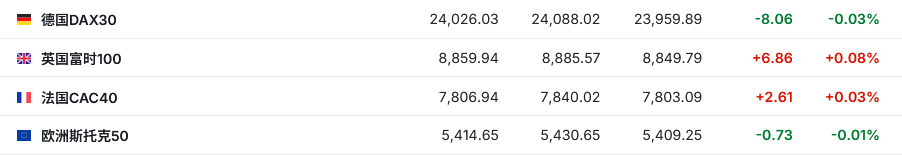

2. As of press release, the German DAX index fell 0.03%, the UK FTSE 100 index rose 0.08%, the French CAC40 index rose 0.03%, and the European Stoxx 50 index fell 0.01%.

3. As of press release, WTI crude oil rose 1.35% to $65.86 per barrel. Brent crude rose 1.17% to $67.65 per barrel.

Market news

First CPI questionnaire under the impact of tariffs: Wall Street expects core inflation in May to be the biggest month-on-month increase in a year. The consumer price index (CPI) for May is expected to show a slight acceleration in price increases compared to April. As the inflation report, which is due to be released on Wednesday, investors are closely watching whether President Trump's imposition of tariffs will affect consumer payments. According to the data, the overall inflation rate in May is expected to rise slightly to 2.4% from 2.3% in April, the latter being the lowest annualized increase since February 2021. Prices are expected to rise 0.2% month-on-month, in line with the April increase. Excluding volatile food and energy costs, core CPI is expected to rise 2.9% year on year in May, slightly higher than 2.8% in April; core CPI is expected to increase 0.3% month-on-month, up from 0.2% in April. The time period covered by the report coincided with about a month after Trump's “Liberation Day” tariff declaration impacted markets and businesses. Although many retaliatory tariffs have been suspended, the 10% basic tariff against most countries remains in effect. Wells Fargo economist Sarah House said, “The May CPI report will be an important litmus test for testing the speed and extent of transmission of tariff increases to consumers.” Goldman Sachs economist Jan Hatzius pointed out, “Future tariffs may give a greater boost to monthly inflation. We expect the core CPI to increase by around 0.35% month-on-month in the next few months.” He observed a “sharp acceleration” in most core commodity categories, but the impact on core services inflation was limited, at least in the short term.

China and the US have reached an agreement framework in principle. According to reports, while discussing the first meeting of the Sino-US economic and trade negotiation mechanism in London, Li Chenggang, the international trade negotiator and vice-minister of the Ministry of Commerce, said that China and the US have had professional, rational, in-depth, and honest communication. In principle, the two sides have reached a framework for implementing the June 5 call agreement between the two heads of state and the agreement on the Geneva talks.

The three “thunders” have not been removed, can the S&P 500 reach its peak again? Driven by the better-than-expected May non-farm payrolls report and optimism about US-China trade negotiations, the S&P 500 index rose for two consecutive weeks, climbing to its highest level since February, and is only one step away from a record closing point. As investors cheer for the historically rapid rebound in US stocks after the April sell-off, the S&P 500 seems increasingly likely to challenge its all-time high in the near future. However, some market strategists warn that investors should not be complacent, as the historical high of the S&P 500 index could be the next key resistance level to watch. Mark Hackett, chief market strategist at Nationwide Investment Management Group, said that from a technical analysis perspective, it was relatively easy for the market to rebound from the April low, mainly because the previous decline was steep and steep, so in the process of rebounding to its current position, it actually did not encounter resistance. The problem is that we now have to rely on market fundamentals to drive the next rise. Hackett pointed out, however, that the fundamental risk that caused the stock market to plummet in April still exists. Overvalued valuations, ongoing trade uncertainty, and declining corporate profit expectations are still key factors plaguing the stock market. He said that even if the S&P 500 index hits a new high in the short term, it may face challenges in maintaining this upward momentum without a “clear macro catalyst”.

CEO Komo: US economic data is likely to deteriorate, and July-October may face a shock wave. J.P. Morgan Chairman and CEO Jamie Dimon said he believes key economic indicators such as the US labor market “are likely to deteriorate soon.” He pointed out at the Morgan Stanley US Finance Conference that the current trade pattern and geopolitics are undergoing structural changes, and “many changing factors are interacting.” “We are already feeling the initial impact,” Dimon said. “The tariff policy is showing results.” He predicted that a more significant shock could occur between July and October, but added: “Hopefully, there will be no severe shocks, and a relatively gentle soft landing may be achieved.” Currently, these effects have not materialized, but Dimon emphasized that consumer-side performance is closely related to the job market. He said, “If inflation rises again or stagflation occurs, it will trigger market panic.”

Expectations for the Fed to cut interest rates have changed! The real money market is betting that interest rates will only be cut once during the year, and has even begun to accept “no interest rate cuts throughout the year.” More and more Wall Street traders are betting that the Fed will cut interest rates only once this year rather than the expectation that it will cut interest rates twice for a long time this year. The main logic is that signs of America's economic growth resilience and stubborn inflation continue to appear. US consumer price data for May (i.e. May CPI) will be released on Wednesday. The market predicts that this data will pick up slightly, which may reinforce the Fed's position of continuing to wait and see no further easing while evaluating the impact of tariffs. The market generally expects the Federal Reserve to stand still next week, while futures and options pricing, which tracks the policy path, shows that traders are cutting the interest rate cut premiums accumulated over the next few months. Swap traders currently generally expect the Federal Reserve to cut interest rates by only 0.45 percentage points by the end of the year, and some traders are even betting on “no interest rate cuts for the whole year” in 2025. This is the smallest decline forecast included since the US administration led by Donald Trump, who returned to the White House, introduced high equivalent tariffs in early April.

Individual stock news

Musk “Seeks Peace”? Regretting posting anger against Trump, Tesla (TSLA.US) rose in the premarket. Tesla CEO Elon Musk said in a post on social platforms that he regretted his post about US President Trump last week, saying “the content went too far.” In addition, Musk also said that Tesla will soon deliver the first fully autonomous vehicle in Austin, Texas, while promoting the trial operation of the Robotaxi service. According to Musk, the first fully automated Tesla car will “drive from the production line to the owner's home” on June 28. At that time, the vehicle will not need a steering wheel or pedal, and Tesla's latest FSD (Full Self-Driving) software will control the entire process autonomously. He also revealed that Tesla is tentatively scheduled to launch the Robotaxi pilot service in Austin on June 22. However, due to safety considerations, the specific operating hours may change according to actual conditions. As of press release, Tesla's US stocks rose nearly 2% before the market on Wednesday.

Game Station (GME.US) declined before the market, and Q1 revenue fell short of expectations. Despite being profitable for the fourth consecutive quarter, GameStop's first quarter revenue fell short of expectations as consumers increasingly preferred digital downloads over physical store purchases. According to financial reports, GameStop's revenue for the first quarter fell 17% year over year, from US$881.8 million in the same period last year to US$732.4 million. Analysts expected US$750 million. In the first quarter, the revenue of the hardware and accessories division, which includes sales of new and used video games, fell by about 32%. Following the closure of nearly 600 US stores in 2024, the company announced that it will also close a “large number” of stores this year, indicating that its retail business continues to be sluggish despite attempted reforms. Through cost reduction measures, the company achieved net profit of 44.8 million US dollars (9 cents per share) in the first quarter, compared with a net loss of 32.3 million US dollars (11 cents per share) for the same period last year, marking the fourth consecutive quarter of the company's profit. Adjusted earnings per share reached 17 cents, far exceeding analysts' expectations of 8 cents. As of press release, GameStop's US stock fell more than 4% before the market on Wednesday.

Google (GOOGL.US) launched a company-wide voluntary exit buyout program involving core business departments such as search. According to reports, Google proposed voluntary exit buyout plans to employees in various business departments, involving knowledge and information departments, core engineering departments, and marketing, research and public relations teams. Among them, the Knowledge and Information Division (K&I) covers Google search, advertising, and commercial business segments. This is Google's latest move to reduce the number of employees through multiple rounds of adjustments after laying off 12,000 employees in 2023. The exact number of employees involved in this round of buyouts has not yet been confirmed. According to earlier reports, Google has offered a buyout plan to search and advertising department employees.

Key economic data and event forecasts

US May CPI at 20:30 Beijing time

23:00 Beijing time US June IPSOS main consumer sentiment index PCSI

Performance Forecast

Thursday Morning: Oracle (ORCL.US)

Thursday pre-market: YRD.US (YRD.US), Tuniu (TOUR.US)

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal