Kohl's (NYSE:KSS) Sees 34% Price Jump Over Last Month

Kohl's (NYSE:KSS) recently completed a $360 million senior secured note offering, with proceeds earmarked to repay existing borrowings, highlighting a focus on strategic debt management amid ongoing financial adjustments. This, along with the first-quarter earnings report, showing a narrowed net loss despite a drop in sales and revenue, could have contributed to positive market sentiment. Against a backdrop of general market gains, such as the S&P 500 rising to its highest since February, Kohl's 34% increase in share price over the last month also aligns with broader market enthusiasm, adding weight to these developments rather than opposing trends.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

While Kohl's recent $360 million secured note offering could signal a proactive debt management approach, its overall impact on the company's future remains uncertain given its broader financial context. Over the last five years, Kohl's shares experienced a total return decline of 47.93%, showing significant underperformance. This long-term dip contrasts sharply with the recent 34% share price jump over the past month, partly driven by general market gains and the company's latest earnings report. Specifically, the S&P 500's recent upward trajectory may have buoyed investor sentiment.

In the past year, Kohl's shares continued to lag, underperforming both the US market and the Multiline Retail industry, suggesting ongoing competitive pressures. Despite this, the company's refocused merchandise strategy and omnichannel efforts could influence revenue and earnings improvements. Analysts expect earnings to grow, albeit from a lower revenue base, with projections indicating a potential rise to $239.3 million by 2028. This optimistic earnings forecast remains subject to execution risks, given current operational inefficiencies and challenges in digital sales.

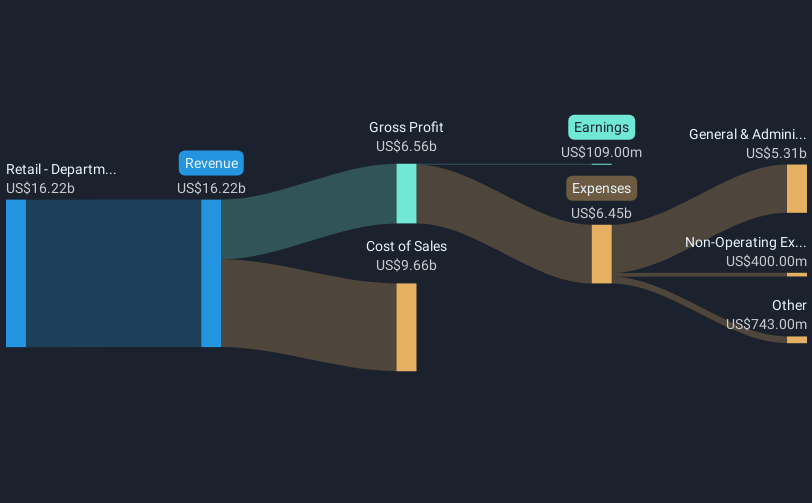

Regarding valuation, Kohl's current share price around $6.82 represents a significant discount to the consensus price target of $9.66, indicating potential upside if the company can meet or exceed earnings expectations. However, the realization of this potential would require achieving a lower price-to-earnings ratio than currently seen in the industry, indicating market skepticism. Investors must weigh these variables carefully, considering both the company's recent strategic adjustments and its historical performance against broader market factors.

Assess Kohl's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal