Bilibili And 2 Other Stocks That May Be Priced Below Their Estimated Fair Value

Over the last 7 days, the United States market has risen by 1.5%, contributing to a 12% climb over the past year, with earnings forecasted to grow by 14% annually. In this environment of steady growth, identifying stocks that are potentially undervalued can offer opportunities for investors seeking to capitalize on shares that may be priced below their estimated fair value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.14 | $47.84 | 49.5% |

| TXO Partners (TXO) | $15.03 | $29.95 | 49.8% |

| TAL Education Group (TAL) | $10.83 | $21.61 | 49.9% |

| Reddit (RDDT) | $117.53 | $229.23 | 48.7% |

| Mid Penn Bancorp (MPB) | $26.64 | $52.26 | 49% |

| Lyft (LYFT) | $15.63 | $30.54 | 48.8% |

| Insteel Industries (IIIN) | $36.31 | $72.06 | 49.6% |

| First Busey (BUSE) | $22.82 | $45.56 | 49.9% |

| Brookline Bancorp (BRKL) | $10.52 | $20.74 | 49.3% |

| Berkshire Hills Bancorp (BHLB) | $25.19 | $49.25 | 48.9% |

Let's review some notable picks from our screened stocks.

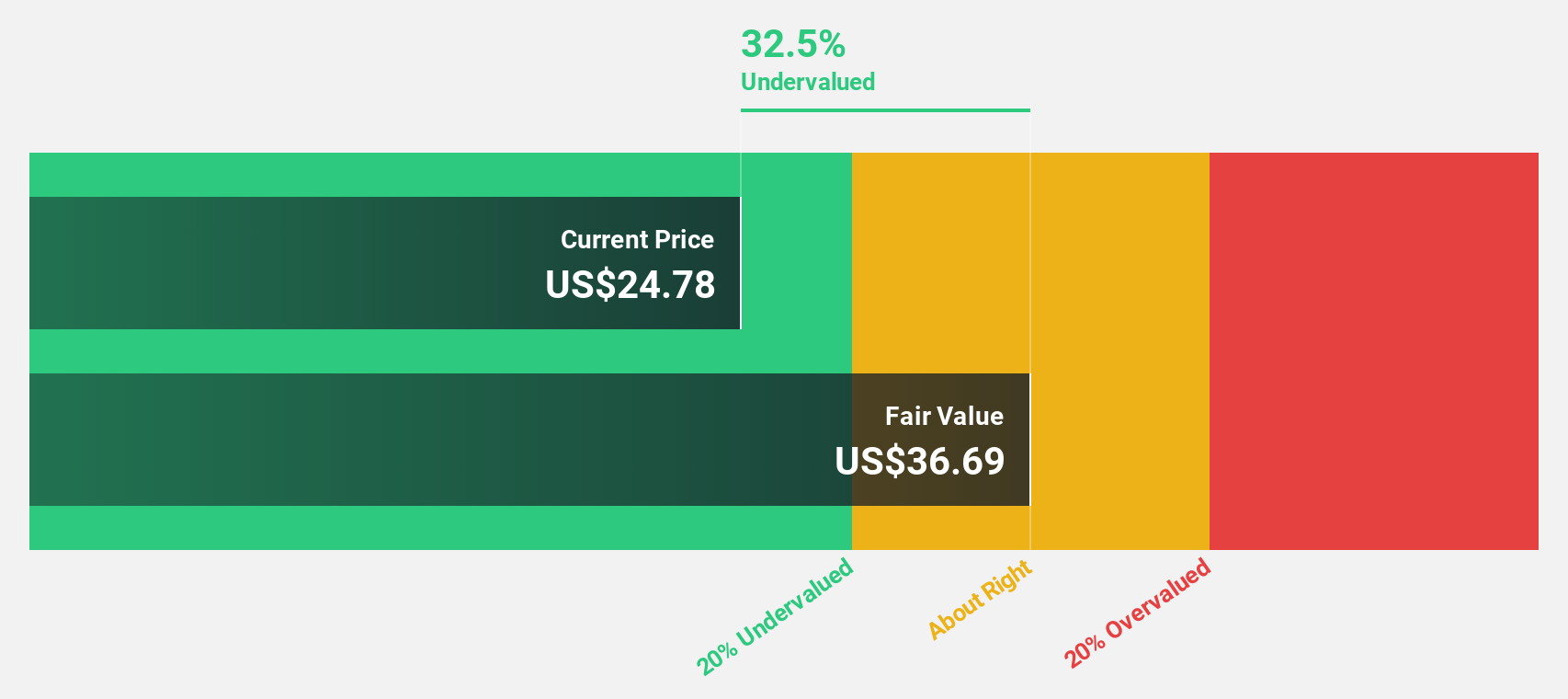

Bilibili (BILI)

Overview: Bilibili Inc. offers online entertainment services targeting young generations in China, with a market cap of $7.65 billion.

Operations: The company generates revenue from its Internet Information Providers segment, amounting to CN¥28.17 billion.

Estimated Discount To Fair Value: 42.6%

Bilibili is trading at 42.6% below its estimated fair value of US$33.88, highlighting its undervaluation based on discounted cash flow analysis. Recent earnings show significant improvement, with a net loss reduced to CNY 9.1 million from CNY 748.55 million year-over-year, alongside robust revenue growth to CNY 7 billion from CNY 5.66 billion. Additionally, the company completed a US$600 million fixed-income offering, enhancing liquidity and financial flexibility amidst expected profitability within three years.

- Our earnings growth report unveils the potential for significant increases in Bilibili's future results.

- Click here to discover the nuances of Bilibili with our detailed financial health report.

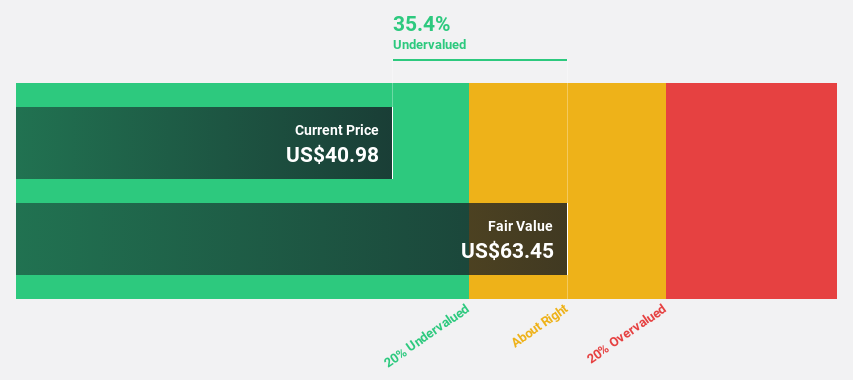

ON Semiconductor (ON)

Overview: ON Semiconductor Corporation offers intelligent sensing and power solutions globally, with a market cap of approximately $20.97 billion.

Operations: The company's revenue is derived from three primary segments: Power Solutions Group ($3.12 billion), Intelligent Sensing Group ($1.07 billion), and Analog & Mixed-Signal Group ($2.48 billion).

Estimated Discount To Fair Value: 16.9%

ON Semiconductor's shares are trading at US$52.38, reflecting a 16.9% discount to the estimated fair value of US$63.03, suggesting an undervaluation based on cash flows. Despite a forecasted revenue growth below the market average, its earnings are expected to grow significantly at 33.5% annually over three years. Recent results show a net loss of US$486.1 million for Q1 2025 due to large one-off items, contrasting with previous profitability and highlighting potential volatility in financial performance.

- According our earnings growth report, there's an indication that ON Semiconductor might be ready to expand.

- Get an in-depth perspective on ON Semiconductor's balance sheet by reading our health report here.

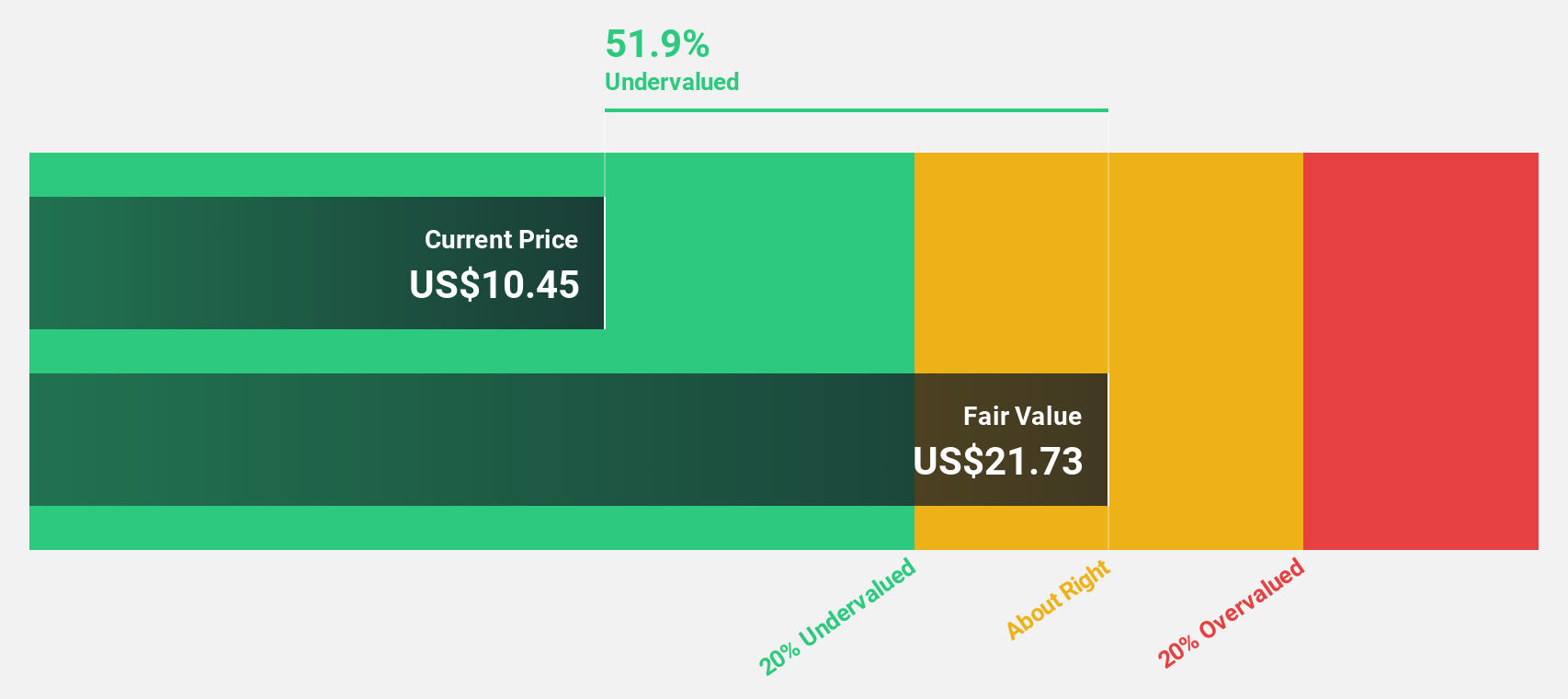

TAL Education Group (TAL)

Overview: TAL Education Group offers K-12 after-school tutoring services in the People's Republic of China and has a market cap of approximately $6.43 billion.

Operations: The company's revenue primarily comes from its K-12 after-school tutoring services, generating approximately $2.25 billion.

Estimated Discount To Fair Value: 49.9%

TAL Education Group is trading at US$10.83, significantly below its estimated fair value of US$21.61, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 28.2% annually, outpacing the US market's growth rate. Despite a recent Q4 net loss of US$7.31 million, TAL became profitable over the full year with net income of US$84.59 million and revenue growth surpassing market expectations at 18% annually.

- The growth report we've compiled suggests that TAL Education Group's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of TAL Education Group stock in this financial health report.

Next Steps

- Gain an insight into the universe of 169 Undervalued US Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal