Not Many Are Piling Into Renova Energia S.A. (BVMF:RNEW11) Stock Yet As It Plummets 34%

The Renova Energia S.A. (BVMF:RNEW11) share price has fared very poorly over the last month, falling by a substantial 34%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

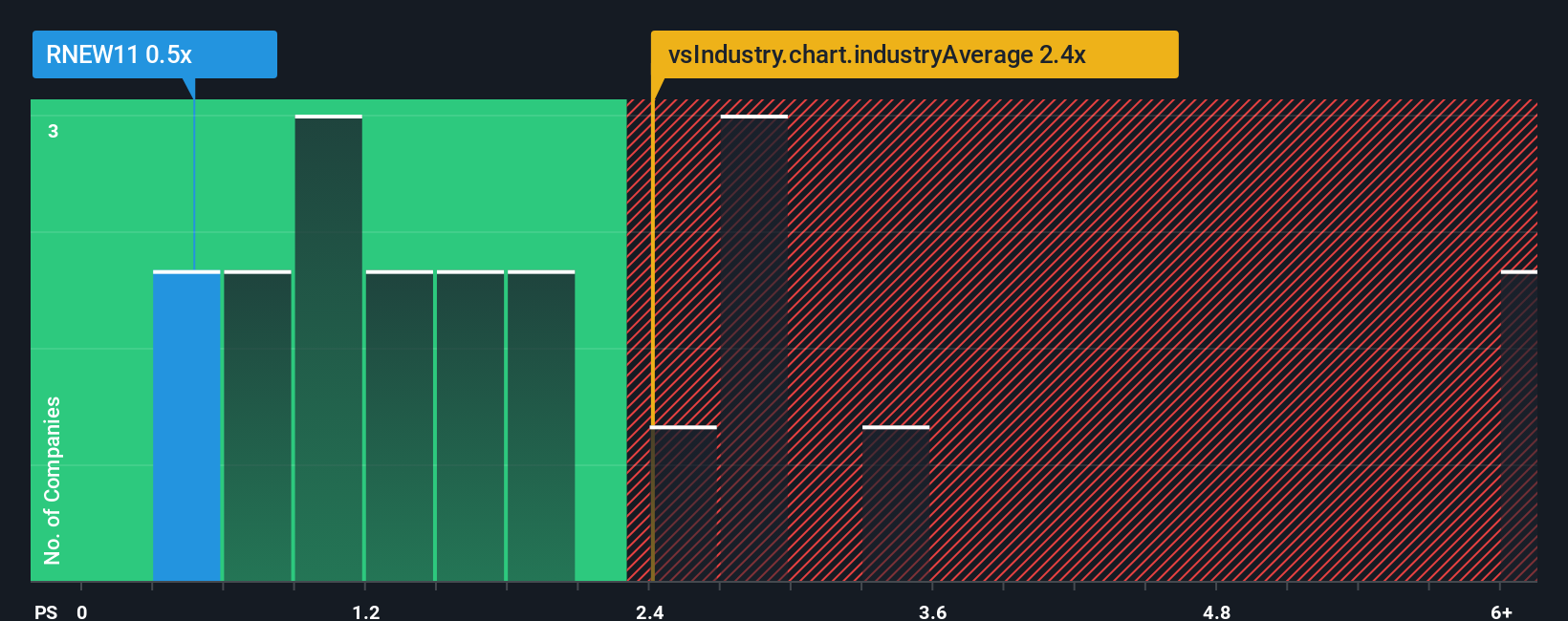

After such a large drop in price, when close to half the companies operating in Brazil's Renewable Energy industry have price-to-sales ratios (or "P/S") above 1.7x, you may consider Renova Energia as an enticing stock to check out with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Renova Energia

How Has Renova Energia Performed Recently?

Recent times have been quite advantageous for Renova Energia as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Renova Energia will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Renova Energia's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Renova Energia's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 47%. The latest three year period has also seen an excellent 193% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 6.5% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Renova Energia's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Renova Energia's P/S?

Renova Energia's recently weak share price has pulled its P/S back below other Renewable Energy companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Upon analysing the past data, we see it is unexpected that Renova Energia is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

You always need to take note of risks, for example - Renova Energia has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal