Orexo AB (publ) (STO:ORX) Shares Fly 32% But Investors Aren't Buying For Growth

Orexo AB (publ) (STO:ORX) shareholders have had their patience rewarded with a 32% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10% in the last twelve months.

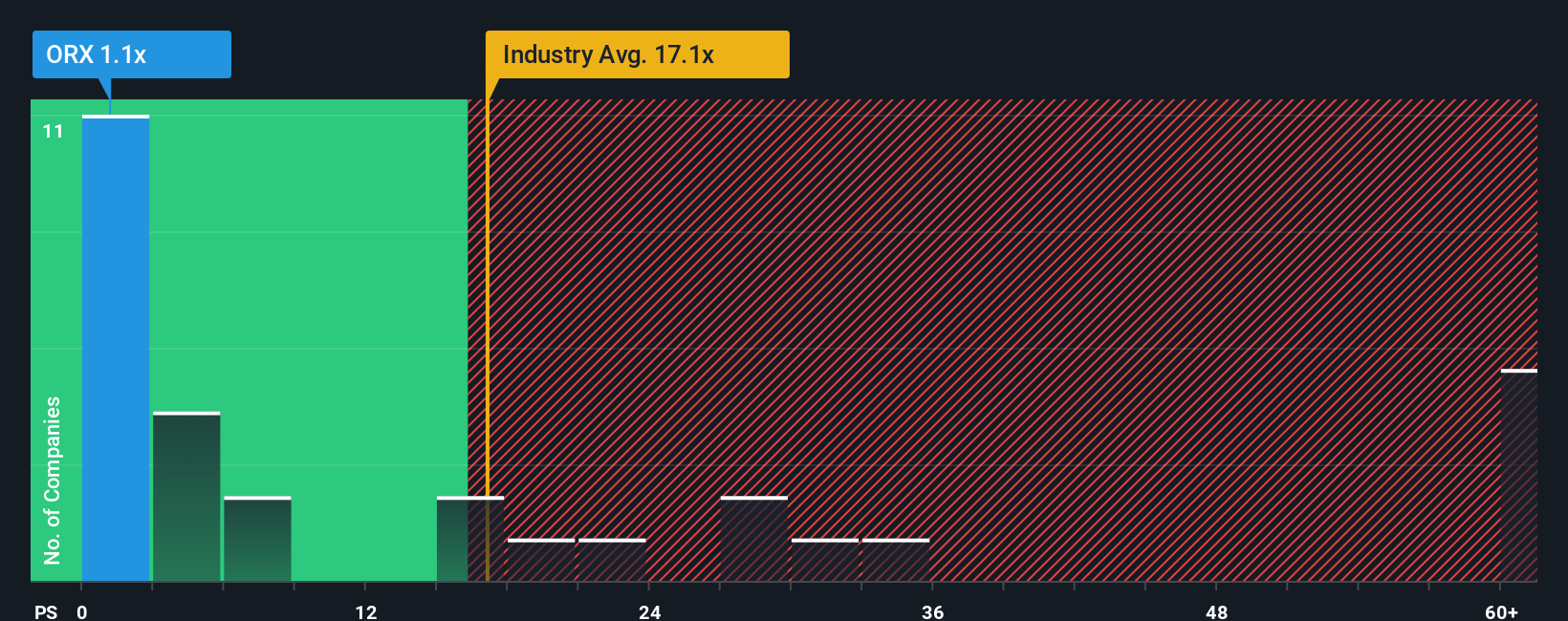

Even after such a large jump in price, Orexo's price-to-sales (or "P/S") ratio of 1.1x might still make it look like a strong buy right now compared to the wider Pharmaceuticals industry in Sweden, where around half of the companies have P/S ratios above 16.5x and even P/S above 68x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Orexo

What Does Orexo's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Orexo's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Orexo will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Orexo's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 3.6% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 4.8% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 79% growth, that's a disappointing outcome.

In light of this, it's understandable that Orexo's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Orexo's P/S?

Orexo's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Orexo maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Orexo (1 is significant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal