3 Promising TSX Penny Stocks With Market Caps Under CA$300M

As the Canadian market navigates ongoing trade uncertainties, investors are finding opportunities amid the shifting landscape. Penny stocks, while an older term, continue to capture interest as they often represent smaller or newer companies with potential for growth at lower price points. In this article, we explore three such penny stocks on the TSX that offer strong fundamentals and hidden value, presenting intriguing possibilities for those looking beyond the big names.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.71 | CA$75.86M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.64 | CA$585.62M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.43 | CA$753.84M | ✅ 4 ⚠️ 2 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.75M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.71 | CA$478.93M | ✅ 3 ⚠️ 2 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.50 | CA$108.33M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.20 | CA$130.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.76 | CA$133.99M | ✅ 1 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.79 | CA$172.09M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 876 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Telescope Innovations (CNSX:TELI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Telescope Innovations Corp. is a chemical technology company focused on developing manufacturing processes and tools for the pharmaceutical and chemical industries in the United States and Canada, with a market cap of CA$19.32 million.

Operations: The company generates revenue from its Chemicals segment, amounting to CA$4.45 million.

Market Cap: CA$19.32M

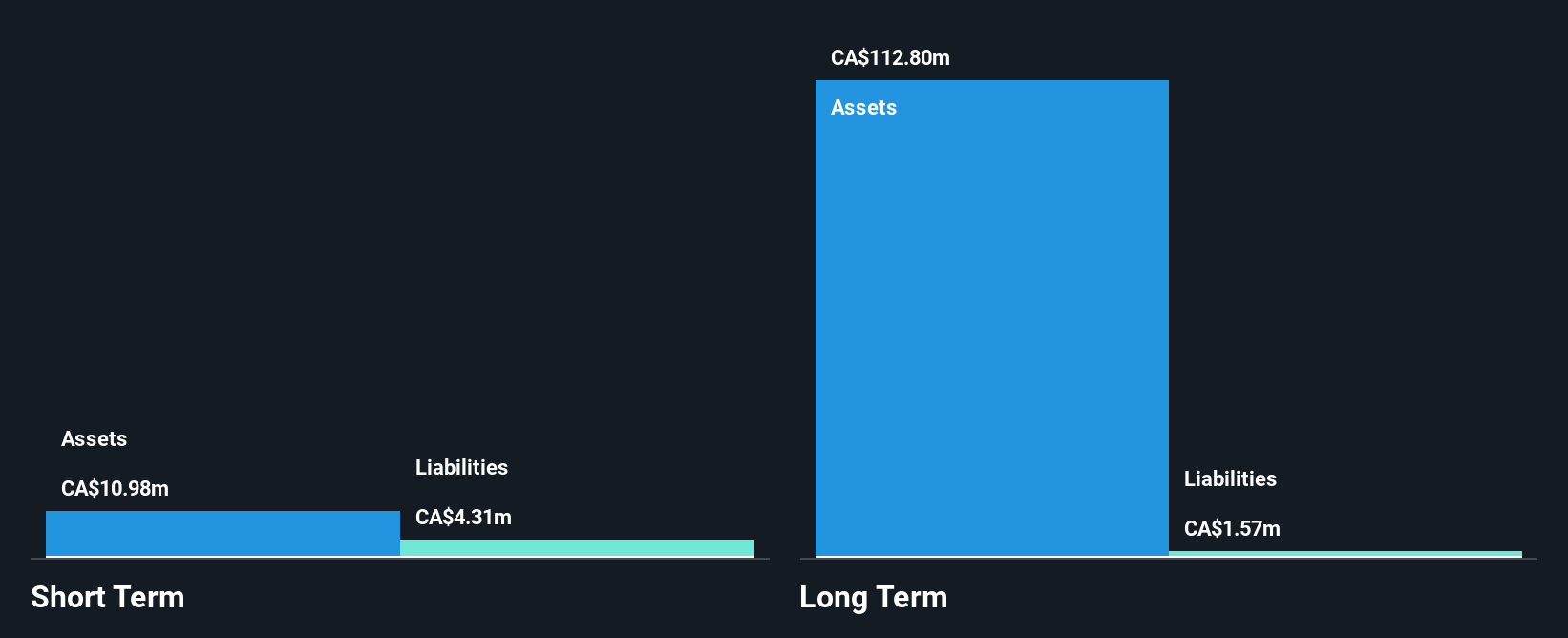

Telescope Innovations Corp., with a market cap of CA$19.32 million, is navigating the penny stock landscape by focusing on innovative chemical technologies for battery materials. Despite being unprofitable, it maintains a positive cash flow and has no debt, offering some financial stability. Recent collaborations, such as with Standard Lithium Ltd., highlight its strategic efforts in developing lithium sulfide using its proprietary DualPure™ process—a promising advancement in solid-state battery technology. However, challenges remain as short-term liabilities exceed assets and revenue growth is modest at CA$2.21 million for the last six months reported.

- Dive into the specifics of Telescope Innovations here with our thorough balance sheet health report.

- Gain insights into Telescope Innovations' historical outcomes by reviewing our past performance report.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GoldMining Inc. is a mineral exploration company focused on acquiring, exploring, and developing gold and copper assets in the Americas, with a market cap of CA$207.79 million.

Operations: GoldMining Inc. does not report any specific revenue segments.

Market Cap: CA$207.79M

GoldMining Inc., with a market cap of CA$207.79 million, is pre-revenue and unprofitable, yet it remains debt-free, offering some financial stability. The company has less than a year of cash runway based on current free cash flow trends. Recent developments include the approval to advance its Rea Uranium Project in Alberta's Athabasca Basin, positioning GoldMining to capitalize on rising uranium demand for cleaner energy solutions. Additionally, exploration at its São Jorge Project in Brazil is underway with extensive drilling programs planned. Despite these initiatives, the company faces challenges due to limited revenue generation and increasing losses over recent years.

- Get an in-depth perspective on GoldMining's performance by reading our balance sheet health report here.

- Gain insights into GoldMining's outlook and expected performance with our report on the company's earnings estimates.

Emerita Resources (TSXV:EMO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emerita Resources Corp., through its subsidiary, focuses on acquiring, exploring, and developing mineral properties in Spain with a market cap of CA$279.97 million.

Operations: Emerita Resources Corp. has not reported any revenue segments.

Market Cap: CA$279.97M

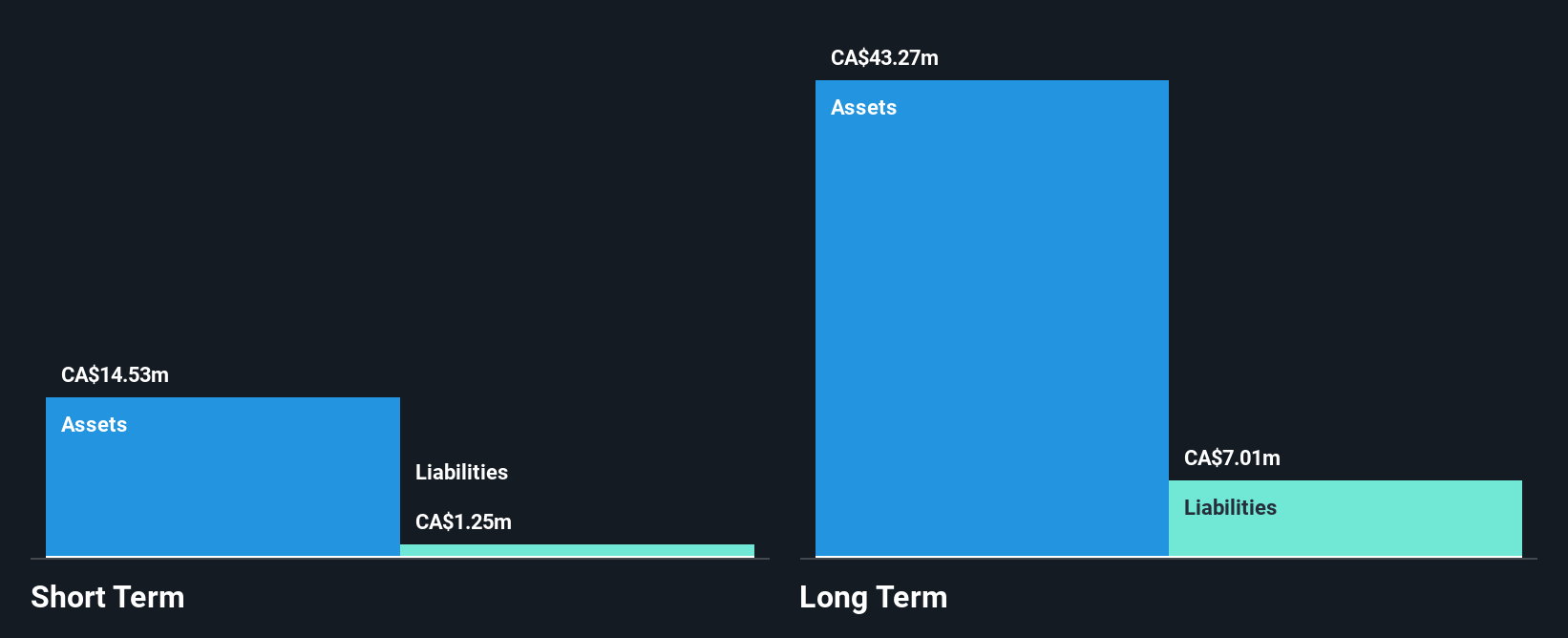

Emerita Resources, with a market cap of CA$279.97 million, is pre-revenue and currently unprofitable, yet it maintains financial stability with more cash than debt and short-term assets exceeding liabilities. The seasoned management team has overseen significant advancements in its Iberian Belt West Project in Spain, including improved metallurgical recovery processes for gold and base metals. Recent updates to the Mineral Resource Estimate highlight potential growth through ongoing drilling campaigns at El Cura deposit. However, the company faces challenges with increasing losses reported in recent earnings results and less than a year of cash runway based on free cash flow trends.

- Navigate through the intricacies of Emerita Resources with our comprehensive balance sheet health report here.

- Explore Emerita Resources' analyst forecasts in our growth report.

Key Takeaways

- Access the full spectrum of 876 TSX Penny Stocks by clicking on this link.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal