June 2025's Promising Penny Stocks to Consider

As the U.S. stock market experiences a rally, with the S&P 500 reaching new heights and investor confidence buoyed by strong economic data, attention turns to potential opportunities in smaller segments of the market. Penny stocks, though an older term, continue to represent a sector where smaller or newer companies can offer intriguing prospects for growth. By focusing on those with robust financial health, investors may uncover hidden value and potential for significant returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.12 | $103.93M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $0.90 | $30.44M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.45 | $542.49M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.01 | $35.14M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.08 | $179.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.81 | $183.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.77 | $22.44M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.37 | $55.14M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8313 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.37 | $76.21M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 714 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

OmniAb (OABI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OmniAb, Inc. is a biotechnology company that licenses discovery research technology to pharmaceutical and biotech companies, as well as academic institutions, to facilitate therapeutic discoveries across the United States, Europe, Japan, China, and Canada with a market cap of approximately $171.27 million.

Operations: The company generates revenue of $26.74 million from its research services segment.

Market Cap: $171.27M

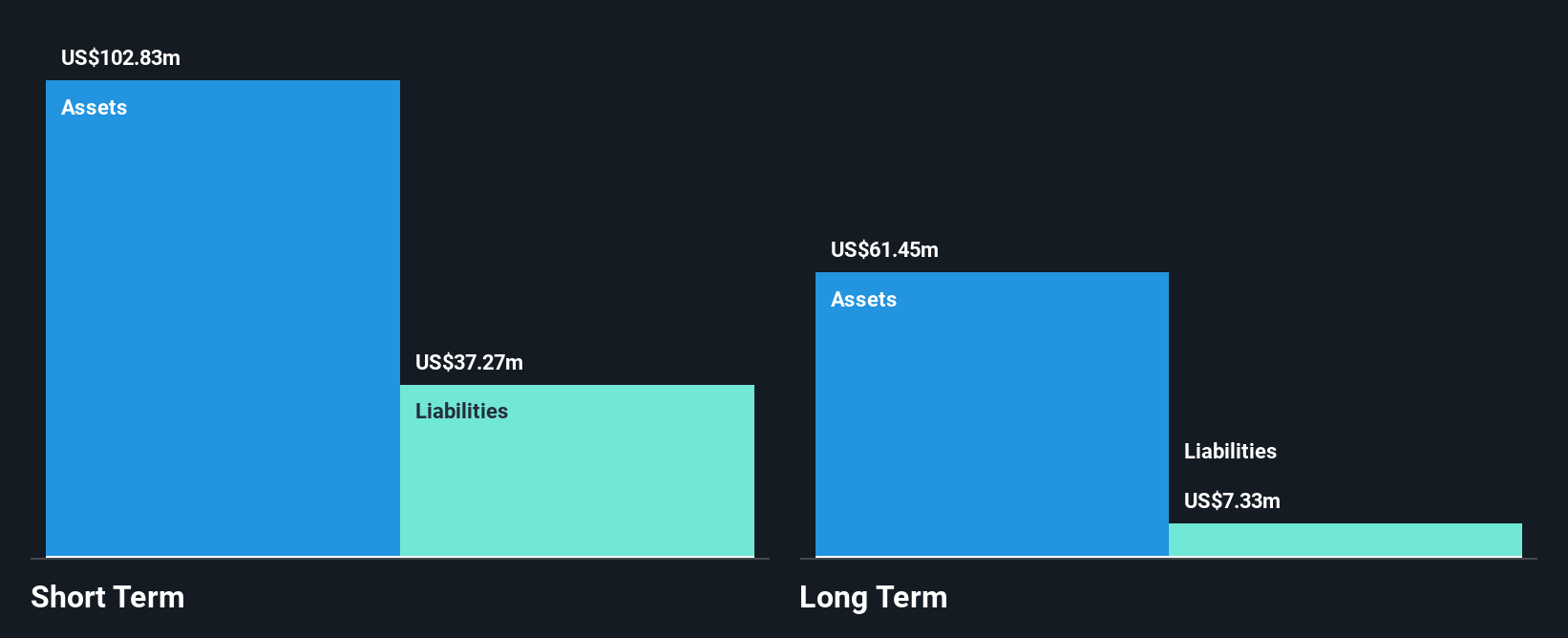

OmniAb, Inc., a biotechnology company with a market cap of approximately US$171.27 million, has been making strategic moves despite its unprofitable status. It recently launched the xPloration Partner Access Program, enhancing capabilities in antibody discovery using advanced AI and machine learning technologies. The company's revenue for Q1 2025 was US$4.15 million, showing modest growth from the previous year, but it remains unprofitable with a net loss of US$18.2 million for the quarter. OmniAb's financial position is stable short-term as assets exceed liabilities, though it faces challenges in achieving profitability within three years.

- Take a closer look at OmniAb's potential here in our financial health report.

- Understand OmniAb's earnings outlook by examining our growth report.

Telos (TLS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Telos Corporation, with a market cap of approximately $200.25 million, offers cyber, cloud, and enterprise security solutions both in the United States and internationally.

Operations: The company's revenue is primarily derived from its Security Solutions segment, which generated $83.94 million, and its Secure Networks segment, contributing $25.33 million.

Market Cap: $200.25M

Telos Corporation, with a market cap of US$200.25 million, remains unprofitable despite generating revenue primarily from its Security Solutions and Secure Networks segments. Recent developments include a US$14 million contract with the Defense Information System Agency for messaging services and earnings guidance indicating potential revenue growth of 14% to 21% for Q2 2025. Despite its volatile share price and increased losses over five years, Telos maintains financial stability in the short term with assets exceeding liabilities and no debt burden. The company continues to expand TSA PreCheck enrollment centers, enhancing consumer convenience nationwide.

- Navigate through the intricacies of Telos with our comprehensive balance sheet health report here.

- Evaluate Telos' prospects by accessing our earnings growth report.

Seer (SEER)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seer, Inc. is a life sciences company focused on developing and commercializing products to decode the biology of the proteome, with a market cap of $128.87 million.

Operations: The company generates revenue primarily from its Biotechnology (Startups) segment, amounting to $15.31 million.

Market Cap: $128.87M

Seer, Inc., with a market cap of US$128.87 million, remains unprofitable but shows potential through its innovative Proteograph® Product Suite, which was recently enhanced to improve scalability and affordability in proteomics research. Despite generating US$4.21 million in revenue for Q1 2025 and experiencing insider selling, Seer maintains financial stability with no debt and assets exceeding liabilities. Its management and board are experienced, contributing to strategic advancements like the new Proteograph workflow that significantly reduces costs per sample by about 60% since 2021. Although losses have increased over five years, Seer has a substantial cash runway exceeding three years.

- Jump into the full analysis health report here for a deeper understanding of Seer.

- Examine Seer's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Unlock our comprehensive list of 714 US Penny Stocks by clicking here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal