Uncovering Global Undiscovered Gems in June 2025

As global markets navigate the complexities of trade policies and inflationary pressures, smaller-cap indexes have shown resilience by posting positive returns despite lagging behind their larger counterparts. In this environment, identifying stocks that can thrive amid such volatility requires a keen eye for companies with strong fundamentals and growth potential, which often remain underappreciated by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MSC | 30.39% | 6.56% | 14.62% | ★★★★★★ |

| Showbox | NA | 10.08% | 7.87% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| Creative & Innovative System | 0.66% | 56.48% | 79.21% | ★★★★★★ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| BIOBIJOULtd | 6.87% | 72.99% | 117.16% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 20.07% | 44.84% | 6.75% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Guangdong Shunna Electric (SZSE:000533)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Shunna Electric Co., Ltd. specializes in providing power transmission and distribution equipment in China, with a market cap of CN¥5.41 billion.

Operations: Guangdong Shunna Electric generates revenue primarily from the sale of power transmission and distribution equipment. The company's financial performance is highlighted by a net profit margin that has shown variability over recent periods. Operating costs and other expenses are integral to its cost structure, impacting overall profitability.

Guangdong Shunna Electric, a smaller player in the electrical sector, has shown impressive growth with earnings up by 46.2% over the past year, outpacing the industry average of -1.4%. The company's net income for Q1 2025 reached CNY 19.5 million, compared to CNY 14.02 million a year prior, while sales increased to CNY 486.49 million from CNY 452.8 million last year. With an interest coverage ratio of 42x and a debt-to-equity ratio reduced from 50% to around 26% over five years, Guangdong Shunna displays strong financial health despite recent share price volatility.

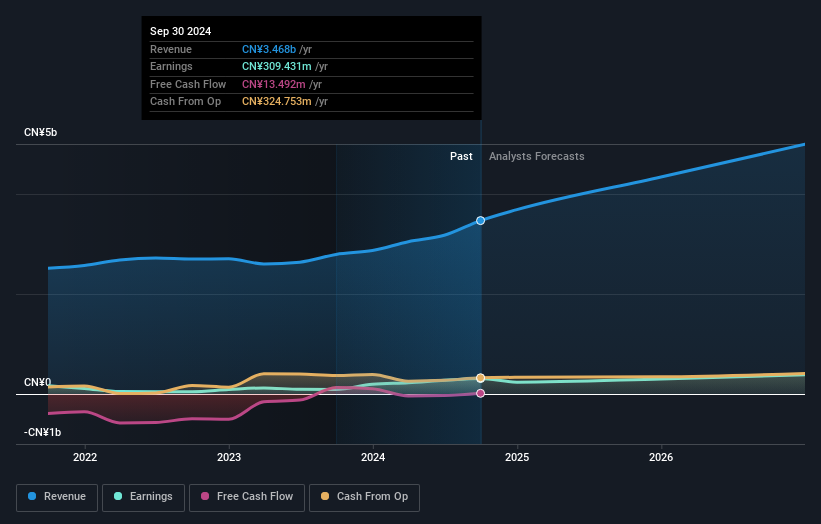

Tongding Interconnection Information (SZSE:002491)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tongding Interconnection Information Co., Ltd. operates in the telecommunications industry, focusing on producing and selling optical fiber cables and related products, with a market cap of CN¥6.99 billion.

Operations: The company generates revenue primarily from the production and sale of optical fiber cables and related products.

Tongding Interconnection Information, a small player in the communications sector, has shown significant earnings growth of 161.6% over the past year, outpacing its industry peers. Despite a dip in sales to CNY 2.88 billion from CNY 3.33 billion year-on-year, net income turned positive at CNY 77.33 million from a previous loss. The company's price-to-earnings ratio of 31x is attractive compared to the broader CN market's average of 38x. However, interest coverage remains tight with EBIT covering only 1.5 times interest payments, suggesting potential challenges in managing debt obligations despite having more cash than total debt.

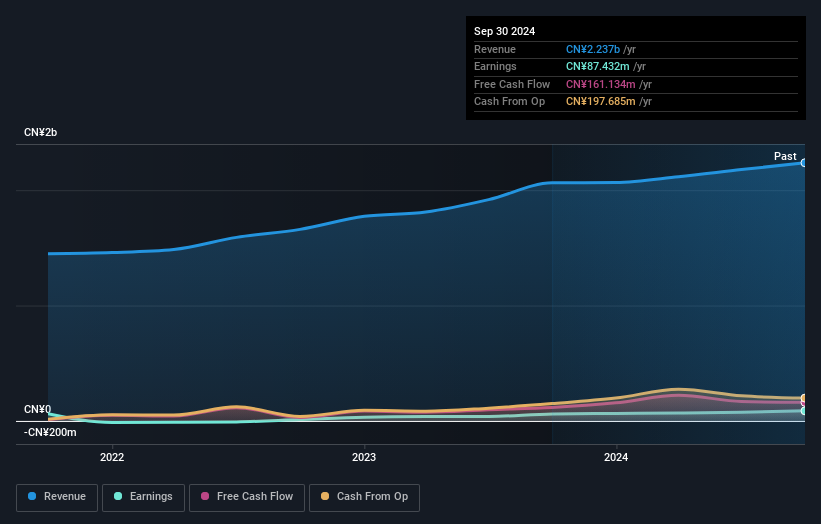

Shenzhen Honor Electronic (SZSE:300870)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Honor Electronic Co., Ltd. is a global manufacturer of switching power adapters, with a market cap of CN¥11.65 billion.

Operations: Shenzhen Honor Electronic generates revenue primarily from the global sale of switching power adapters. The company has a market cap of CN¥11.65 billion, reflecting its substantial presence in the electronics manufacturing sector.

Shenzhen Honor Electronic, a nimble player in the electronics sector, has posted impressive growth with earnings surging by 27% over the past year, outpacing its industry. The company's net income for Q1 2025 stood at CNY 49.57 million, a notable rise from CNY 31.16 million year-on-year. Earnings per share also improved to CNY 0.47 from CNY 0.31 previously. While the debt-to-equity ratio rose to 32.8% over five years, interest payments are comfortably covered by EBIT at a multiple of 26 times, indicating robust financial health despite some volatility in share price recently observed over three months.

Summing It All Up

- Click this link to deep-dive into the 3164 companies within our Global Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal