Tariffs overdraft recovery momentum, Germany's industrial output and exports both surpassed expectations and declined in April

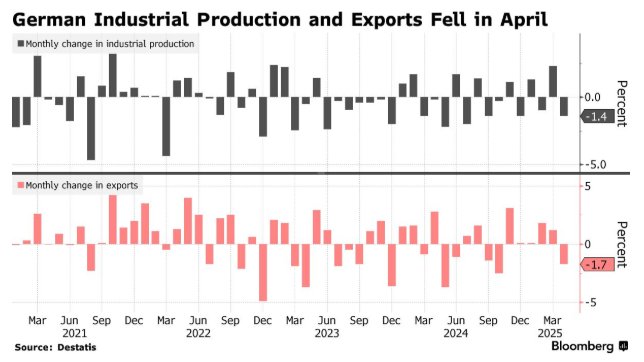

The Zhitong Finance App learned that Germany's industrial output and exports both declined in April. At a time when the threat of US tariffs was imminent, hopes for a cyclical recovery in Europe's largest economy were dashed. According to data from the German Statistical Office on Friday, industrial output fell 1.4% month-on-month, and exports fell 1.7% month-on-month. Both figures exceeded the expectations of economists surveyed by Bloomberg.

The factory order data released on Thursday was an unexpected surprise — driven by a surge in demand for computer, electronic and optical products, the number of orders bucked the trend in April, which was significantly better than the decline expected by the market.

Although the German economy had a good start in the first quarter with growth exceeding expectations, this was mainly due to companies and exporters rushing to ship ahead of expected tariffs. Weak April data showed an unfavorable start to the second quarter. In particular, industrial output showed an overall decline. This posed a serious challenge to Chancellor Mertz, who took office in early May.

However, Commerzbank's chief economist Jörg Kramer is optimistic and believes there is no need to worry too much. He wrote in the research report that “the increase in new orders indicates that production will recover in the coming months.” “Even if the US imposes tariffs to inhibit recovery, the German economy will still benefit from ECB interest rate cuts and upcoming large-scale fiscal stimulus.”

Bloomberg economist Martin Admer warned: “Although the pessimism of manufacturing companies about the short-term outlook has abated slightly, we expect industrial weakness to continue for several months, which may cause overall economic activity to stagnate this summer.”

Most international agencies and economists predict that the German economy will stagnate in 2025, which will be an unprecedented three consecutive years of zero growth, and may even return to the contraction trend of 2023 and 2024.

The Bundesbank will release its latest growth forecast later Friday. Governor Joachim Nagel recently stated that following early overdraft growth in the first quarter, “with the entry into force of the tariff policy, the economy is expected to weaken for the rest of the year.”

Germany is regarded as the country most vulnerable to US trade tariffs, and is still constrained by structural problems such as weak global growth, aging labor, and bureaucracy.

The new government's plans to massively increase defense and infrastructure spending have brought some optimism. On Wednesday, the German cabinet approved a corporate tax relief plan with a total value of about 46 billion euros (52 billion US dollars) as an important component of the economic revitalization plan.

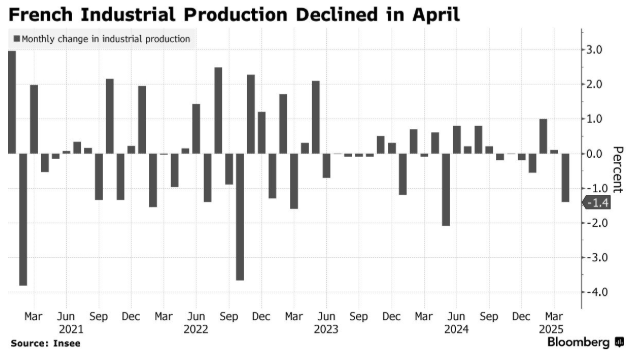

According to data from France on the same day, industrial output in the Eurozone's second-largest economy fell 1.4% in April, far below the stability expected by economists. The data was dragged down by a sharp drop in energy output due to abnormally mild weather, and manufacturing output also fell 0.6% month-on-month.

The trade report shows that France's merchandise trade deficit widened slightly in April, with exports falling to 50.4 billion euros (57.6 billion US dollars) from 50.5 billion euros in March.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal