Discover China Shengmu Organic Milk And 2 Other Promising Asian Penny Stocks

Amidst a backdrop of fluctuating global trade policies and economic indicators, Asian markets are navigating a complex landscape. Investors seeking opportunities beyond established giants might find value in penny stocks, which often represent smaller or emerging companies. Despite the somewhat outdated terminology, these stocks can still offer surprising value and potential for growth when backed by solid financial foundations.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.88 | HK$3.25B | ✅ 5 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.09 | HK$1.74B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.20 | HK$2B | ✅ 4 ⚠️ 2 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.66 | THB798M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.31 | SGD9.09B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.176 | SGD35.06M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.11 | SGD853.23M | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.38 | HK$50.15B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,153 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

China Shengmu Organic Milk (SEHK:1432)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Shengmu Organic Milk Limited is an investment holding company that produces and distributes raw milk and dairy products in the People’s Republic of China, with a market cap of HK$1.82 billion.

Operations: The company generates CN¥3.13 billion in revenue from its dairy farming business segment.

Market Cap: HK$1.82B

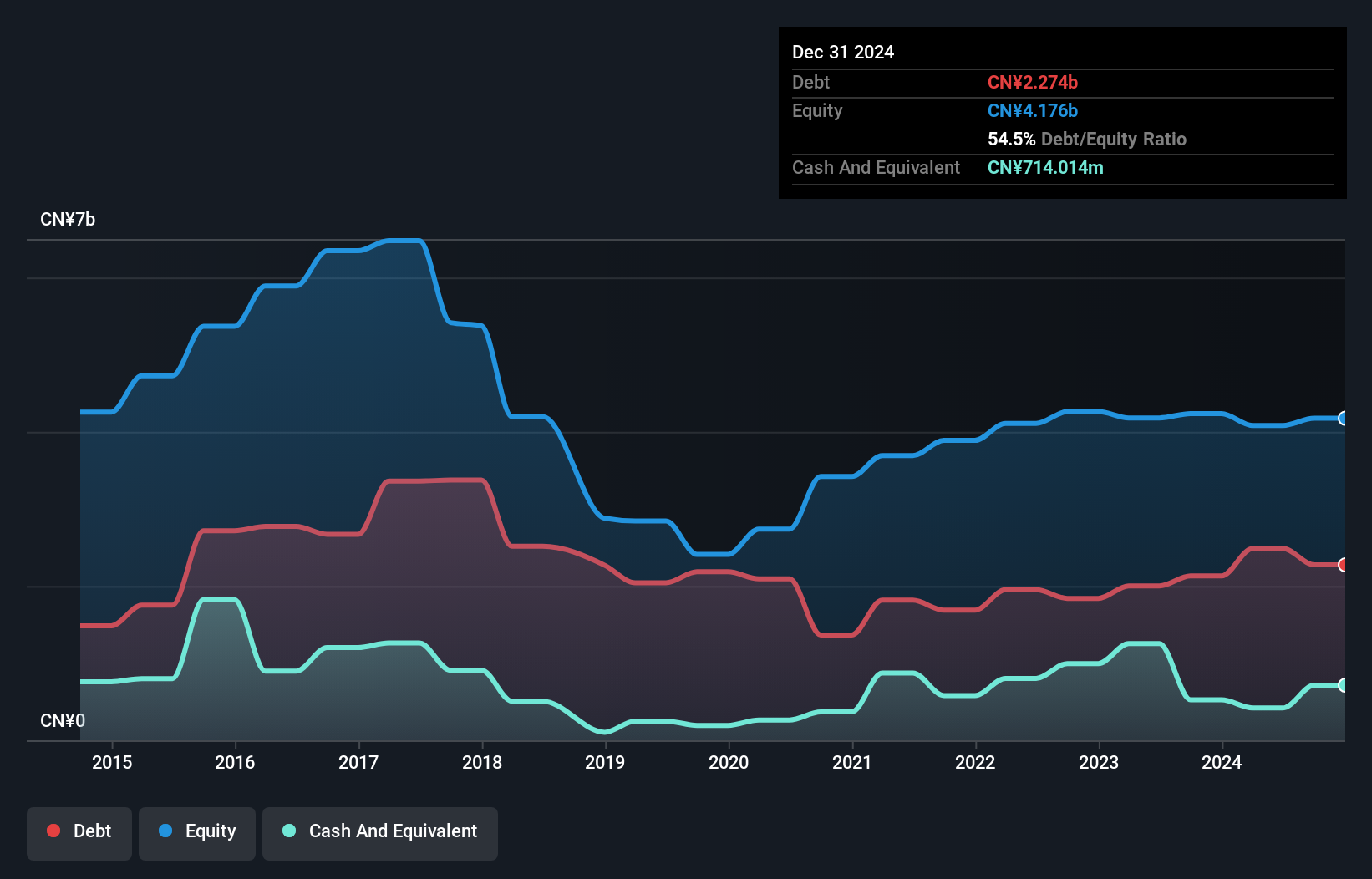

China Shengmu Organic Milk Limited, with a market cap of HK$1.82 billion, faces challenges typical of penny stocks such as volatility and financial instability. The company reported a net loss of CN¥65.5 million for 2024, contrasting with a profit the previous year, and did not declare a dividend. Although its operating cash flow covers 40.3% of its debt and it maintains a satisfactory net debt to equity ratio of 37.4%, short-term liabilities exceed assets by CN¥500 million. Despite these issues, its seasoned management team offers stability amidst the financial struggles common in this investment category.

- Unlock comprehensive insights into our analysis of China Shengmu Organic Milk stock in this financial health report.

- Explore historical data to track China Shengmu Organic Milk's performance over time in our past results report.

Scholar Education Group (SEHK:1769)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scholar Education Group is an investment holding company that provides private education services in the People's Republic of China and Hong Kong, with a market cap of HK$2.45 billion.

Operations: The company generates revenue primarily from its private education services, amounting to CN¥852.33 million.

Market Cap: HK$2.45B

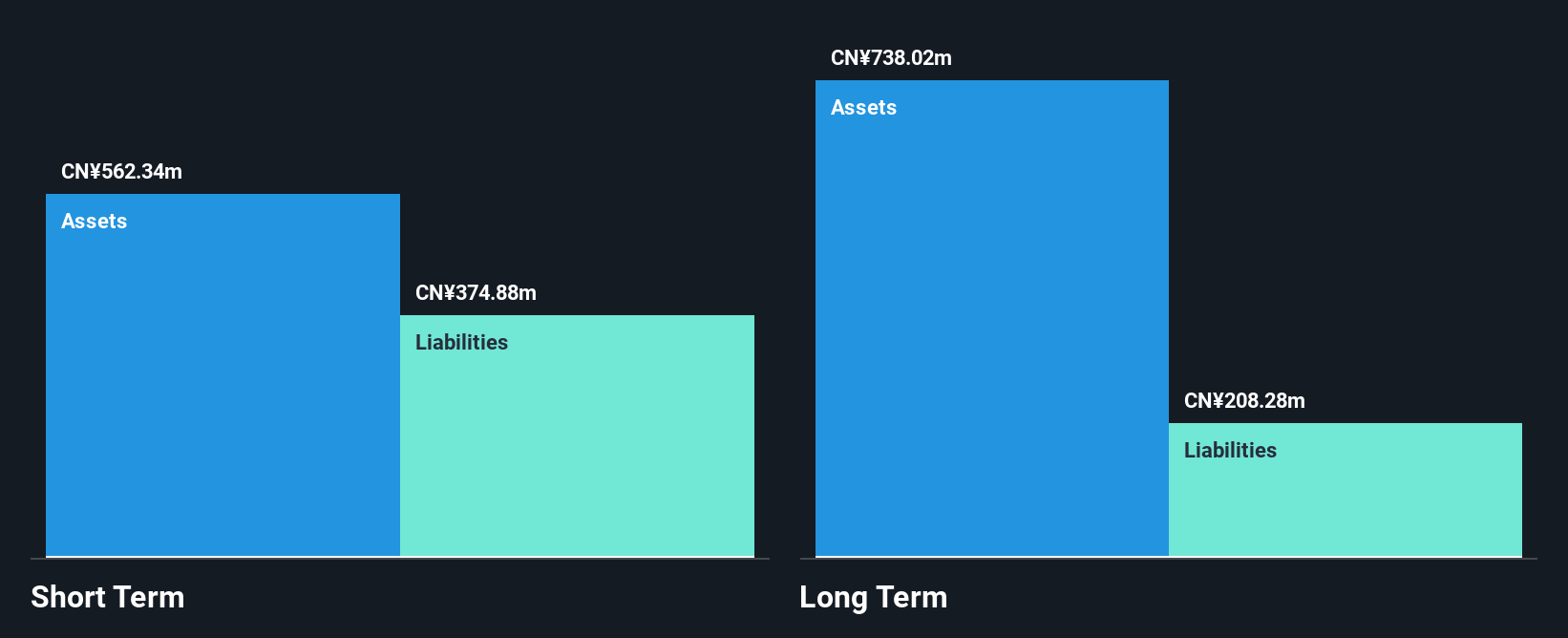

Scholar Education Group, with a market cap of HK$2.45 billion, demonstrates financial stability uncommon in penny stocks. The company has high-quality earnings and its revenue is projected to grow by 26.94% annually. Scholar Education's debt is well-covered by operating cash flow and it maintains a strong balance sheet with short-term assets exceeding both short- and long-term liabilities. Recent board changes include the appointment of Prof. Zhang Wenjun, enhancing its experienced management team. The company declared a final dividend of HKD 0.07 per share for 2024, reflecting solid performance and shareholder returns amidst strategic growth initiatives.

- Get an in-depth perspective on Scholar Education Group's performance by reading our balance sheet health report here.

- Examine Scholar Education Group's earnings growth report to understand how analysts expect it to perform.

CSE Global (SGX:544)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CSE Global Limited is an investment holding company that provides integrated industrial automation, information technology, and intelligent transport solutions across the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market capitalization of SGD332.09 million.

Operations: The company's revenue is derived from three primary segments: Automation (SGD194.36 million), Communications (SGD232.04 million), and Electrification (SGD434.78 million).

Market Cap: SGD332.09M

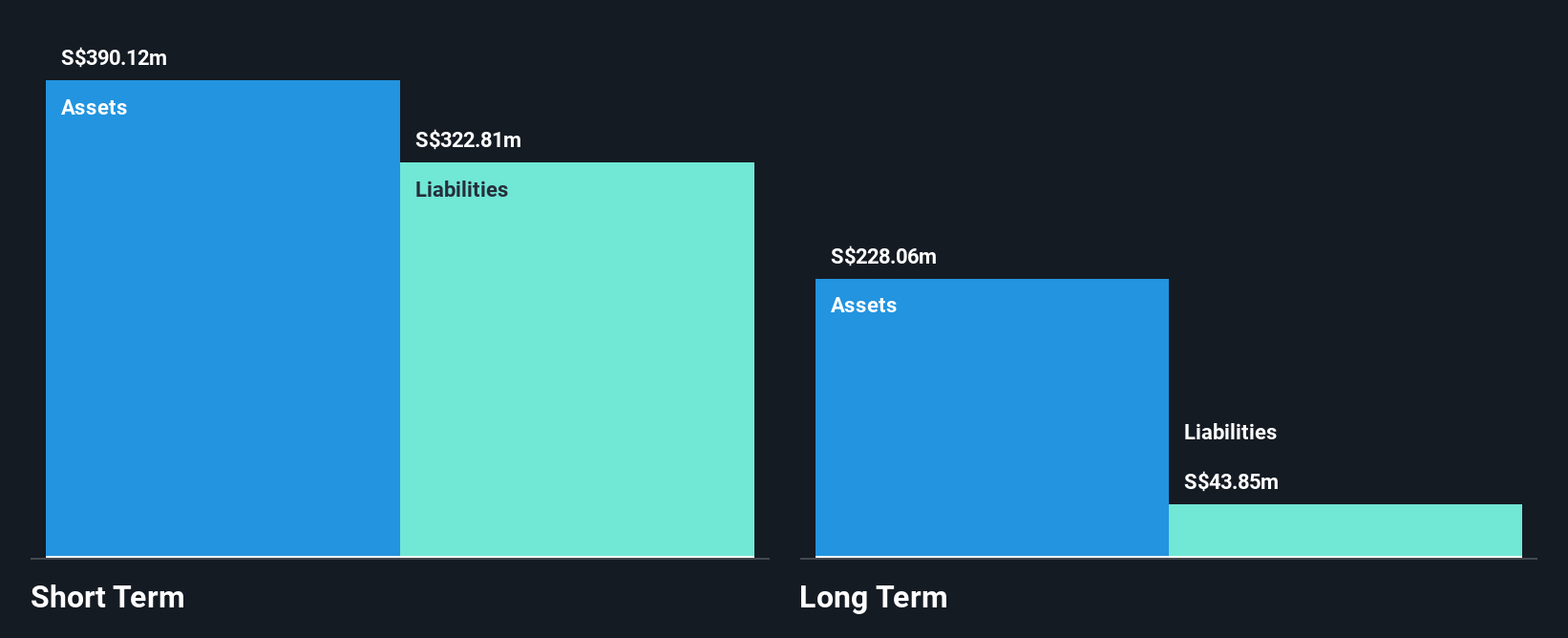

CSE Global Limited, with a market cap of SGD332.09 million, offers a compelling profile in the penny stock landscape. The company is trading at 61.7% below its estimated fair value and demonstrates financial prudence with short-term assets exceeding liabilities and satisfactory debt coverage by operating cash flow. Despite low return on equity (10.3%) and declining earnings over five years, recent profit growth of 16.9% shows promise, outpacing industry averages. However, the dividend yield of 5.11% is not well-supported by free cash flows, and recent board retirements could impact governance stability as strategic shifts unfold.

- Click to explore a detailed breakdown of our findings in CSE Global's financial health report.

- Explore CSE Global's analyst forecasts in our growth report.

Summing It All Up

- Click this link to deep-dive into the 1,153 companies within our Asian Penny Stocks screener.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal