US stock outlook | Futures on the three major stock indexes had mixed ups and downs, and the US Senate approved Bauman as Vice Chairman of the Federal Reserve Supervisory Committee

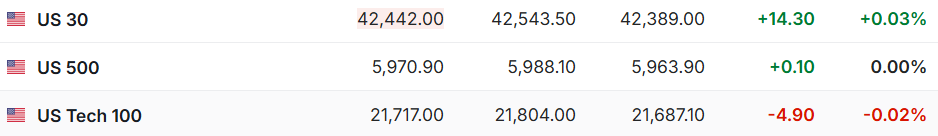

1. Before the US stock market on June 5 (Thursday), futures for the three major US stock indexes had mixed ups and downs. As of press release, Dow futures rose 0.03%, S&P 500 futures rose slightly, and NASDAQ futures fell 0.02%.

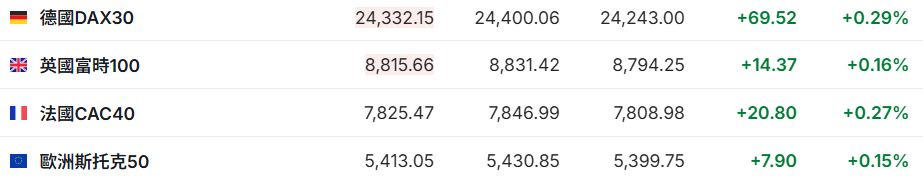

2. As of press release, the German DAX index rose 0.29%, the British FTSE 100 index rose 0.16%, the French CAC40 index rose 0.27%, and the European Stoxx 50 index rose 0.15%.

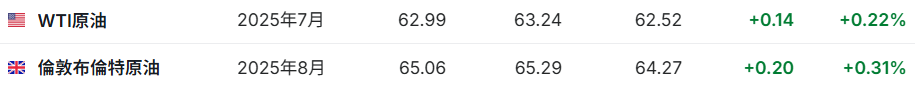

3. As of press release, WTI crude oil rose 0.22% to $62.99 per barrel. Brent crude rose 0.31% to $65.06 per barrel.

Market news

Does loose regulation come to the top? Bauman's new job exacerbates the dispute over the “close relationship” between the Federal Reserve and Wall Street. On Wednesday, the US Senate approved Federal Reserve Governor Michelle Bowman (Michelle Bowman) as the Federal Reserve's vice chairman in charge of regulation, which further indicates that regulations under US President Trump will shift to easing. As a fifth-generation banker and Republican, Bauman has long advocated in his speeches the need for more “tailored” regulation. Compared to her predecessor Michael Barr (Michael Barr), she hinted that regulatory priorities will change significantly, and the relationship with the banking industry will also be more friendly. Meanwhile, Bauman often refutes Barr on issues such as bank regulation, stress testing reforms, and capital rules. According to reports, Bauman told members of the National Assembly in April that the current regulations are too complicated and repetitive.

US steel and aluminum tariffs are doubling, and industry executives warn that demand will be hit. Industry executives warned that US President Trump's new move to impose a 50% tariff on aluminum imports may make it difficult for consumers to accept, leading to a decline in demand. Derek Prichett, senior vice president of global metals business at Novelis, said at the 17th summit of Harbor Aluminum in Chicago: “We are concerned that this tax policy may cause a decline in demand, especially with current levies. Overall, it's a real downside.” He also pointed out that his company's business in Canada and the US has been seriously affected by tariffs. The Atlanta, Georgia-based company is the largest manufacturer of flat rolled aluminum products widely used in a variety of industries, including products in the automotive and aerospace sectors.

Kashkari: The Federal Reserve is in an “advantageous position” to wait and see the impact of tariffs on the economy before considering cutting interest rates. Minneapolis Federal Reserve Chairman Neel Kashkari (Neel Kashkari) said on Wednesday that the Federal Reserve is currently in an advantageous position to wait and see the impact of the tariff policy on the economy before deciding whether to adjust interest rates. He said, “The economy seems quite resilient so far, so for me, now is the time to collect data, observe the results of tariff negotiations, and then make a clear judgment on interest rate trends.” Kashkari pointed out that the decline in corporate investment due to tariff uncertainty is a major hidden danger to the US economy. He said, “The longer this uncertainty continues, the greater the negative impact,” adding that some companies are considering layoffs in different ways, and the labor market has shown some signs of weakness. A report released earlier Wednesday showed that private sector employment growth fell to its slowest rate in two years.

The US dollar continues to fall, and Bank of America Securities is booming in emerging market assets. Bank of America Securities said that as the dollar is expected to continue to fall, emerging market assets are expected to achieve double-digit returns this year. David Hauner, head of fixed income strategy for global emerging markets at Bank of America Securities, said, “This year, we can easily maintain double-digit returns. This is because we believe that the US dollar is the most important driver and that long-term US bonds will stabilize.” Bank of America Securities is optimistic about Eastern European currencies and stocks. Hauner said that in terms of fixed income, Brazil is still the first choice because interest rates in this South American country are very high, and interest rate cuts may begin before the end of the year. The US dollar exchange rate is close to a two-year low. Wall Street banks, including Morgan Stanley and J.P. Morgan Chase, expect the dollar to weaken further due to possible interest rate cuts by the Federal Reserve, slowing economic growth, and uncertainty in fiscal and trade policies.

Individual stock news

The net revenue of MOMO.US (MOMO.US) in Q1 fell 1.5% year over year, and the number of Momo paid subscribers fell to 4.2 million. Zhiwen Group's Q1 net revenue was 2,520.8 billion yuan (RMB, same below), down 1.5% year on year. Net profit attributable to the company was 358 million yuan, 5.2 million yuan for the same period last year. After dilution, revenue per ADS was 2.07 yuan, and 0.03 yuan for the same period last year. Non-GAAP net profit attributable to the company was 403.8 million yuan; diluted revenue per ADS was 2.34 yuan. In March 2025, the number of monthly active users of the Exploration App was 10.7 million, 13.7 million in the same period last year, 800,000 paid users in the fourth quarter, and 1.1 million in the same period last year. In the first quarter, the total number of paid users of the Momo app was 4.2 million, compared to 7.1 million in the same period last year. Looking ahead, the company expects total net revenue for the second quarter of 2025 to be between 2.57 billion yuan and 2.67 billion yuan, a year-on-year decrease of 4.5% to 0.8%.

Water Drop (WDH.US) achieved profit for 13 consecutive quarters with Q1 revenue of 754 million yuan in 2025. In the first quarter of 2025, Shuidi's net revenue was 754 million yuan, up 7% year on year; net profit to mother was 108 million yuan, up 34.2% year on year, achieving profit for 13 consecutive quarters; operating expenses (including sales expenses, management expenses and R&D expenses) accounted for 40.3% of revenue, down 6.1 percentage points year on year. Since announcing the launch of the share repurchase program in September 2021, as of May 31, 2025, Shuidi has repurchased approximately 54.2 million ADS (American Depositary Receipts) shares from the open market. With the approval of the company's board of directors, Shuidi also completed a cash dividend of 7.3 million US dollars in May to share the company's value creation with shareholders.

To cope with tariff costs and weak demand, Procter & Gamble (PG.US) plans to cut 15% of office jobs over the next two years. Procter & Gamble (PG.US), an international household goods giant headquartered in the US, plans to abolish as many as 7,000 office jobs within the next two years to improve productivity and operational efficiency. The consumer goods giant, which produces stain remover and Gillette shavers, said in a presentation posted on its official website that the jobs that have been cut account for about 15% of the current total number of non-manufacturing employees, but did not disclose the exact location of the layoffs. Additionally, P&G plans to officially raise prices for the next fiscal year starting in July.

Tech giants buck the tide of layoffs and expand their forces! Alphabet (GOOGL.US) CEO: AI talent will continue to grow next year. Alphabet CEO Sundar Pichai (Sundar Pichai) said that although the company has increased its investment in artificial intelligence (AI), it will continue to expand the team of engineers until at least 2026. Pichay said he will continue to increase investment in the engineering team in the near future, and emphasized that “talent is still the key.” US tech giants, including Microsoft (MSFT.US), have cut more employees this year, partly because of the huge investments needed to free up resources to secure a leading position in the AI field. Alphabet itself has also carried out a series of layoffs in recent years to free up resources. These layoffs have also raised concerns that AI will replace certain job functions.

Apple (AAPL.US) lost the lawsuit, and the US appellate court refused to suspend the App Store rectification order. The US Court of Appeals denied Apple (AAPL.US)'s request to suspend execution of the App Store rectification order. The order requires Apple to allow App Store developers to guide users to buy in-app items online without paying commissions. The San Francisco Federal Court of Appeals handed down this ruling on Wednesday, the latest setback in a long-standing dispute between Apple and Fortnite developer Epic Games over their App Store dominating the smartphone software market. Apple is seeking to suspend the order while appealing the judge's April ruling requiring Apple to comply with the 2021 ban issued by the judge after finding that the company was engaged in anti-competitive conduct in violation of California law.

Key economic data and event forecasts

20:30 Beijing time: US trade balance for April (100 million US dollars), number of US jobless claims for the week ending May 31 (10,000).

22:30 Beijing time: Changes in US EIA natural gas inventories for the week ending May 30 (100 million cubic feet).

04:30 Beijing time the next morning: US central banks held US treasury bonds (100 million US dollars) for the week ending May 31.

20:15 Beijing time: The ECB announces the interest rate decision.

00:00 Beijing time the next morning: Federal Reserve Governor Kugler delivered a speech at the New York Economic Club.

The next morning at 01:30 Beijing time: 2026 FOMC voting committee and Philadelphia Federal Reserve Chairman Huck delivered a speech on the economic outlook.

01:30 Beijing time the next morning: 2025 FOMC and Kansas Federal Reserve Chairman Schmid delivered a speech on banking policy.

Performance Forecast

Friday morning: Broadcom (AVGO.US)

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal