ASX Penny Stocks Spotlight: Biome Australia And Two Promising Picks

The Australian market continues to show strength, nearing record highs with sectors like energy leading the charge, despite some economic concerns such as a low GDP growth rate. For investors looking beyond the major players, penny stocks—commonly smaller or newer companies—remain an intriguing area of potential. While the term may seem outdated, these stocks can offer growth opportunities at lower price points when they possess strong financials and fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.715 | A$226.78M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.83 | A$147.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.88 | A$1.13B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.52 | A$71.7M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.60 | A$400.87M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.49 | A$165.6M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.30 | A$773.18M | ✅ 4 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$3.13 | A$732.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.705 | A$450.82M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,000 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Biome Australia (ASX:BIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biome Australia Limited focuses on developing, commercializing, and marketing live biotherapeutics and complementary medicines both in Australia and internationally, with a market cap of A$103.08 million.

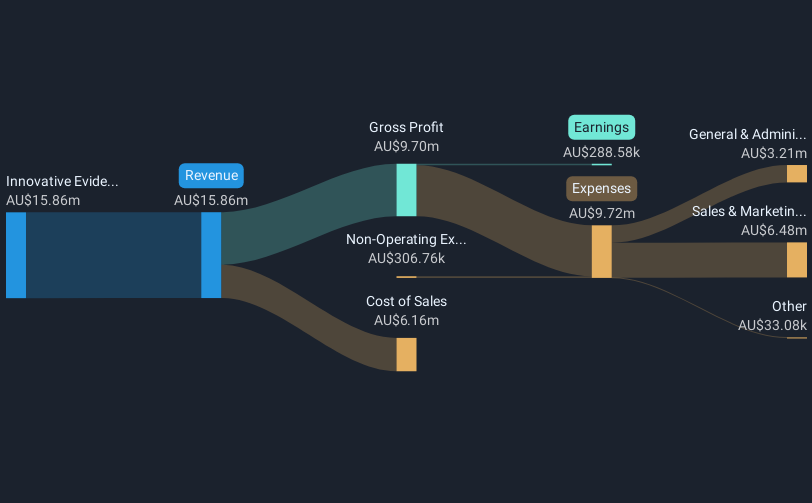

Operations: The company generates revenue of A$15.86 million from its segment focused on innovative evidence-based products that connect gut health with overall human health.

Market Cap: A$103.08M

Biome Australia Limited, with a market cap of A$103.08 million, has shown significant progress by becoming profitable this year and growing earnings at 29.8% per year over the past five years. Trading at 77.5% below its estimated fair value, it presents potential for investors seeking undervalued opportunities in the biotherapeutics sector. Despite negative operating cash flow and low return on equity at 6.4%, its short-term assets cover both short- and long-term liabilities effectively. The recent addition to the S&P/ASX Emerging Companies Index highlights increased visibility within investment circles, although management experience data remains insufficient for evaluation.

- Click here and access our complete financial health analysis report to understand the dynamics of Biome Australia.

- Explore Biome Australia's analyst forecasts in our growth report.

Hot Chili (ASX:HCH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hot Chili Limited, with a market cap of A$92.47 million, is a mineral exploration company operating in Chile.

Operations: Hot Chili Limited does not have any reported revenue segments.

Market Cap: A$92.47M

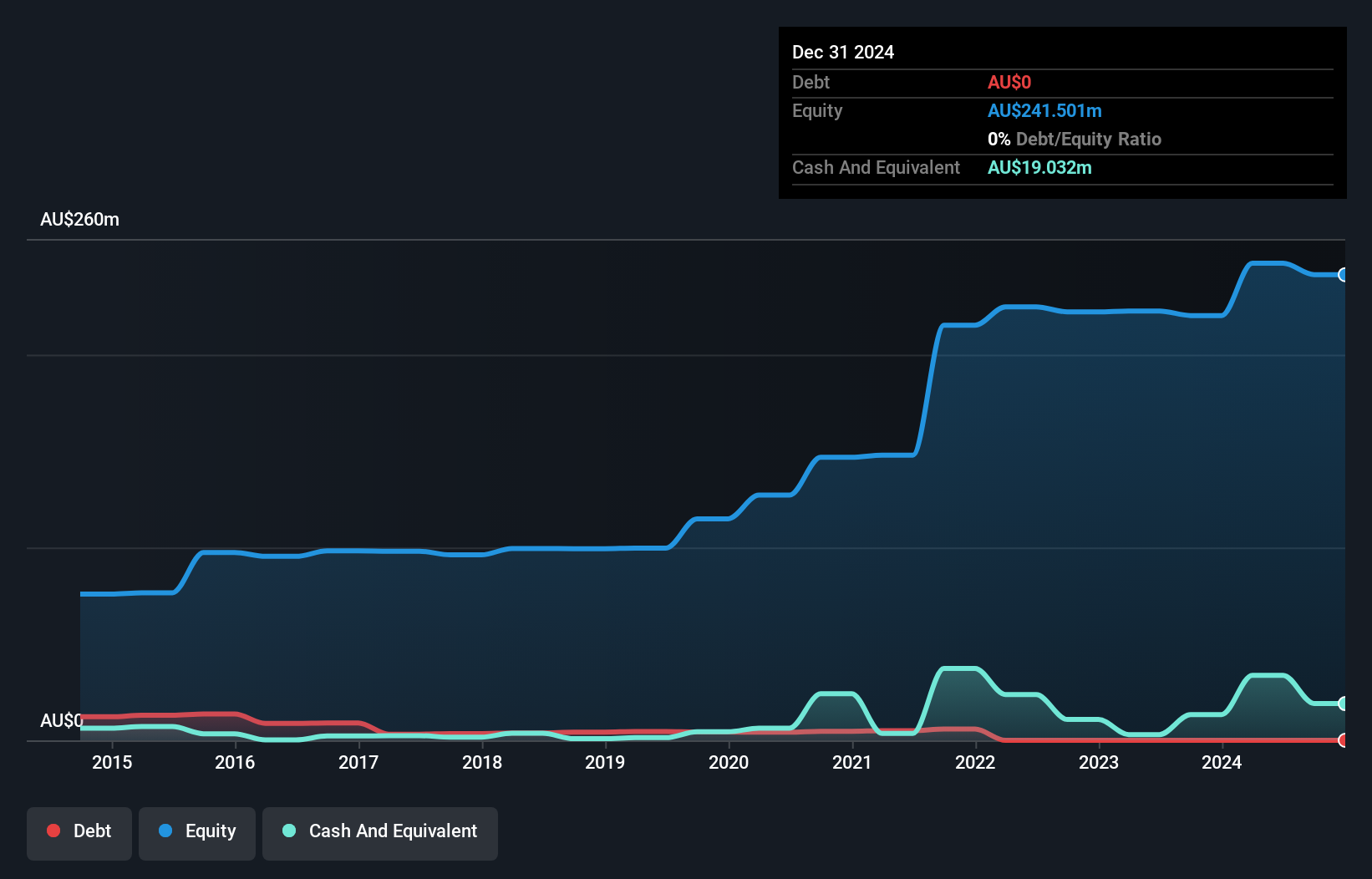

Hot Chili Limited, with a market cap of A$92.47 million, is pre-revenue and focused on mineral exploration in Chile. Recent updates highlight the La Verde copper-gold discovery's potential, with assay results expanding the mineralisation footprint significantly. The identification of three look-alike targets suggests potential for a district-scale porphyry cluster. Despite being unprofitable and having less than a year of cash runway, Hot Chili's short-term assets exceed its liabilities, providing some financial stability. The company remains debt-free and has strengthened its board with experienced mining executives to guide strategic growth amid ongoing exploration activities at La Verde and Costa Fuego projects.

- Unlock comprehensive insights into our analysis of Hot Chili stock in this financial health report.

- Gain insights into Hot Chili's outlook and expected performance with our report on the company's earnings estimates.

PointsBet Holdings (ASX:PBH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PointsBet Holdings Limited operates a cloud-based platform offering sports, racing, and iGaming betting products and services in Australia, with a market cap of A$398.07 million.

Operations: The company's revenue is derived from its Canadian trading segment, which generated A$36.24 million, and its Australian trading segment, contributing A$216.01 million.

Market Cap: A$398.07M

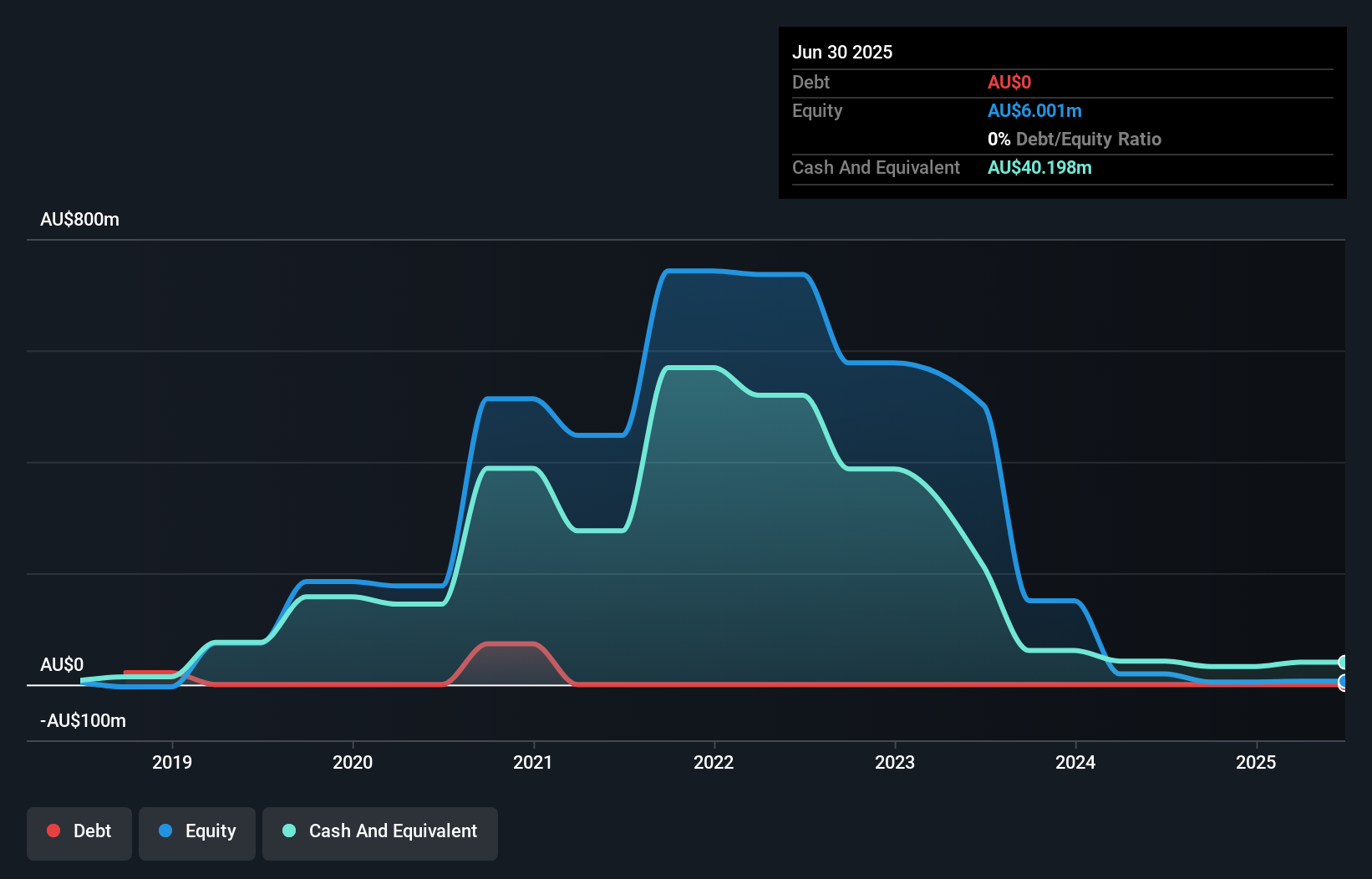

PointsBet Holdings, with a market cap of A$398.07 million, operates in the betting industry and is currently unprofitable but has reduced its losses at a rate of 27.1% annually over five years. The company is debt-free and its management team and board are experienced, with average tenures of 3.4 and 6.1 years respectively. Although trading below estimated fair value by 41.6%, the company's short-term assets (A$39.2M) fall short of covering its short-term liabilities (A$62.3M). Despite this, PointsBet has sufficient cash runway for more than three years based on current free cash flow trends.

- Jump into the full analysis health report here for a deeper understanding of PointsBet Holdings.

- Evaluate PointsBet Holdings' prospects by accessing our earnings growth report.

Seize The Opportunity

- Jump into our full catalog of 1,000 ASX Penny Stocks here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal