SoundHound AI (NasdaqGM:SOUN) Announces Sales Growth To US$29 Million In Q1 Earnings

SoundHound AI (NasdaqGM:SOUN) has been actively engaged in significant corporate movements, including the approval of revised company bylaws and showcasing innovative AI solutions at industry events. These developments, alongside a partnership with Allina Health, provide a backdrop for the company's 5.75% price increase over the last month. In particular, their Q1 earnings report showed a strong financial recovery, highlighting sales growth to $29.13 million and a net income of $129.93 million. While the overall market has been flat recently, these actions may have added weight to the broader positive performance trend observed over the past year.

We've spotted 3 weaknesses for SoundHound AI you should be aware of.

The recent developments surrounding SoundHound AI, including the revised company bylaws and emerging AI solutions, could have significant implications for the company's trajectory. While these initiatives might amplify its brand presence and operational efficiency, the immediate ramifications on revenue and earnings projections are tied to the successful execution of these strategies. The partnership with Allina Health indicates a targeted expansion, likely aiding revenue streams and solidifying market position in specific industry verticals. Yet, this does not instantly translate to profitability amidst the existing financial risks and high R&D costs.

Over the past three years, SoundHound's total shareholder return was 148.25%, a very large increase reflecting substantial growth when compared to the broader market's performance of 12.6% over the last year. Within the same period, SoundHound's return also exceeded the US Software industry's 24.1% return, showcasing its resilience and traction in a competitive sector. These figures underline the potential momentum behind SoundHound's strategic initiatives and diversified customer approach as factors influencing its positive trajectory.

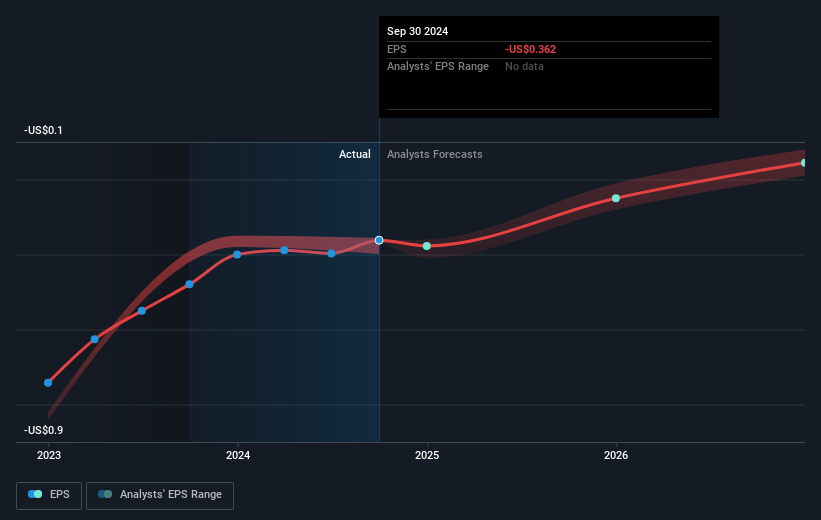

SoundHound's stock price movements, which saw a 5.75% rise recently, contrasts with the broader market flat performance and align with optimistic earnings forecasts made by analysts. The firm's current share price diverges from the analyst consensus target of US$13.93, as the stock trades at a 32% discount, suggesting potential upside if the company's growth forecasts materialize. However, such growth is contingent upon how well SoundHound manages its existing risks and capitalizes on its market opportunities to bridge this valuation gap effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal