UnitedHealth Group (NYSE:UNH) Declares US$2.21 Dividend; Shareholders Reject Parachute Proposal

On June 4, 2025, UnitedHealth Group (NYSE:UNH) declared a quarterly dividend of $2.21 per share, illustrating its ongoing commitment to shareholder value. Concurrently, the company addressed executive compensation transparency, with shareholders voting against a proposal for a mandate on golden parachutes. Over the last week, UnitedHealth’s stock price rose by 2%, aligning with the flat market performance. These developments, including dividend announcements and shareholder actions, likely added weight to the company's positive momentum, counteracting any broader market stagnation. Overall, UnitedHealth's proactive governance and shareholder engagement reflect a strong commitment to long-term value creation.

Be aware that UnitedHealth Group is showing 1 weakness in our investment analysis.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

UnitedHealth Group’s recent dividend declaration and shareholder engagement actions reinforce a commitment to delivering value, illustrating efforts to maintain investor confidence and counteract broader market conditions. However, over the past five years, the company’s total return, combining share price and dividends, was 4.84%, suggesting modest long-term growth. This performance provides context against its more recent share price increase of 2% over the past week, which aligns with a flat US market trend but contrasts with last year's underperformance relative to the US healthcare industry, which declined 20.3%.

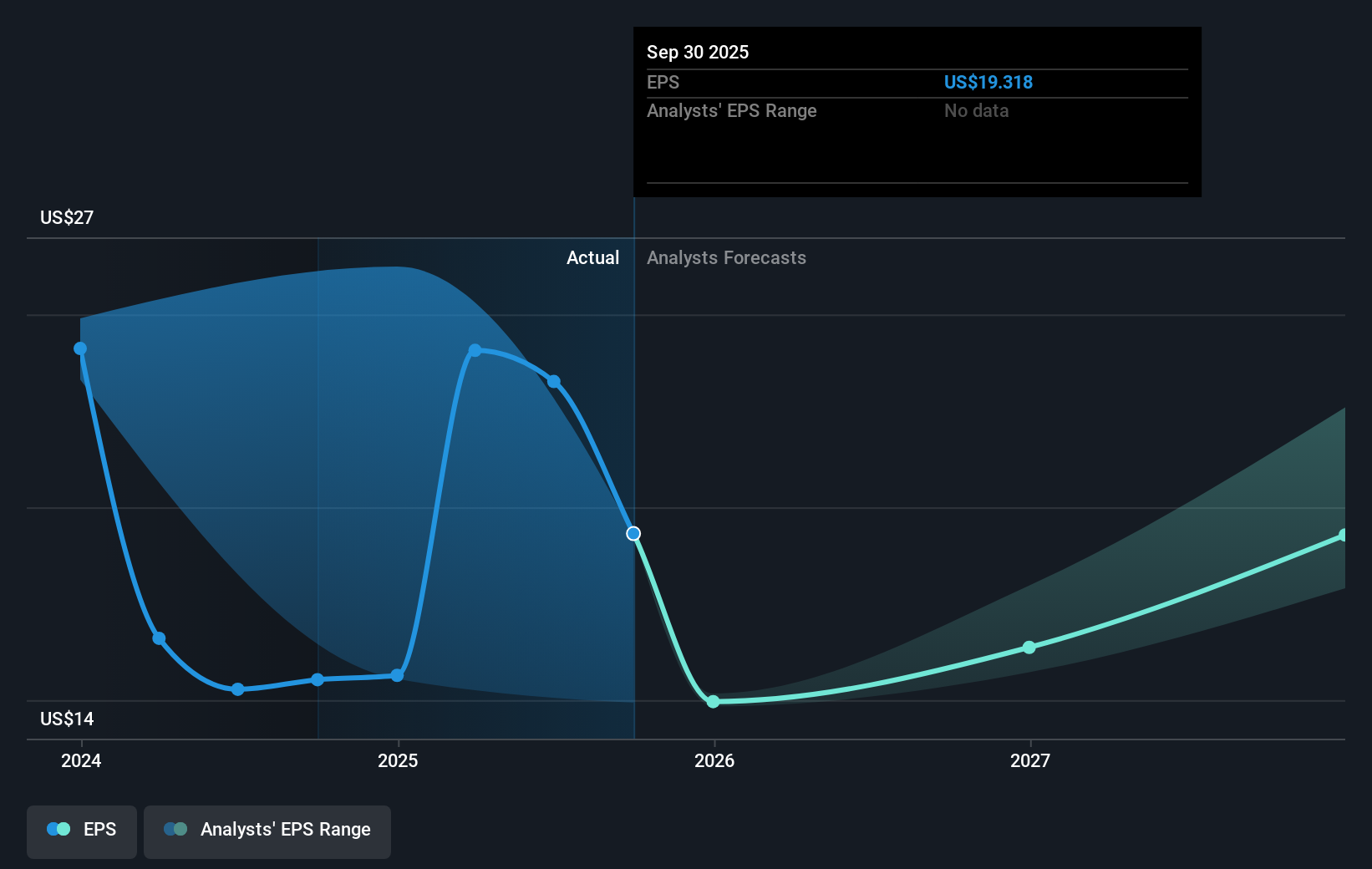

The company's initiatives targeting Medicare strategies and digital tool investments are crucial as they navigate evolving market dynamics. While adjustments in these areas may enhance future revenue and earnings, challenges persist, including executing the CMS risk model changes and external funding pressures. These issues could influence operational efficiencies and net margins adversely. Analysts forecast a 9.4% annual revenue growth over the next three years and an increase in profit margins from 5.4% to 5.7%, expressing cautious optimism despite the risks.

With a current share price of $394.51, the stock trades at a significant discount to consensus analyst price targets of $547.65, a potential upside of 28%. This could indicate confidence in the company's long-term strategic initiatives despite near-term risks. As UnitedHealth continues to engage shareholders and refine its healthcare offerings, its actions are expected to increasingly align with these analyst projections.

Evaluate UnitedHealth Group's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal