IPO Foresight | Hitting the IPO twice, can rapid innovation and transfer to Hong Kong stocks “make the dream come true”?

Since this year, Hong Kong stocks have had an obvious money-making effect, attracting investors' attention to IPOs, and the popularity of IPOs has continued to rise. According to the Hong Kong Stock Exchange, recently Rapid Innovation submitted a listing application to the main board of the Hong Kong Stock Exchange. CICC Corporation, CITIC Construction Investment International, and China Merchants Securities International are co-sponsors.

Fast Innovation is an enterprise-level network solution provider. Previously, the company wanted to be listed on the Shenzhen Main Board in 2023, but soon after entering the inquiry stage, the company withdrew the relevant application documents and the IPO was terminated. Now that it has been listed in Hong Kong for the second time, are there any new highlights in the fundamentals of rapid innovation?

Behind the increase in revenue, high debt or hidden concerns

According to the prospectus, Fast Innovation is an enterprise providing enterprise-level network solutions. The company is committed to helping global enterprises achieve rapid digital transformation through rich enterprise-level network solutions. The company's products and services include high-performance network equipment, expandable network device operating systems and cloud network management platforms. Through the online DTC business model, the company provides comprehensive, one-stop network solutions that are scalable and affordable.

During the reporting period, the company's performance showed a continuous upward trend, but profit declined in 2024. In 2022, 2023 and 2024, Rapid Innovation achieved revenue of approximately RMB 1,988 million, RMB 2,213 billion, and RMB 2,612 billion respectively (in RMB, same below); for the same period, total revenue for the year was approximately RMB 371 million, RMB 459 million, and RMB 397 million, respectively. In 2022, 2023 and 2024, the company's gross margins were 45.4%, 49.4% and 50.0%, respectively.

According to product classification, the company's products can be divided into high-performance network solutions and basic performance network solutions. Among them, the share of revenue from high-performance network solutions increased from 23.8% in 2022 to 31.9% in 2024, while the share of revenue from basic performance network solutions fell from 64.9% to 57.3%.

According to the prospectus, high-performance network products are suitable for bandwidth-intensive environments and have the characteristics of high throughput, low latency, and scalability; basic performance network products provide safe and reliable connectivity and simplified deployment, operation and maintenance to meet daily operational requirements.

According to the Zhitong Finance App, the rapid innovation business mainly comes from overseas. In 2022, 2023 and 2024, the company's overseas sales revenue accounted for 99.3%, 99.1% and 99.3% of the total revenue for each year, respectively, and the proportion of revenue from the US exceeded 46%, close to half.

As of the last practical date, the company has established 7 major global delivery centers with a construction area of more than 68,000 square meters in China, the United States, Germany, Australia, Singapore, the United Kingdom and Japan, which can achieve intelligent and efficient scheduling.

During the reporting period, the company's customer base grew, and the average customer revenue also increased. In 2022, 2023 and 2024, about 74,000, 76,600 and 82,500 customers placed orders through the company's online sales platform. The average revenue for each customer in the corresponding year was about 26,900 yuan, 28,900 yuan and 31,700 yuan, respectively. As of May 19, 2025, the company has served more than 450,000 customers in more than 200 countries and regions, covering about 60% of the Fortune 500 companies, including information technology, financial services, healthcare, education, automobiles and electronics.

Furthermore, the company recorded net revenue retention rates of 94.4% and 102.1% in 2023 and 2024, respectively, and customer stickiness continued to increase.

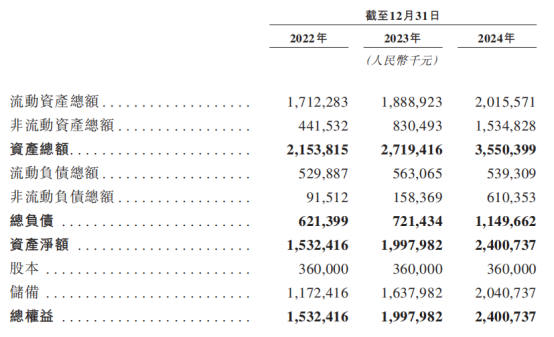

It is worth noting that the size of debt has risen sharply, which has also led to a relatively rapid increase in the company's interest expenses. From 2022 to 2024, the company's liabilities were about 621 million yuan, 721 million yuan, and 1.15 billion yuan respectively; the corresponding financial costs also increased from 4,511 million yuan to 18.544 million yuan.

Optical module manufacturer or cross-border e-commerce?

Judging from rapidly innovating products and services, the company's main business is optical communication and cross-border e-commerce. According to the prospectus, the company's own brands provide more than 120,000 SKU products, covering optical modules and high-speed cables, optical fiber, switches, optical transmission equipment, optical fiber wiring management products and copper cable system products; at the same time, the company has also built a self-operated online DTC e-commerce platform to provide one-stop procurement services such as online inquiry, technical consultation, solution design, and self-service ordering.

The investment boom in the optical module industry began in 2023. Benefiting from the boom in AI models, the demand for the construction of high-performance AI server clusters continued to grow rapidly, which in turn led to a significant rise in the boom in the optical module industry. Not only did many “optical module concept stocks” reap significant gains in the secondary market, but many listed companies are also actively deploying the optical module industry through mergers and acquisitions, such as Changfei Optical Fiber successfully acquired Bochuang Technology in 2022, Aofei Data acquired 70% of Huatuo Optical Communications's shares in 2024, and Huilu Ecology acquired 30% of the shares of the optical module company Wuhan Hengjun Technology Co., Ltd. for 9.5 billion yuan.

As of 2025, the optical module industry remains unabated. Recently, Cambridge Technology, a leading segment in the high-speed optical module field, submitted a listing application to the Hong Kong Stock Exchange. It is reported that the company has shipped 800G optical module products in batches and completed the development of first-generation 1.6T module prototypes. It is expected that various 1.6T optical module products will be delivered to customers in 2025.

However, unlike such traditional manufacturers, rapidly innovating private brand products use a third-party supplier's OEM production model, and they have an e-commerce platform and provide corresponding services such as order management and after-sales customer service. Therefore, the nature of its business is not so much a communication equipment manufacturing company; in fact, it is more biased towards a cross-border e-commerce company.

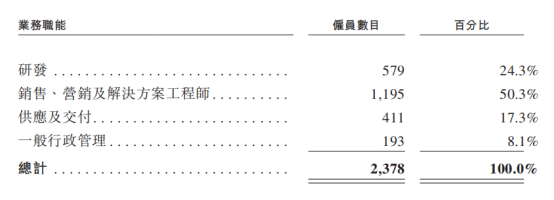

According to the Zhitong Finance App, judging from various expenses and personnel arrangements, the sales expenses of Rapid Innovation are far higher than R&D expenses, and the number of sales teams is significantly larger than that of the R&D team. In 2022, 2023 and 2024, the company's sales and distribution expenses were 270 million yuan, 339 million yuan and 488 million yuan respectively, accounting for 13.6%, 15.3% and 18.7% of total revenue for the same period, showing a continuous growth trend. Among them, advertising and promotion expenses alone spent more than 100 million yuan in 2024.

In contrast, the level of R&D investment was low and stable. In 2022, 2023 and 2024, the company's R&D expenses were 998.24 million yuan, 110 million yuan and 144 million yuan respectively, accounting for 5.0%, 5.0% and 5.5% of total revenue for the same period.

As of December 31, 2024, sales and marketing employees accounted for more than 50% of the company's nearly 2,400 employees, while R&D personnel only accounted for 24.3%.

If you compare Fast Innovation with Cambridge Technology, an optical module and communication equipment manufacturer that also recently went public in Hong Kong, the business scale of the two is at the same level (Cambridge Technology's 24-year revenue was 3.65 billion yuan, and Fast Innovation was 2,612 billion yuan), but Cambridge Technology spent 409 million yuan in R&D in 24 years, accounting for 11.19% of revenue, which is significantly higher than Rapid Innovation.

Furthermore, against the backdrop of a significant increase in the overall performance of the optical module industry in 2024, Rapid Innovation's profit fell 13.5% year on year, which also seems to indicate that there are hidden concerns about the company's profitability. According to media statistics, thanks to the rapid growth in demand for AI computing power, the overall revenue of the 15 listed optical module companies increased 48% in 2024, and net profit to mother recorded a 122% year-on-year growth rate, in stark contrast to the performance performance of Rapid Innovation.

Overall, despite the popular concept of overhead optical modules, the actual business nature of rapid innovation is more biased towards cross-border e-commerce, and its high level of debt may put a lot of pressure on the company's cash flow. Furthermore, the company is highly dependent on US business, and the risk of future trade friction and exchange rate risks cannot be ignored.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal