Global Dividend Stocks To Consider In June 2025

As global markets navigate the complexities of trade policies and inflation trends, investors are keenly observing the impact of these factors on equity performance. With U.S. stocks showing resilience amid tariff uncertainties and European indices buoyed by easing inflation expectations, dividend stocks continue to be an attractive option for those seeking steady income in a fluctuating market environment.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.28% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.42% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

| Daicel (TSE:4202) | 4.93% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.39% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.36% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.04% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.65% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.40% | ★★★★★★ |

Click here to see the full list of 1552 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

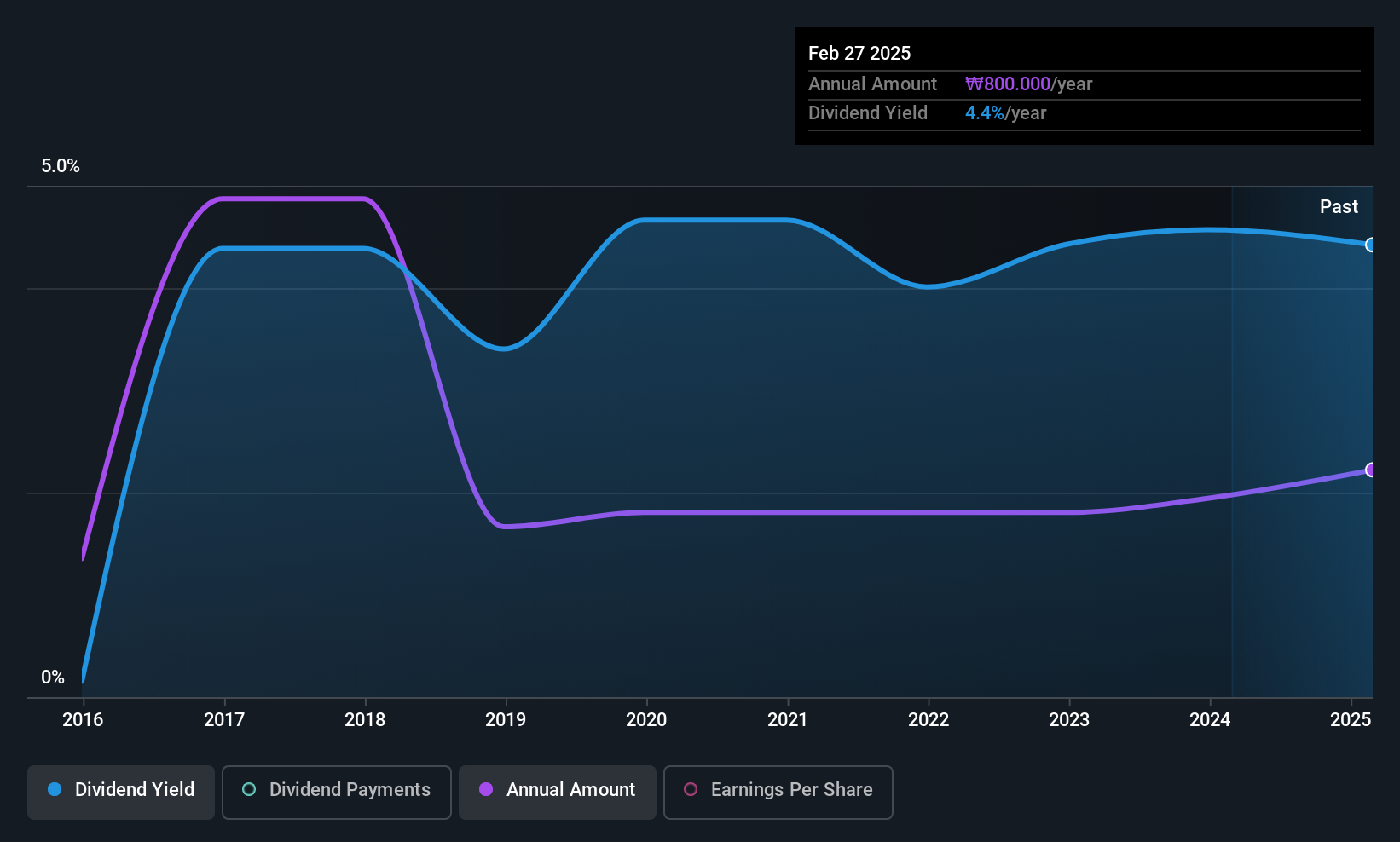

ORION Holdings (KOSE:A001800)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ORION Holdings Corp. is a company that manufactures and sells confectioneries in South Korea, China, and internationally, with a market cap of ₩1.12 trillion.

Operations: ORION Holdings Corp.'s revenue segments include Confectionery at ₩3.90 trillion, Landlord at ₩66.56 billion, and Video at ₩41.64 billion.

Dividend Yield: 3.6%

ORION Holdings' dividend payments are well-covered by both earnings and cash flows, with a payout ratio of 31.5% and a cash payout ratio of 12.6%. However, the dividends have been volatile over the past decade, showing unreliability despite growth in payouts during this period. Recent earnings reports indicate fluctuating performance, with Q1 2025 net income decreasing compared to the previous year, highlighting potential challenges for maintaining stable dividends.

- Click here to discover the nuances of ORION Holdings with our detailed analytical dividend report.

- Our valuation report here indicates ORION Holdings may be undervalued.

Guilin Sanjin Pharmaceutical (SZSE:002275)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guilin Sanjin Pharmaceutical Co., Ltd. focuses on the research, production, and sale of traditional Chinese and natural medicines in China, with a market cap of CN¥8.62 billion.

Operations: Guilin Sanjin Pharmaceutical Co., Ltd. generates its revenue primarily through the research, production, and sale of traditional Chinese and natural medicines in China.

Dividend Yield: 3.7%

Guilin Sanjin Pharmaceutical's dividend is well-covered by earnings and cash flows, with payout ratios of 66.6% and 67.9%, respectively. Despite being among the top dividend payers in China, its track record has been unstable over the past decade, with no growth in payments. Recent approval of a CNY 3.50 per 10 shares dividend highlights commitment to returns despite past volatility and large one-off items affecting financial results.

- Navigate through the intricacies of Guilin Sanjin Pharmaceutical with our comprehensive dividend report here.

- Our expertly prepared valuation report Guilin Sanjin Pharmaceutical implies its share price may be lower than expected.

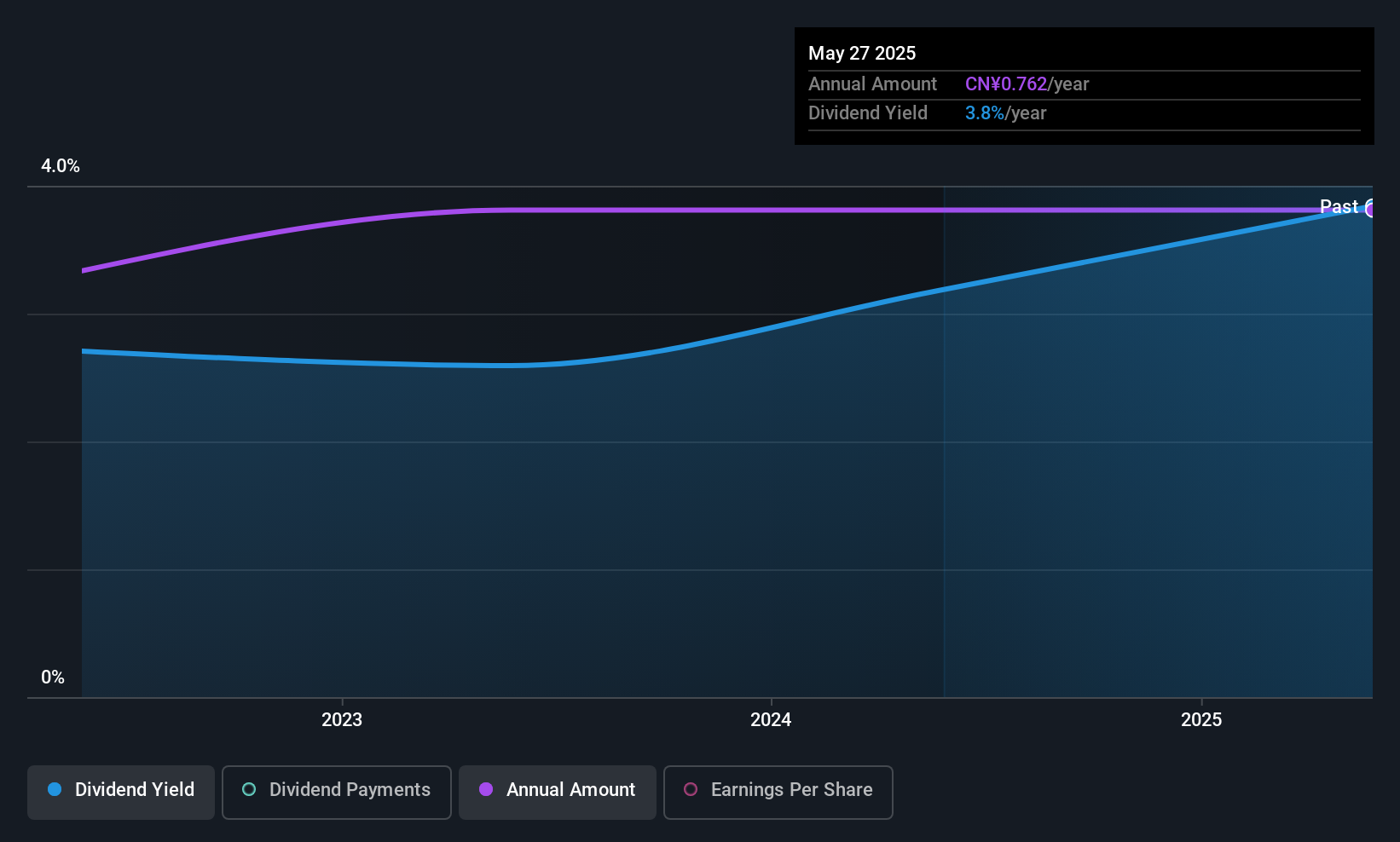

Qingdao Baheal Medical (SZSE:301015)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Baheal Medical INC. is involved in the research, development, production, and sale of pharmaceutical products and has a market cap of CN¥9.84 billion.

Operations: Qingdao Baheal Medical INC. generates its revenue through the research, development, production, and sale of pharmaceutical products.

Dividend Yield: 3.8%

Qingdao Baheal Medical's dividend payments are well-supported by earnings and cash flows, with payout ratios of 67.6% and 68.2%, respectively. Although the company has only paid dividends for three years, its CNY 7.62 per 10 shares dividend reflects a stable commitment to shareholders, placing it among the top dividend payers in China. Despite recent earnings pressure with net income declining to CNY 85 million in Q1 2025, dividends remain sustainable due to strong coverage metrics.

- Click to explore a detailed breakdown of our findings in Qingdao Baheal Medical's dividend report.

- The valuation report we've compiled suggests that Qingdao Baheal Medical's current price could be quite moderate.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1552 Top Global Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal