Demand for Japan's 10-year treasury bonds hit a 14-month high, and the market focuses on the sale of 30-year treasury bonds on Thursday

The Zhitong Finance App learned that demand for Japan's ten-year treasury bond auctions is unexpectedly strong, injecting a dose of strength into the bond market, which has recently increased volatility. But traders haven't relented — there are only 48 hours left until the next 30-year treasury bond auction, a test that will directly reveal the market's true attitude towards ultra-long-term bonds.

Auction results were revealed on Tuesday. A key indicator for measuring demand rose to a new high since April 2024. The main ten-year treasury bond futures contract rose slightly to 139.14 yuan, corresponding to a 2.5 basis point drop in yield to 1.48%. Despite this, investors remain highly wary of the upcoming 30-year treasury bond auction against the backdrop of the collective rise in long-term treasury bond yields in major economies around the world.

According to an analysis by Miki Den, senior interest rate strategist at Sumitomo Mitsui Nikko Securities, “The 1.5% yield level is very attractive to allocated funds, which is the key to a recovery in demand.” But at the same time, he warned that considering the imminent issuance of 30-year treasury bonds on Thursday, the room for declining yields may be limited, and “the market needs to absorb the supply pressure on ultra-long-term bonds first.”

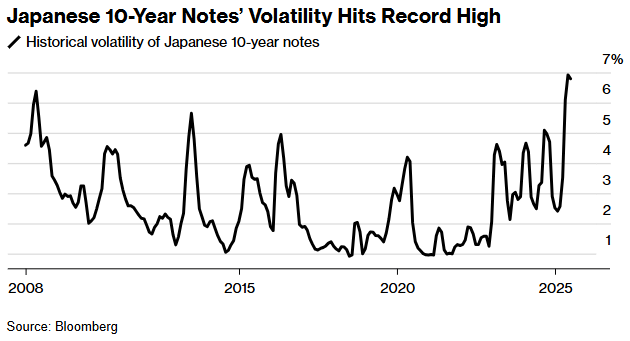

The global bond market is currently experiencing a crisis of confidence. Investors are worried that huge fiscal deficits in major economies will push up debt burdens, and the Bank of Japan is gradually withdrawing from large-scale debt purchases, further worsening the already steep treasury bond yield curve. According to the data, the issuance of 20-year and 40-year treasury bonds fell cold one after another last month, triggering intense discussions on the sustainability of sovereign debt in the market.

Bank of Japan Governor Ueda Kazuo sent an important signal during a parliamentary inquiry: the central bank will re-evaluate the pace of debt purchase operations at the June 16-17 policy meeting. It is worth noting that since last summer, the Bank of Japan has reduced the size of debt purchases for three consecutive quarters, with a quarterly decline of 400 billion yen (about 2.8 billion US dollars). However, former central bank member Makoto Sakurai hinted that this reduction process may face adjustments.

It is worth noting that Japan's Ministry of Finance recently distributed a questionnaire to market participants to solicit opinions on the bond issuance plan. Katsutoshi Inadome, asset management strategist at Sumitomo Mitsui Trust, believes that this move “at least allays concerns about the spread of the ultra-long-term bond market crisis to 10-year varieties.” However, he stressed that until the results of Thursday's 30-year treasury bond auction are clear, it will still be difficult for market sentiment to completely shift to optimism.

Judging from the latest auction data, the current 2.6 trillion yen ten-year treasury bond subscription ratio increased significantly by 2.54 times compared to the previous month, exceeding the average for nearly a year. Market participants pointed out that although the current yield has risen by more than 50 basis points from the low in 2023, it is still attractive compared to other developed countries, which is the main reason for attracting the placement market.

As the Japanese bond market gradually frees itself from the central bank's policy dominance, the market pricing mechanism is undergoing a painful reconstruction. Thursday's 30-year treasury bond auction will be an important observation window — the yield for this term has reached the highest level in history since issuance, and the auction results will directly influence global investors' risk assessments of the Japanese treasury bond market.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal