IPO Foresight | Hidden concerns behind the performance roller coaster Huanshi International Logistics is stuck in the freight rate cycle

Along with profound changes in the global supply chain and the wave of overseas expansion of Chinese brands, international logistics, as the artery and basic industry of international trade, has long been a racetrack full of changes and opportunities.

According to public data, the growth rate of cross-border e-commerce logistics companies reached a new peak in 2024. As of October 2024, the total number of cross-border logistics companies had reached 167,444, and growth has slowed markedly. Meanwhile, in 2024, all provinces across the country experienced a slowdown in the growth of the number of enterprises. From this trend, it can be inferred that in the next few years, as the market becomes more saturated, the industry will enter a period of adjustment.

The industry has entered a reshuffle period, taking the lead in entering the capital market, and may have more chances of winning in the second half of the competition. Recently, the track welcomed a “new recruit” in the capital market.

According to the Hong Kong Stock Exchange's disclosure on May 27, Huanshi International Logistics Holdings Limited (“Huanshi Logistics” for short) submitted a listing application to the main board of the Hong Kong Stock Exchange, with CITIC Securities and CMB International as co-sponsors.

Performance fluctuates greatly

According to the prospectus, Huanshi Logistics was founded in 2003 and is a leading integrated cross-border logistics service provider in China. According to Frost & Sullivan research data, in 2024, Huanshi Logistics ranked first among private cross-border integrated logistics service providers in China and ranked 8th in the world in terms of container throughput. Furthermore, in the “Belt and Road” corridor, the company is also in a leading position. According to Frost & Sullivan research data, in 2024, Huanshi Logistics ranked first in the China-Middle East and Red Sea routes and ranked first in container volume among all operators on this route.

Huanshi Logistics's global logistics network covers more than 6,000 cross-border routes, covering about 200 countries and regions. According to Frost & Sullivan research data, in 2024, the company ranked first among private cross-border integrated logistics service providers in China based on two core indicators: the number of countries and regions covered by the network and the number of supported cross-border routes. In 2024, Huanshi Logistics will deliver 772423TEU to about 26,000 diversified enterprises around the world, covering all categories of products.

Externally, Huanshi Logistics's big treasurer platform focuses on the three strategic pillars of reaching a wide range of customers, efficient product penetration, and smart supply chain solutions. As of December 31, 2024, more than 100,000 customers and suppliers have been connected, and end-to-end logistics processes have been digitized through more than 100 visual nodes.

Internally, the company achieved cost reduction and efficiency improvement and cross-departmental collaboration through process reengineering, and deployed an automated risk control system based on the control requirements of global organizations. The company's internal financial system automates settlement and intelligentizes risk control at more than 20 overseas branches around the world. Compared with 2022, in terms of the number of tickets processed per person per week in 2024, Huanshi Logistics's contract fulfillment efficiency increased by more than 20%.

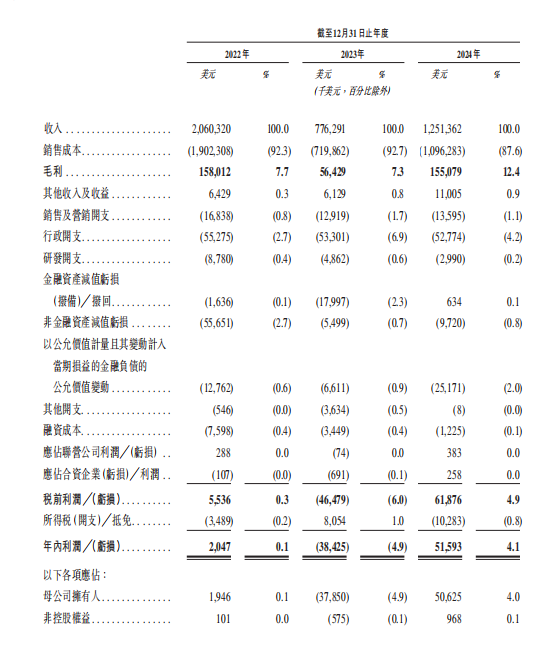

Despite its impressive market size ranking, Huanshi International Logistics Holdings' performance is unstable. From 2022 to 2024 (hereinafter referred to as the reporting period), the company's revenue was 2.06 billion yuan (unit: US dollar, same below), 776 million yuan and 1,251 billion yuan respectively; profit for the same period was 2.047 million yuan, -384.25 million yuan and 51.593 million yuan, respectively.

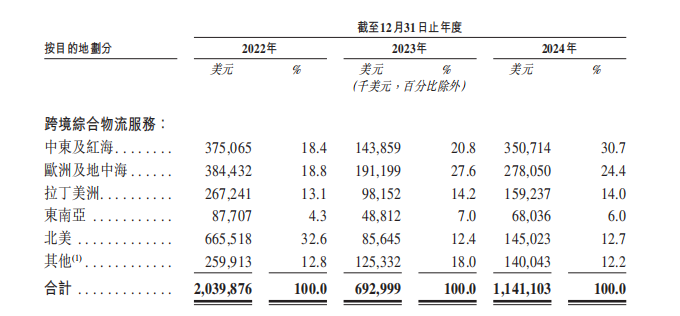

During the track record period, Huanshi International Logistics Holdings' cross-border integrated logistics service revenue accounted for the majority of total revenue, accounting for 99.0%, 89.3% and 91.2% of its total revenue in 2022, 2023 and 2024, respectively. During the track record period, the company's revenue from integrated cross-border logistics services was limited by fluctuations in container volume and freight rates.

During the reporting period, order revenue for the Middle East and Red Sea destinations accounted for 18.4%, 20.8% and 30.7% of total cross-border integrated logistics service revenue, respectively. This is mainly due to the company's strategic deployment of Middle East and Red Sea routes in the “Belt and Road” corridor in response to the 2023 Red Sea crisis.

During the period, the company's gross margin also fluctuated, at 7.7%, 7.3% and 12.4%, respectively. Regarding the decline in gross margin in 2023, the company said that due to a slight increase in container volume in the same year, the freight rate per container decreased. However, due to the delayed effect of falling costs, it will take time to fully reflect the decline in gross margin generated by its integrated cross-border logistics services in profits. The increase in gross margin in 2024 is due to the fact that in the second half of 2024, the overall freight rate per container in the entire market soared, leading to a corresponding increase in gross profit per container. On the other hand, the company's strategic resource allocation for high-demand and high-profit routes in the Middle East and Red Sea regions enabled it to enhance its pricing capacity in 2024, and gross margin increased from 7.3% to 12.4% as a result.

Behind the change in performance, Huanshi International Logistics Holdings faced fluctuating freight rates and did not have sufficient ability to smooth out these costs.

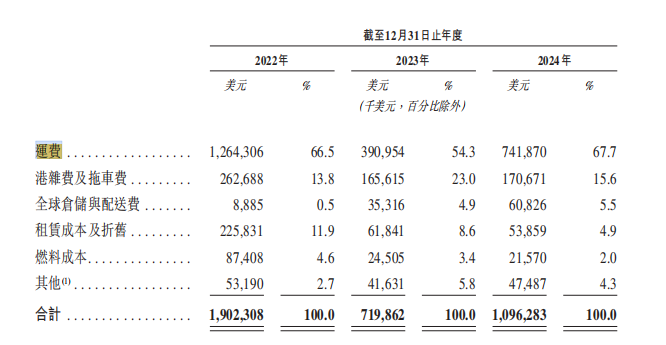

According to the Zhitong Finance App, shipping costs have always been the company's biggest cost. During the period, freight charges were 1,264,300 yuan, 391,000 yuan and 741,900 yuan respectively, accounting for 66.5%, 54.3% and 67.7% of sales costs. The future profitability of the company is still closely related to the freight price trend.

The shipping market continued its downward trend in the first quarter, and long-term uncertainty increased

Affected by the negative impact of tariffs imposed by the United States, the Organization for Economic Cooperation and Development's mid-term economic outlook report lowered the 2025 global economic growth forecast from 3.3% to 3.1%. The International Monetary Fund also indicated that it may lower the global economic growth forecast in the latest outlook report, showing a weakening trend in global economic recovery.

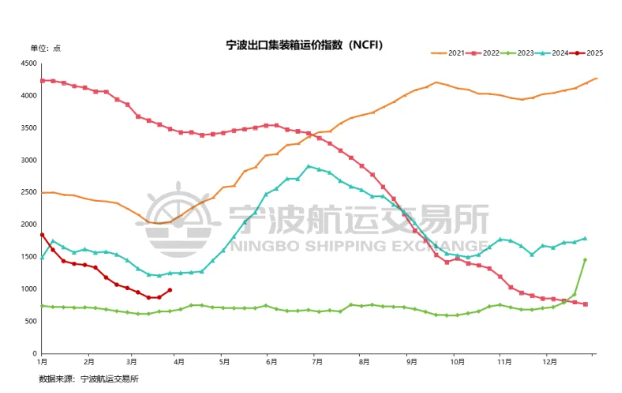

In the context of weakening global economic resilience, shipping prices continued to decline in the first quarter. According to Ningbo Export Container Freight Index (NCFI) data, the average value of the NCFI Composite Index for the first quarter of 2025 was 1223.5 points, down 17.1 from the previous year. The beginning of the year was affected by the Spring Festival off-season combined with the restructuring of shipping alliances. Liner companies maintained supply through drastic price reductions, and the loading rate of some routes exceeded 100%. After the holiday season, due to the “export grab” effect subsided at the end of last year and destination inventory removal, freight prices continued to be pressured due to weak demand. Liner companies' price increase plans failed to be implemented, and the decline continued until the end of the quarter. By the end of the first quarter of 2025, the NCFI Composite Index closed at 1786.4 points, down 23.1% from the same period last year.

In the long run, the supply of capacity has grown at a high level and has maintained an expansion trend for a long time. Global container capacity supply is expected to increase by 5.7% in 2025, slightly slower than in 2024 (10.3%), but the overall level remains high, with additional capacity reaching 248 container ships and 2.1 million TEU.

However, freight rates are operating under pressure, and uncertainty continues unabated. In the second quarter, the world is expected to maintain the normal state of detours, and tariffs will be the biggest variable affecting the demand side. The implementation of America's high “equal tariffs” will actually reduce the volume of goods on North American routes. Both long-term and immediate freight rates will be lower than the same period last year, and it will be difficult to push up freight rates during peak season. Meanwhile, transit trade route freight rates may rise sharply, and the overall market is in a wait-and-see period. There is a possibility that the Red Sea will resume navigation in the second half of the year. If traffic resumes, the released capacity will account for about 1/10 of the global capacity. Combined with the additional capacity, the relationship between supply and demand will worsen, and overall shipping prices may face another sharp drop.

Focus on Huanshi International Logistics Holdings. Facing the fluctuating freight rate market, only by consolidating our own hard power can we smooth out risks.

The Zhitong Finance App observed that Huanshi International Logistics Holdings is trying to break out of the international shipping market with intelligent technology. Currently, the company is undergoing continuous digital transformation and upgrading, using the perfect combination of high-tech digital SaaS platforms and global logistics fulfillment capabilities to link resources and networks in various upstream and downstream segments of the shipping industry. At the same time, it is systemically connected with various logistics service providers, shipowners, airlines and overseas agency platforms to provide digital, online, visual, and one-stop integrated logistics connectivity services, bringing customers more convenient and efficient logistics services. The ability of AI models can help Huanshi Logistics Group optimize data analysis, automated decision-making, etc., and improve logistics efficiency and service quality.

It is worth noting that in the digital intelligence process, Huanshi International Logistics Holdings has received investment from leading strategic investment institutions including Cainiao, COSCO Shipping, Yunqi Capital, Innovation Factory, Humble Investment, and Detong Capital.

In summary, Huanshi International Logistics Holdings is greatly affected by international freight rates, and its performance fluctuates greatly. In the future, freight rates are operating under pressure, and it is uncertain that they will increase unabated. The company is trying to break through the international logistics circuit through digital intelligence upgrades. We will wait and see if the company can smooth out the fluctuation in freight rate operations through this move.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal