Crude oil bulls don't panic! The actual increase in OPEC+ production may be greatly discounted

The Zhitong Finance App learned that OPEC+ issued a statement on Wednesday stating that it agreed to maintain the current group-wide oil production quota plan. OPEC+ countries said they agreed to “reaffirm the overall crude oil production level of OPEC and non-OPEC participating countries,” which was determined in accordance with the agreement reached at the coalition's December meeting last year. According to official policy, the entire OPEC+ Group plans to cut production by about 2 million barrels per day by the end of next year.

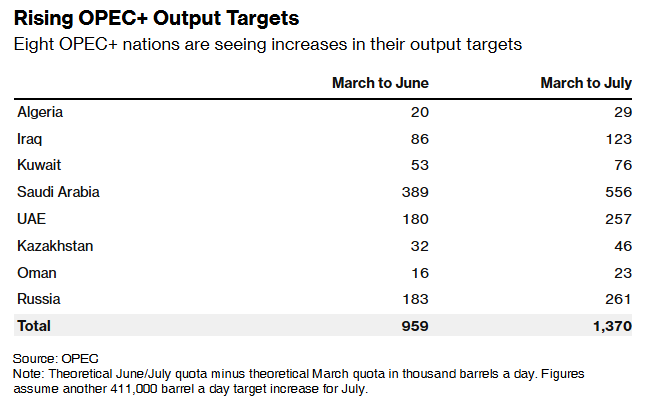

Meanwhile, this Saturday, OPEC+ met separately to discuss increasing oil production in July. The focus of the market turned to a group of eight member states in the alliance. This was a key decision that really affected market nerves. These member countries had previously implemented voluntary production reduction agreements. Whether to continue the aggressive pace of increasing production by 411,000 barrels per day will be decided by these eight core member states during a video conference on Saturday.

OPEC+ appears to be once again worrying crude oil bulls this Saturday, adding a new wave of supply to the market at a time when there is no urgent need for additional supply in the crude oil market. OPEC's eight core member states have agreed to increase crude oil production by 960,000 b/d from March production by June. Traders and analysts expect that the eight member states will agree on Saturday to raise this figure to 1.37 million b/d by July.

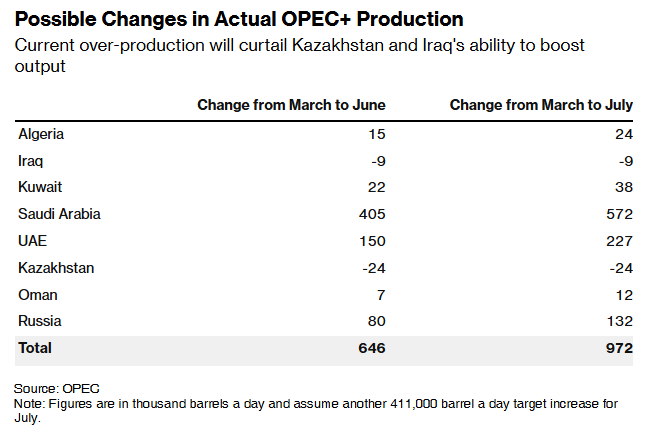

However, in reality, up to one-third of the increase in production claimed by OPEC+ may not actually be realized, and in the end, there may be even less additional supply actually entering the global market.

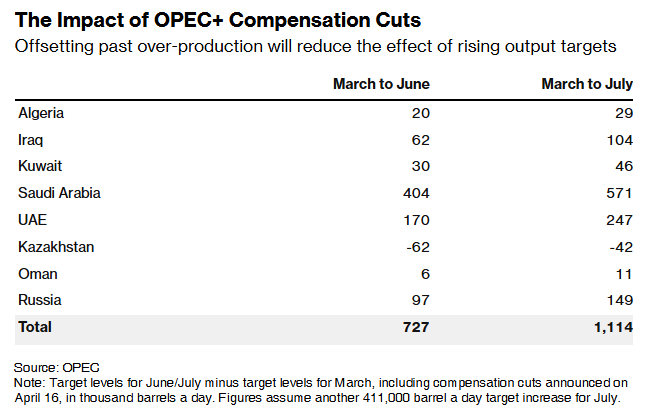

Seven of the eight member states mentioned above have promised to make up for past overproduction for at least part of the period up to July. According to estimates, fulfilling promises to compensate for excess behavior will increase crude oil production by 1.1 million b/d in July compared to March.

Although Iraq has reduced production to official target levels, until now Iraq has not fully implemented the compensatory production cuts it has promised. The opposite is true in Kazakhstan — the country increased production earlier this year, and production in March and April was more than 400,000 b/d above its compensation-adjusted target. While Kazakhstan may no longer be able to increase production any further, it does not seem capable of cutting production.

If production in Iraq and Kazakhstan remains at the average level of March-April — Iraq is due to compliance with the agreement, while Kazakhstan is “beyond its reach,” production in other member countries will increase from the actual production level claimed by OPEC in March to the target level after compensation adjustments. In this case, the increase in production by July will decrease from 1.37 million b/d to 972 thousand b/d, or nearly 30%.

Furthermore, not all additional crude oil supplies will enter the global market. Demand for crude oil in the Middle East will soar during the hot summer, as energy consumption for power generation and seawater desalination will increase dramatically. According to data submitted to the Joint Organization Data Initiative, Saudi Arabia's direct crude oil usage increased by more than 460,000 b/d between March and July last year. If a similar situation were to occur this year, it would mean that Saudi Arabia would consume more than 80% of its own increase in production, which is also equivalent to nearly half of the total production increase of the eight member states.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal