Global Market Insights: Penny Stocks To Watch In May 2025

Global markets have experienced a turbulent week, with major indices declining amid U.S. Treasury market volatility and renewed tariff threats. Despite these challenges, the allure of penny stocks remains significant for investors seeking potential growth opportunities in smaller or newer companies. While the term "penny stocks" may seem outdated, their potential is underscored when these investments are supported by strong financials, offering a blend of affordability and growth prospects that larger firms might not provide.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.08 | SGD8.19B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.71 | SEK278.19M | ✅ 4 ⚠️ 2 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.995 | MYR1.55B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.365 | MYR1.06B | ✅ 4 ⚠️ 3 View Analysis > |

| Synergy House Berhad (KLSE:SYNERGY) | MYR0.715 | MYR357.5M | ✅ 4 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.19 | HK$738.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.795 | £427.61M | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.535 | A$74.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Tasmea (ASX:TEA) | A$2.81 | A$674.03M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,633 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Leo Group (SZSE:002131)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Leo Group Co., Ltd. researches, develops, manufactures, and sells pumps and garden machinery products in China with a market cap of CN¥24.16 billion.

Operations: Leo Group Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥24.16B

Leo Group Co., Ltd. has faced challenges with declining profit margins, dropping from 5.6% to 0.4%, and negative earnings growth of -92.3% in the past year, despite having short-term assets of CN¥14.3 billion that exceed both its short-term and long-term liabilities. The company reported a net loss of CN¥259.29 million for 2024 but showed improvement in Q1 2025 with a net income of CN¥108.03 million compared to a loss the previous year. While Leo Group's debt is not well covered by operating cash flow, it maintains more cash than total debt, providing some financial stability amidst volatility.

- Take a closer look at Leo Group's potential here in our financial health report.

- Learn about Leo Group's historical performance here.

Hunan Er-Kang Pharmaceutical (SZSE:300267)

Simply Wall St Financial Health Rating: ★★★★☆☆

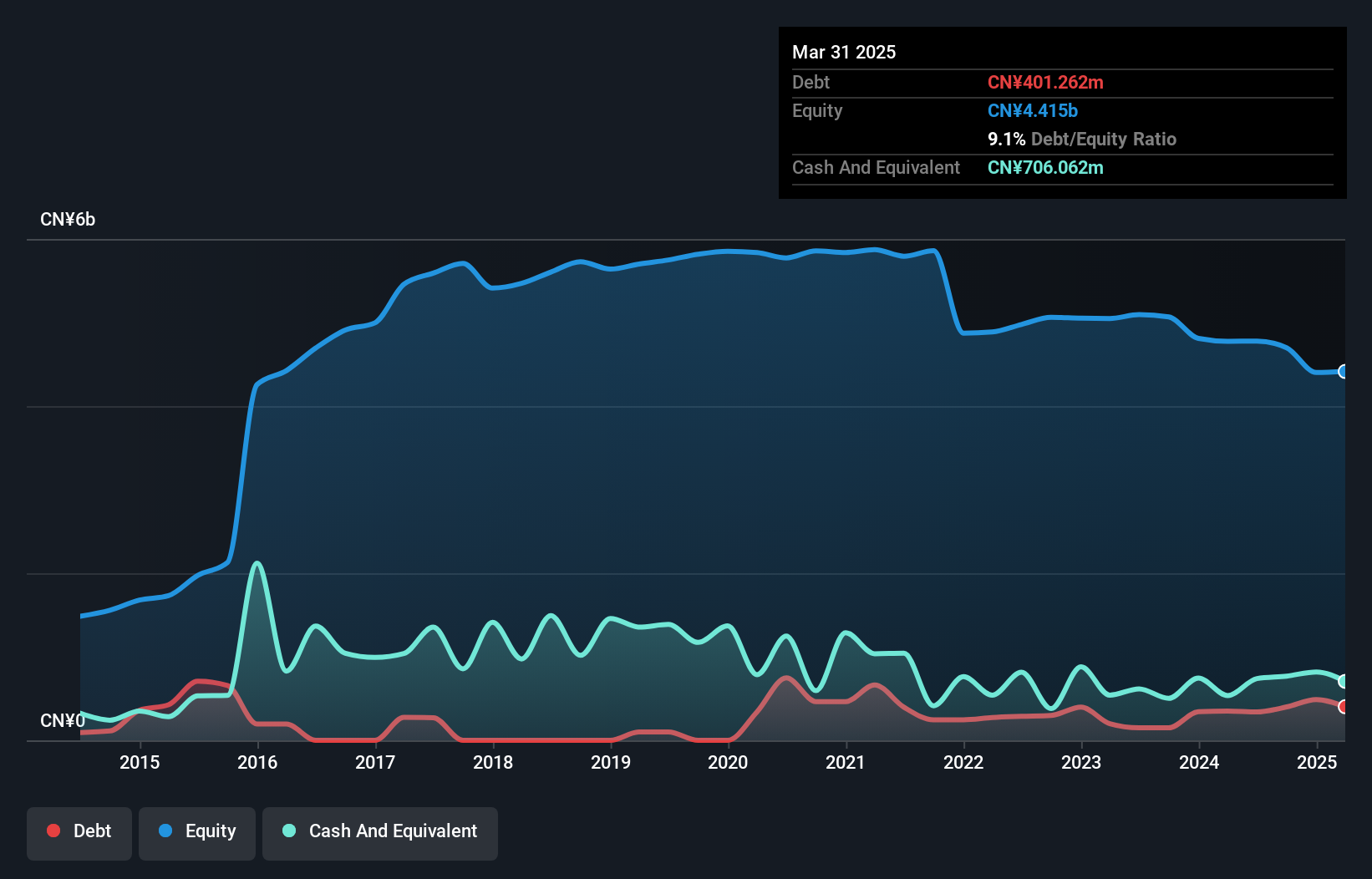

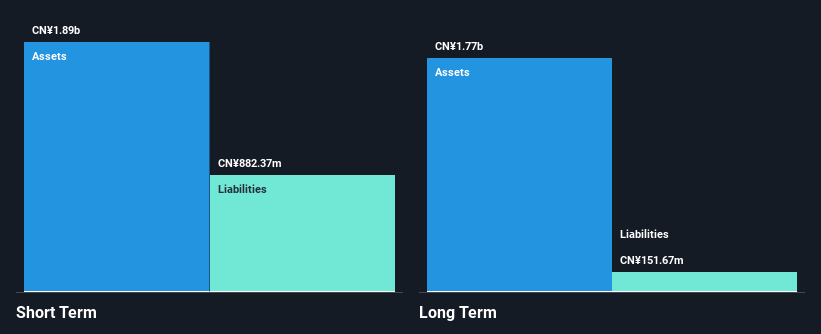

Overview: Hunan Er-Kang Pharmaceutical Co., Ltd is a company that manufactures and sells active pharmaceutical ingredients, finished drug products, and pharmaceutical excipients both in China and internationally, with a market cap of CN¥6.56 billion.

Operations: No specific revenue segments have been reported for Hunan Er-Kang Pharmaceutical Co., Ltd.

Market Cap: CN¥6.56B

Hunan Er-Kang Pharmaceutical Co., Ltd has shown mixed financial performance with a net income of CN¥28.11 million in Q1 2025, improving from CN¥2.9 million the previous year, yet faced a full-year net loss of CN¥373.37 million for 2024 due to declining annual sales from CN¥1.78 billion to CN¥1.14 billion. While short-term assets of CN¥1.7 billion comfortably cover both short and long-term liabilities, the company remains unprofitable with increasing debt-to-equity ratio over five years and negative return on equity at -8.34%. Despite volatility, management stability is notable with an experienced team averaging 5.5 years tenure.

- Click to explore a detailed breakdown of our findings in Hunan Er-Kang Pharmaceutical's financial health report.

- Evaluate Hunan Er-Kang Pharmaceutical's historical performance by accessing our past performance report.

JILIN JINGUAN ELECTRICLtd (SZSE:300510)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: JILIN JINGUAN ELECTRIC Co., Ltd operates in the smart grid equipment, energy charging, and energy storage sectors in China with a market cap of CN¥3.57 billion.

Operations: JILIN JINGUAN ELECTRIC Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥3.57B

JILIN JINGUAN ELECTRIC Co., Ltd operates in the smart grid and energy sectors with a market cap of CN¥3.57 billion. Despite being unprofitable, the company has managed to reduce losses over five years at a significant rate and maintains a positive cash flow, ensuring more than three years of cash runway if current conditions persist. Short-term assets exceed both short- and long-term liabilities, indicating financial stability despite increased debt-to-equity ratio over time. Recent earnings showed improved quarterly revenue but an annual net loss of CN¥333 million for 2024, contrasting with previous profitability. Management is experienced with an average tenure of 3.4 years.

- Unlock comprehensive insights into our analysis of JILIN JINGUAN ELECTRICLtd stock in this financial health report.

- Understand JILIN JINGUAN ELECTRICLtd's track record by examining our performance history report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 5,633 Global Penny Stocks by using our screener here.

- Curious About Other Options? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal