TSX Penny Stocks To Watch: 3 Picks Under CA$300M Market Cap

Recent developments in the Canadian market, including potential changes to U.S. withholding taxes on dividends, have captured the attention of investors seeking to navigate evolving fiscal landscapes. Amidst these shifts, penny stocks—though an older term—continue to represent a compelling investment area for those interested in smaller or less-established companies. By focusing on those with strong financial health and growth potential, investors may uncover opportunities that offer both stability and upside within this niche segment.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.76 | CA$74.85M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.75 | CA$124.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.20 | CA$133.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.70 | CA$485.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.22 | CA$636.86M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.80 | CA$4.57M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.74 | CA$168.16M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.61 | CA$558.14M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.63 | CA$131.96M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.6M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 906 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Critical Elements Lithium (TSXV:CRE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Critical Elements Lithium Corporation focuses on acquiring, exploring, and developing mining properties in Canada with a market cap of CA$84.96 million.

Operations: Currently, there are no revenue segments reported for this company.

Market Cap: CA$84.96M

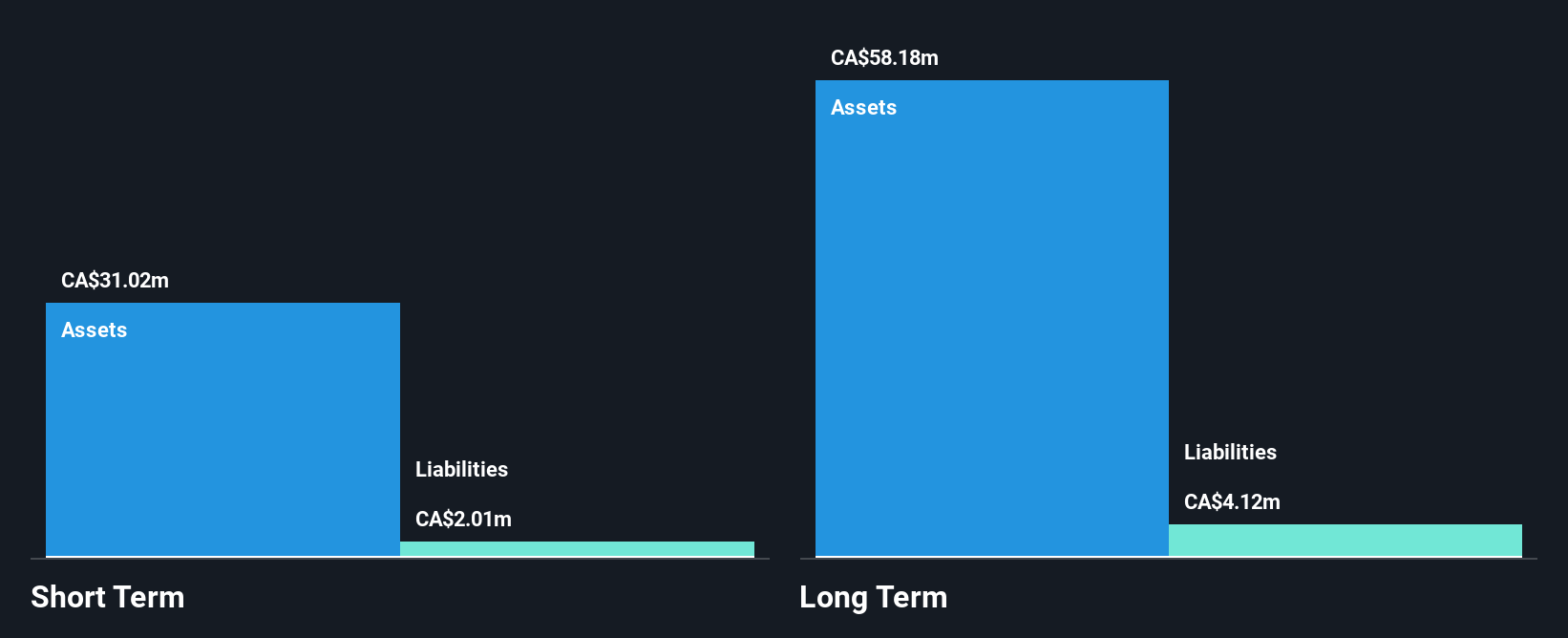

Critical Elements Lithium Corporation, with a market cap of CA$84.96 million, is currently pre-revenue but has recently turned profitable, reporting a net income of CA$7.79 million for the second quarter of 2025. The company is debt-free and maintains strong short-term asset coverage over liabilities. Its recent recommencement of exploration activities in Quebec, supported by significant conditional funding and interest from financial institutions, underscores potential growth prospects. Trading at a favorable price-to-earnings ratio compared to the broader Canadian market, it represents an intriguing opportunity within the penny stock space despite its low revenue base and high non-cash earnings component.

- Jump into the full analysis health report here for a deeper understanding of Critical Elements Lithium.

- Review our growth performance report to gain insights into Critical Elements Lithium's future.

FPX Nickel (TSXV:FPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FPX Nickel Corp. is a junior mining company focused on acquiring, exploring, and developing nickel mineral resource properties in Canada, with a market capitalization of CA$80.34 million.

Operations: FPX Nickel Corp. does not report any revenue segments.

Market Cap: CA$80.34M

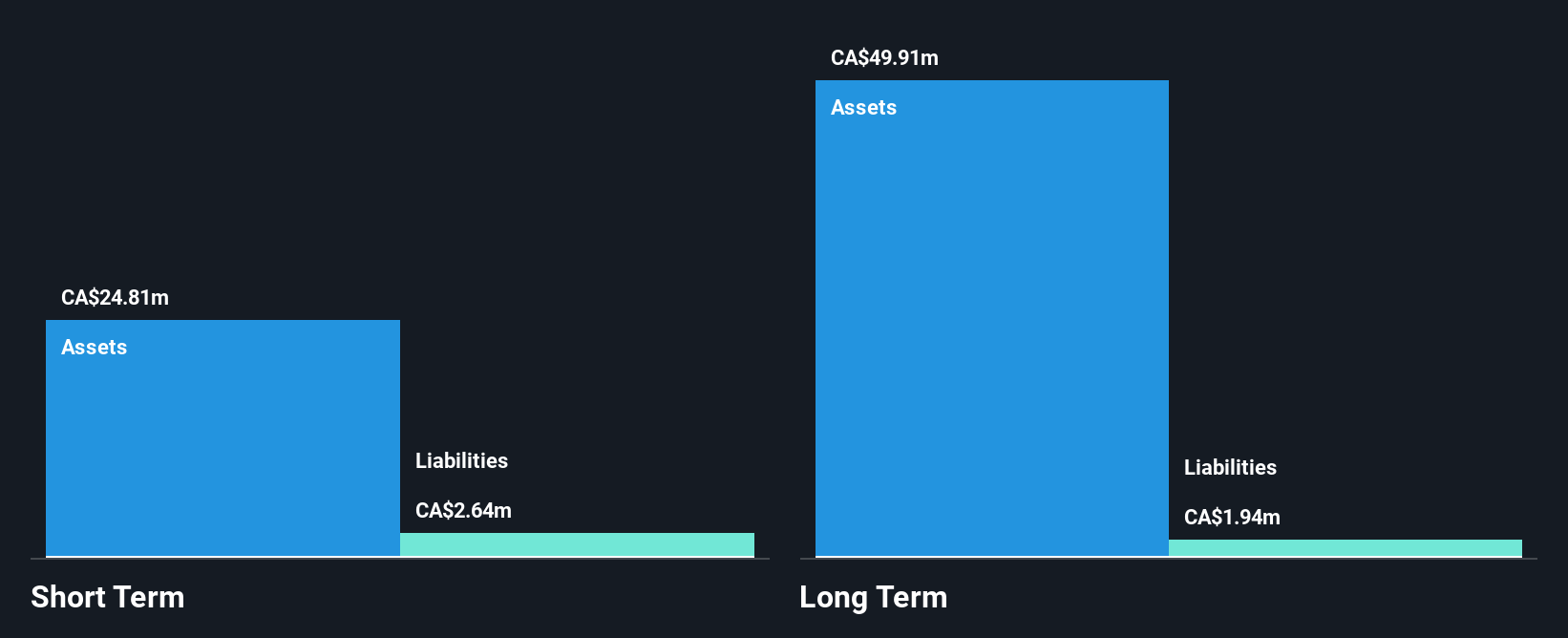

FPX Nickel Corp., with a market cap of CA$80.34 million, is pre-revenue and focuses on developing nickel resources in Canada. Recent strategic developments include an exploration program at the Klow property, funded entirely by JOGMEC under an earn-in agreement, potentially advancing the site to drill-ready status. The company maintains a stable financial position with short-term assets exceeding liabilities and no debt burden. Despite being unprofitable and experiencing increased losses over five years, FPX's cash runway exceeds one year based on current free cash flow levels, indicating financial resilience amidst ongoing exploration efforts.

- Dive into the specifics of FPX Nickel here with our thorough balance sheet health report.

- Understand FPX Nickel's earnings outlook by examining our growth report.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: WonderFi Technologies Inc, along with its subsidiaries, focuses on developing and acquiring technology platforms to enable investments in digital assets, with a market cap of CA$229.01 million.

Operations: The company's revenue is derived from two segments: Trading, which generated CA$53.87 million, and Payments, contributing CA$1.69 million.

Market Cap: CA$229.01M

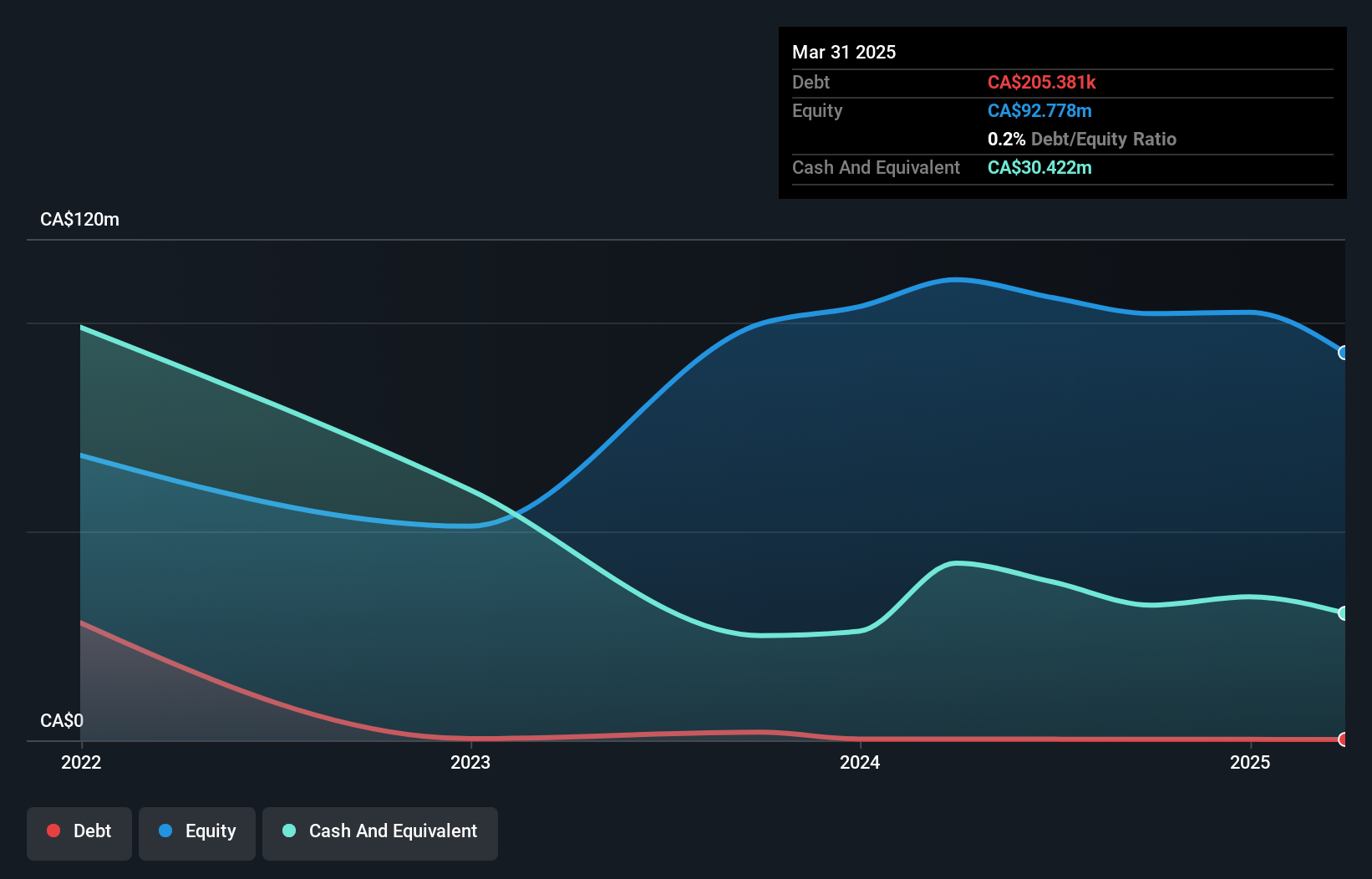

WonderFi Technologies Inc., with a market cap of CA$229.01 million, is experiencing significant developments amidst its unprofitable status. The company reported first-quarter sales of CA$16.36 million but faced a net loss of CA$16.12 million, contrasting with last year's net income. Despite this, WonderFi's short-term assets significantly exceed its liabilities, reflecting solid financial positioning. Recently, Robinhood Markets announced an acquisition agreement valued at approximately CA$240 million, subject to regulatory and shareholder approvals expected in the latter half of 2025. This strategic move could potentially enhance WonderFi's market presence and operational capabilities in digital asset investments.

- Click here and access our complete financial health analysis report to understand the dynamics of WonderFi Technologies.

- Evaluate WonderFi Technologies' prospects by accessing our earnings growth report.

Seize The Opportunity

- Navigate through the entire inventory of 906 TSX Penny Stocks here.

- Seeking Other Investments? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal