Nvidia (NVDA.US) financial report finale debuts or consolidates strong gains in technology stocks

The Zhitong Finance App learned that Nvidia (NVDA.US) will announce financial results for the first quarter of the 2026 fiscal year after the US stock market on Wednesday. The chipmaker with the highest market capitalization in the world is the last of the largest US technology companies to release financial reports. Its performance may successfully put an end to the strong performance of large technology stocks in this financial reporting season. The data shows that since the start of the current US stock earnings season in mid-April, the NASDAQ 100 index has outperformed the S&P 500 index.

According to analysts' consensus expectations, Nvidia's revenue for the first quarter is expected to be US$43.3 billion, compared to US$26 billion for the same period last year; adjusted earnings per share are expected to be US$0.88, compared to US$0.61 for the same period last year.

Earlier, the results of Microsoft (MSFT.US), Meta (META.US), and several other large technology companies showed that despite uncertainty caused by US President Trump's changing tariff policies, the market's expectations for these tech giants are still stable. These financial reports combined with the temporary easing of trade tension between China and the US, fueled a strong rebound in technology stocks. Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder, said: “Overall, Goldman Sachs's financial performance was positive, and some were even very impressive. I think if Nvidia's performance continues to be strong, it will further consolidate the overall upward trend in technology stocks.”

For Nvidia's first-quarter earnings report, the market focused on the supply status and profit margin of its Blackwell chips. In February of this year, Nvidia said that rising costs brought about by Blackwell's production capacity growth would drag down gross profit margins in the first quarter. The company's chief financial officer, Colette Kress, said at the time that gross margin for the first quarter was about 71% and should return to a “mid-70% level” by the end of the year.

Andrew Rocco, stock strategist at Zacks Investment Research, said, “We already saw a decline in gross margin last quarter. If it falls again this quarter, it may weigh on stock prices. Although I don't think this financial report will be a big surprise, the outlook guidance is still risky.”

Also, due to the Trump administration's ban on the export of Nvidia H20 chips to China, Nvidia's financial report faces uncertainty. Analysts at Morgan Stanley, led by Joseph Moore, pointed out in a research report released on Tuesday that Wall Street's expectations for the impact of related bans varied greatly, which could lead to a “chaotic performance” quarter.

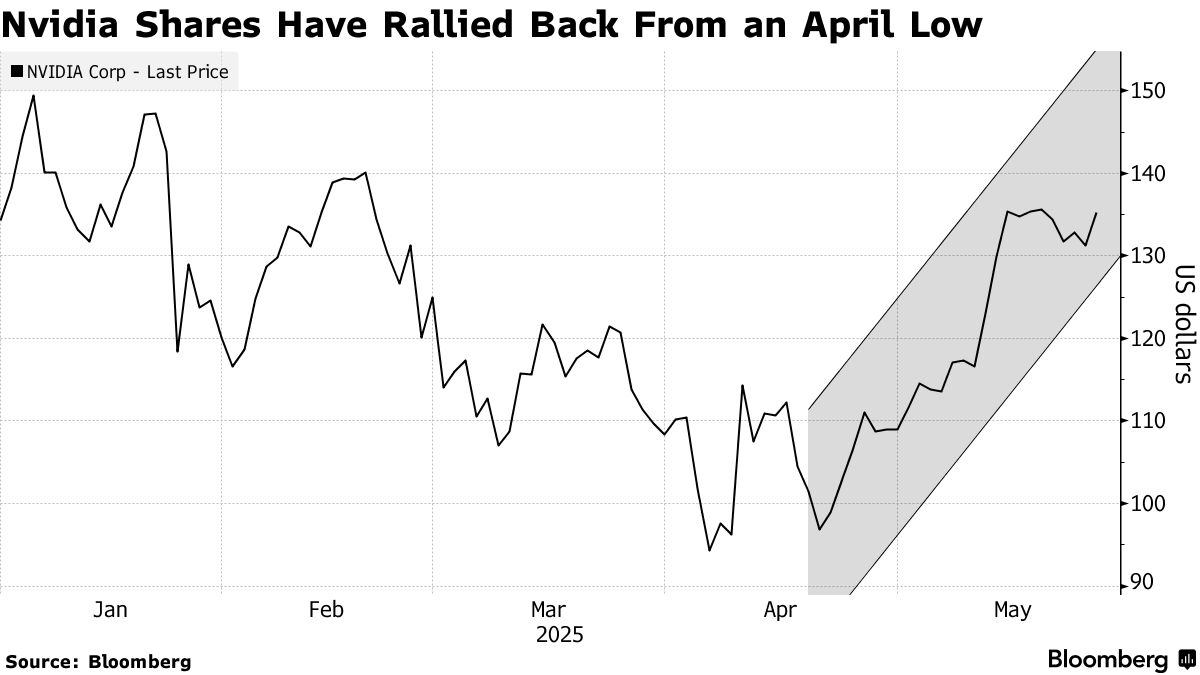

Nvidia's stock price is already up more than 40% from its April low as the company's biggest customers promise to continue to invest heavily in artificial intelligence infrastructure. Microsoft and Alphabet (GOOGL.US) promised to further increase spending next year, and Meta raised its capital expenditure expectations due to strong AI-related demand. In addition to Amazon (AMZN.US), the capital expenditure of these four major technology companies is expected to reach nearly 330 billion US dollars in 2026, an increase of 6% over this year's estimated expenditure.

Rob Almeida, a global investment strategist at MFS Investment Management, said: “The fact that hyperscale companies still don't think they can afford the consequences of not investing in AI is a very strong sign of their intentions for the next four quarters.”

At the same time, Nvidia also won large orders from the Middle East. According to reports, Saudi artificial intelligence company Humain said it will build an artificial intelligence factory with Nvidia in Saudi Arabia. Meanwhile, Nvidia CEO Wong In-hoon announced that it will export 18,000 top artificial intelligence chips to Saudi Arabia. Also, according to people familiar with the matter, the Trump administration is considering an agreement to allow the UAE to import more than 1 million advanced Nvidia chips. This amount far exceeds the limits of artificial intelligence chip regulations in the Biden era.

Despite a rebound in Nvidia's stock price, the stock's current valuation is still discounted compared to expected earnings for the next 12 months. According to the data, Nvidia's current price-earnings ratio is 29 times, which is 40 times lower than its average for the past five years.

According to Krishna Chintalapalli, portfolio manager at Parnassus Investments, Nvidia's appeal is still very strong as the biggest beneficiary of AI spending. He said, “In the past three months, I haven't seen any signs of a dramatic change in the situation. Although the Chinese market is a factor, the Middle East deal shows that there is widespread demand for Nvidia chips in the US and outside of China.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal