3 European Growth Companies With High Insider Ownership Growing Earnings Up To 53%

The European market has recently faced challenges, with the pan-European STOXX Europe 600 Index ending a five-week streak of gains due to renewed tariff threats from the U.S., and economic growth forecasts being revised downwards by the European Commission. In such an environment, companies with strong insider ownership can be appealing as they often indicate management's confidence in their business strategies and potential for growth despite broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Yubico (OM:YUBICO) | 36.2% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Vow (OB:VOW) | 13.1% | 81% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 56.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Lokotech Group (OB:LOKO) | 14.5% | 58.1% |

| XTPL (WSE:XTP) | 23.3% | 143.7% |

| Elliptic Laboratories (OB:ELABS) | 25.8% | 79% |

We're going to check out a few of the best picks from our screener tool.

B2 Impact (OB:B2I)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B2 Impact ASA, along with its subsidiaries, offers a range of debt solutions and has a market capitalization of NOK4.64 billion.

Operations: The company's revenue segments consist of NOK1.26 billion from Servicing and NOK3.04 billion from Investments.

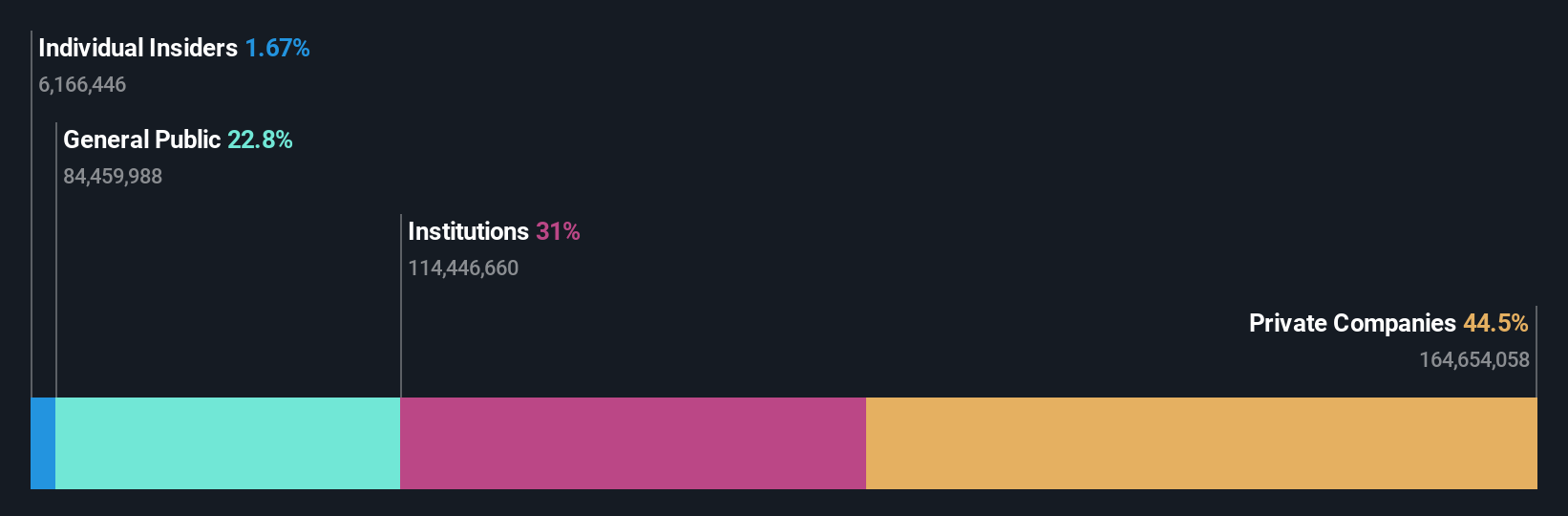

Insider Ownership: 30.3%

Earnings Growth Forecast: 22.8% p.a.

B2 Impact ASA exhibits strong growth potential with expected annual earnings growth of 22.77%, surpassing the Norwegian market average. However, its revenue growth forecast of 14% per year is below the threshold for significant growth. The company carries a high level of debt, and its dividend yield of 11.92% is not well covered by earnings. Recent insider activity shows more buying than selling, although not in substantial volumes, indicating confidence among insiders despite financial challenges.

- Click here to discover the nuances of B2 Impact with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that B2 Impact is priced higher than what may be justified by its financials.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medicover AB (publ) is a company that offers healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of approximately SEK36.01 billion.

Operations: The company's revenue is primarily derived from Healthcare Services, contributing €1.52 billion, and Diagnostic Services, which account for €677.10 million.

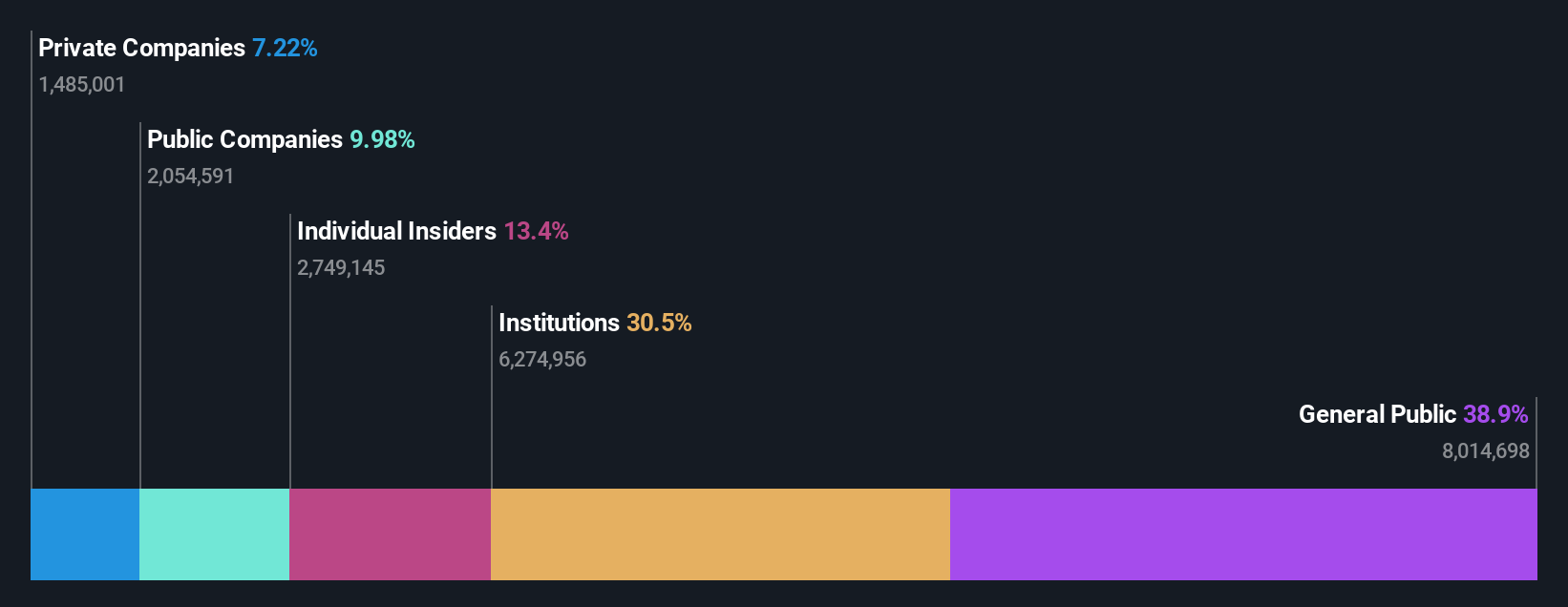

Insider Ownership: 11.2%

Earnings Growth Forecast: 29.1% p.a.

Medicover AB demonstrates robust growth prospects with earnings expected to grow significantly at 29.1% annually, outpacing the Swedish market. Recent Q1 results show sales rising to €578.1 million and net income increasing notably from the previous year, reflecting strong operational performance. While insider buying has been modest recently, the stock trades substantially below its estimated fair value, suggesting potential undervaluation despite interest payments not being well covered by earnings.

- Click here and access our complete growth analysis report to understand the dynamics of Medicover.

- According our valuation report, there's an indication that Medicover's share price might be on the expensive side.

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates as an online pharmacy across several European countries, including the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €2.58 billion.

Operations: The company generates its revenue from two main segments: €2.06 billion from the DACH region and €464.53 million from International markets.

Insider Ownership: 13.3%

Earnings Growth Forecast: 53.7% p.a.

Redcare Pharmacy is forecast to achieve above-market profit growth, becoming profitable within three years, and its revenue is expected to grow at 16.1% annually, outpacing the German market. However, recent earnings show a net loss of €10.82 million for Q1 2025 despite increased sales of €717.29 million. Insider activity indicates more shares sold than bought recently, while the stock trades significantly below estimated fair value amidst high share price volatility.

- Navigate through the intricacies of Redcare Pharmacy with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Redcare Pharmacy's current price could be inflated.

Key Takeaways

- Access the full spectrum of 213 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Looking For Alternative Opportunities? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal