3 Asian Dividend Stocks Yielding Over 4%

As global markets face volatility due to tariff threats and economic uncertainties, investors are increasingly looking towards Asian markets for potential opportunities. In this environment, dividend stocks yielding over 4% can offer a measure of stability and income, making them an attractive option for those seeking to balance risk with regular returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.01% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.22% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.52% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.02% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.35% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.42% | ★★★★★★ |

Click here to see the full list of 1253 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

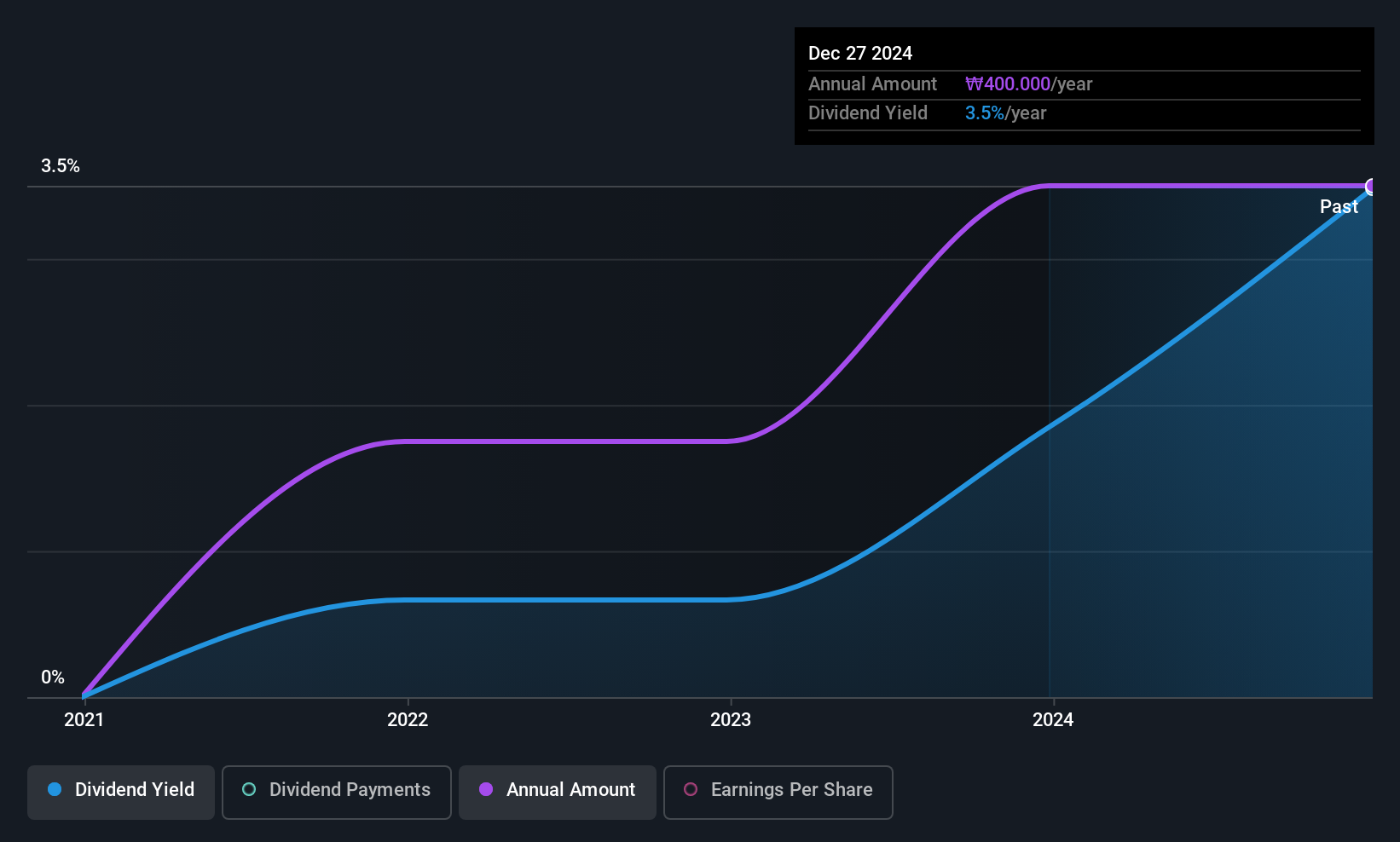

Nature Holdings (KOSDAQ:A298540)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Nature Holdings Co., Ltd. is a lifestyle company with a market cap of approximately ₩162.25 billion.

Operations: The Nature Holdings Co., Ltd. generates revenue primarily from its apparel segment, totaling approximately ₩516.90 billion.

Dividend Yield: 4.5%

Nature Holdings offers a compelling dividend profile, with a yield of 4.46% placing it in the top 25% of dividend payers in Korea. Despite only four years of dividend history, payments have been stable and growing, supported by a low payout ratio of 44.7%. The dividends are well-covered by both earnings and cash flows, with a cash payout ratio at just 20.3%. However, recent profit margins have declined to 3.2%, down from last year's 9%.

- Dive into the specifics of Nature Holdings here with our thorough dividend report.

- Our valuation report here indicates Nature Holdings may be undervalued.

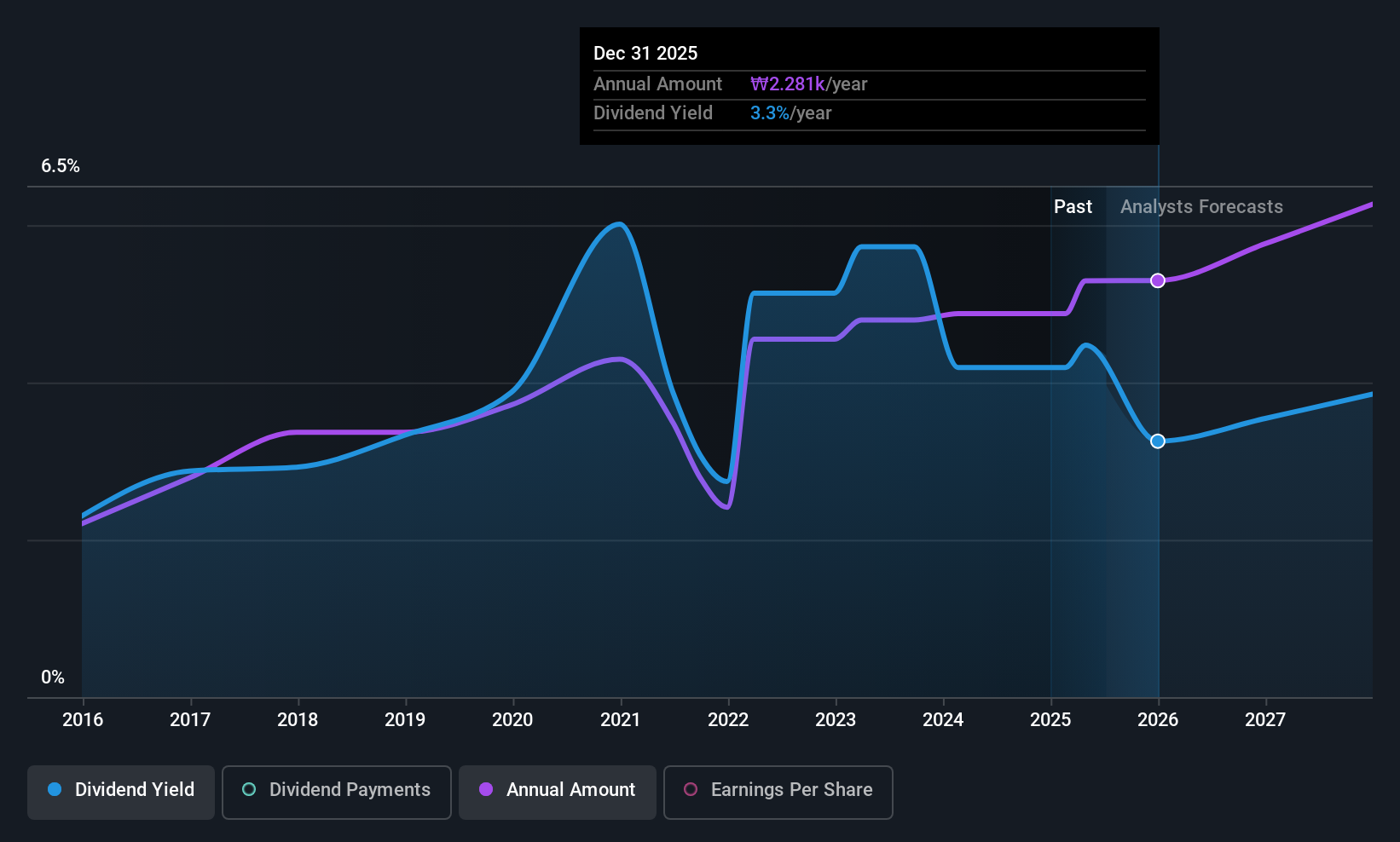

Shinhan Financial Group (KOSE:A055550)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinhan Financial Group Co., Ltd. offers a range of financial products and services both in South Korea and internationally, with a market cap of ₩27.46 trillion.

Operations: Shinhan Financial Group's revenue segments include Banking at ₩9.43 trillion, Credit Card at ₩1.90 trillion, and Securities at ₩1.01 trillion.

Dividend Yield: 4%

Shinhan Financial Group's dividend yield of 4.05% ranks in the top 25% among Korean dividend payers, supported by a low payout ratio of 24.8%, ensuring dividends are well-covered by earnings. However, its dividend history has been volatile over the past decade, with inconsistent payments and occasional drops exceeding 20%. Recent developments include a KRW 278 billion quarterly cash dividend resolution and strategic share buybacks totaling KRW 400 billion, which may influence future payouts.

- Navigate through the intricacies of Shinhan Financial Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility Shinhan Financial Group's shares may be trading at a discount.

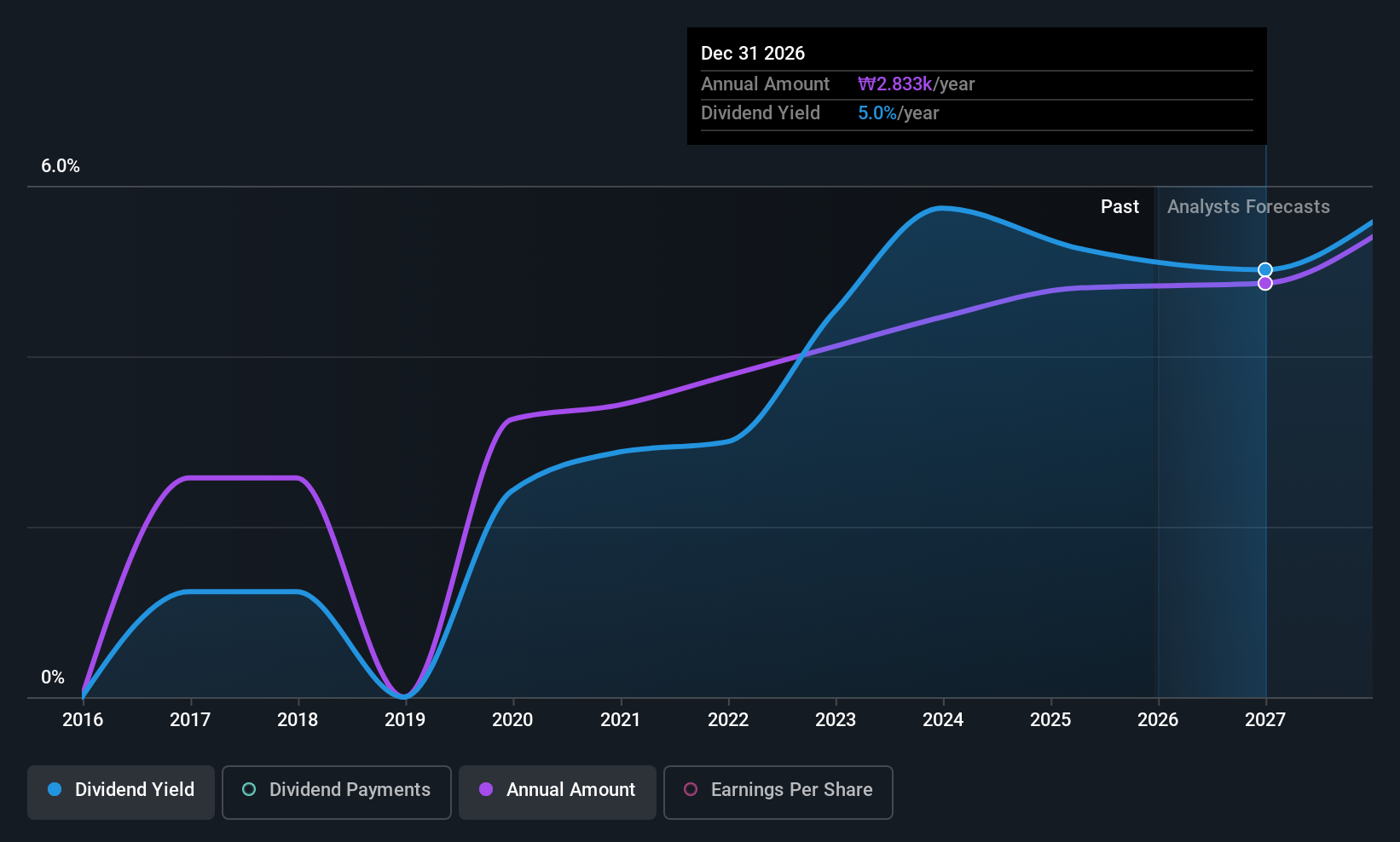

Hyundai Home Shopping Network (KOSE:A057050)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai Home Shopping Network Corporation, along with its subsidiaries, operates an online shopping company in South Korea and has a market cap of ₩608.58 billion.

Operations: Hyundai Home Shopping Network Corporation generates revenue through its online shopping operations in South Korea.

Dividend Yield: 5.2%

Hyundai Home Shopping Network's dividend yield of 5.16% places it among the top 25% in Korea, with a low payout ratio of 31.9%, indicating strong earnings coverage. The company has maintained stable dividends over its nine-year history, supported by a cash payout ratio of 54%. Recent share buybacks totaling KRW 12.16 billion may bolster shareholder value despite declining profit margins from last year’s figures.

- Take a closer look at Hyundai Home Shopping Network's potential here in our dividend report.

- Our expertly prepared valuation report Hyundai Home Shopping Network implies its share price may be lower than expected.

Seize The Opportunity

- Reveal the 1253 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal