Asian Growth Stocks With High Insider Confidence

In a period marked by global market volatility and trade tensions, Asian markets have shown resilience, with China's industrial output exceeding expectations despite broader economic challenges. As investors navigate these uncertain times, stocks with high insider ownership can signal strong internal confidence and alignment with shareholder interests, making them appealing candidates for those seeking growth opportunities in Asia's dynamic market landscape.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| Schooinc (TSE:264A) | 29.6% | 68.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 22% | 40.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

Here we highlight a subset of our preferred stocks from the screener.

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YG Entertainment Inc. is an entertainment company that operates in South Korea, Japan, and internationally with a market cap of ₩1.49 trillion.

Operations: The company generates revenue from its entertainment-related segment, amounting to ₩411.49 billion.

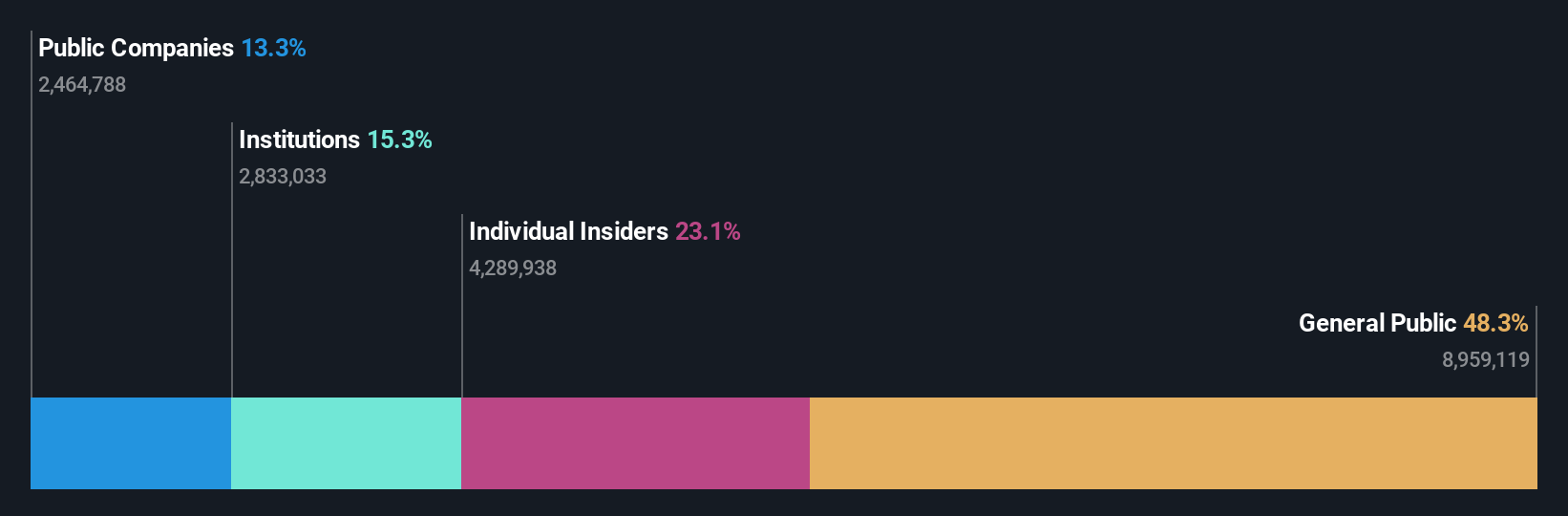

Insider Ownership: 23.1%

YG Entertainment's revenue is forecast to grow at 17.7% annually, outpacing the KR market's 7.4%, while earnings are expected to rise significantly at 30.5% per year, surpassing the market's 20.4%. However, profit margins have declined from last year's figures and Return on Equity is projected to remain low at 9.5%. Recent earnings showed a drop in net income from KRW 61 billion to KRW 18.52 billion, reflecting challenges despite growth prospects.

- Get an in-depth perspective on YG Entertainment's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that YG Entertainment's current price could be inflated.

Hengtong Logistics (SHSE:603223)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hengtong Logistics Co., Ltd. operates in the logistics sector within China and has a market capitalization of approximately CN¥6.95 billion.

Operations: Hengtong Logistics Co., Ltd. primarily generates its revenue through its logistics operations in China.

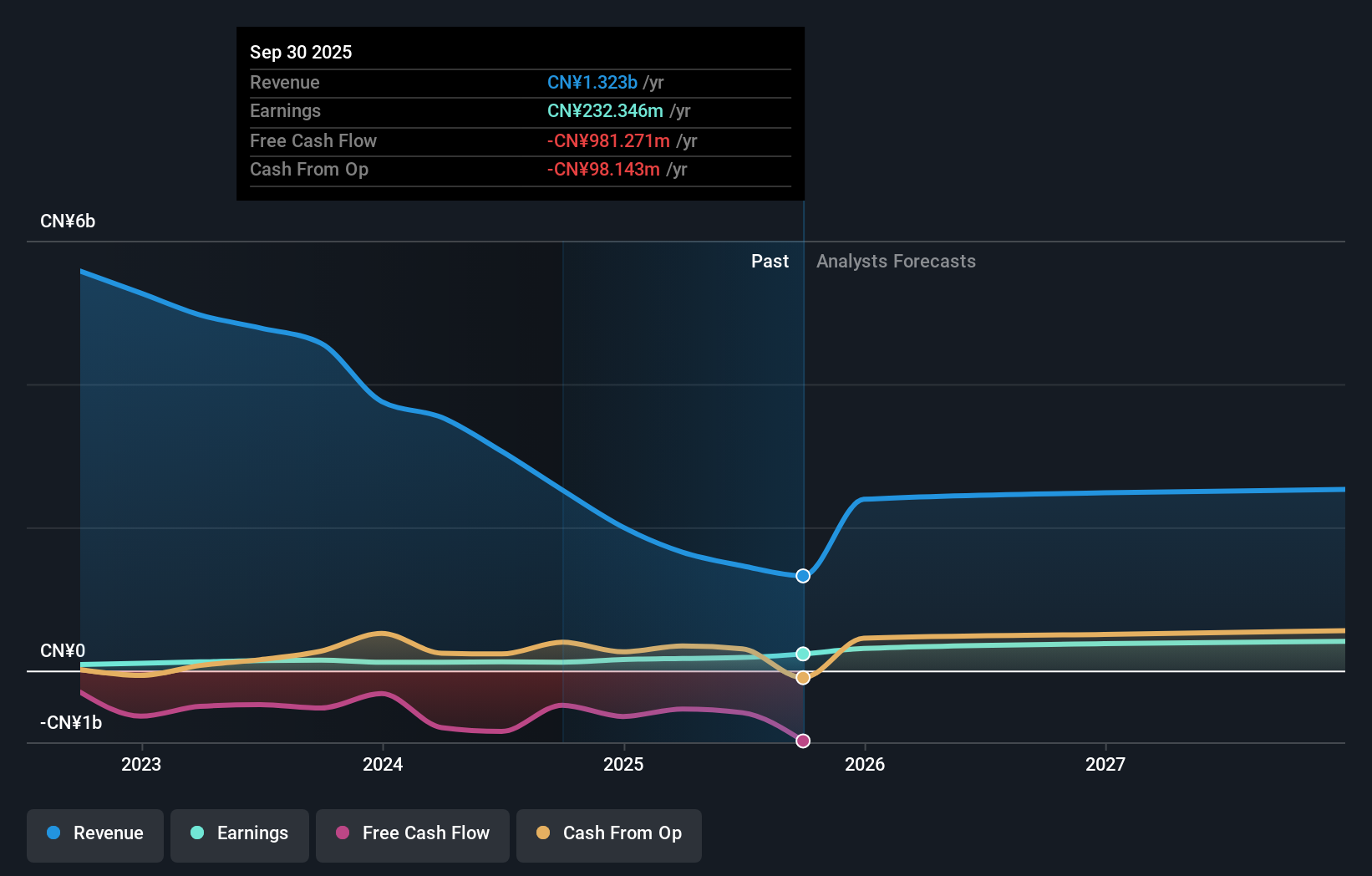

Insider Ownership: 21.2%

Hengtong Logistics is poised for significant earnings growth at 26.32% annually, outpacing the Chinese market's 23.3%. Despite a forecasted revenue increase of 12.4%, which lags behind its earnings growth, the company's profitability has improved with net income rising to CNY 42.55 million in Q1 2025 from CNY 28.06 million a year ago. However, Return on Equity remains low at an expected 8.4%, and recent revenue figures show a decline from previous years, indicating potential challenges ahead.

- Click here and access our complete growth analysis report to understand the dynamics of Hengtong Logistics.

- Our comprehensive valuation report raises the possibility that Hengtong Logistics is priced higher than what may be justified by its financials.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is involved in planning, developing, manufacturing, selling, and distributing home video games, online games, mobile games, and arcade games both in Japan and internationally; it has a market cap of approximately ¥1.77 trillion.

Operations: Capcom generates revenue from its Digital Content segment, which accounts for ¥125.13 billion, Amusement Equipment at ¥15.61 billion, and Amusement Facilities totaling ¥22.75 billion.

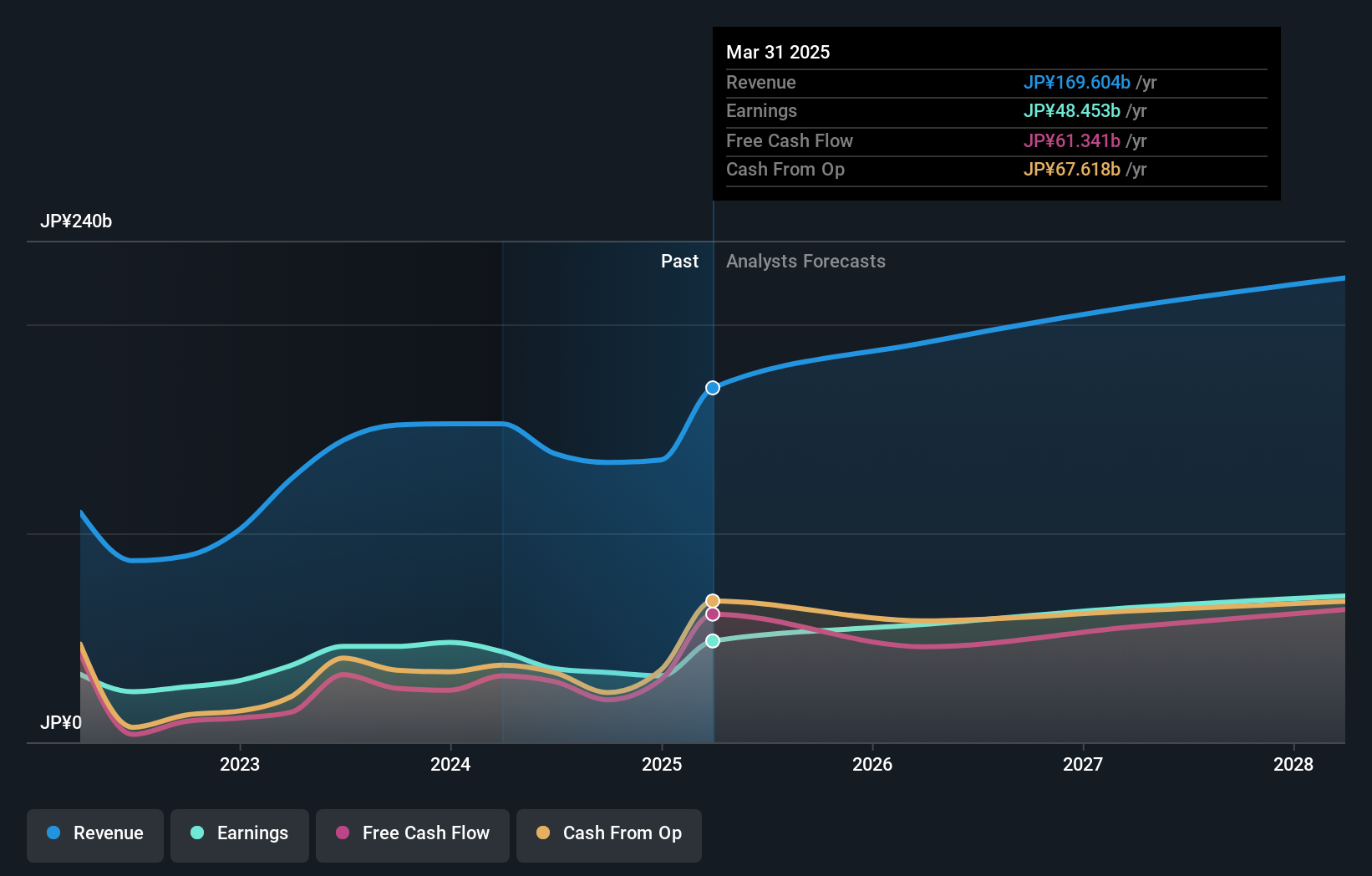

Insider Ownership: 10.5%

Capcom's growth trajectory is marked by a forecasted 10.4% annual earnings increase, surpassing the Japanese market's 7.6%. Despite a slower revenue growth rate of 8.6%, it remains above the market average of 3.6%. Recent product releases like Street Fighter 6 and Kunitsu-Gami have bolstered its portfolio, contributing to significant sales milestones and critical acclaim. However, dividend guidance indicates a reduction for fiscal year ending March 2026, reflecting cautious financial management amidst evolving market conditions.

- Take a closer look at Capcom's potential here in our earnings growth report.

- The analysis detailed in our Capcom valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Investigate our full lineup of 631 Fast Growing Asian Companies With High Insider Ownership right here.

- Contemplating Other Strategies? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal