3 Asian Stocks Estimated To Be Trading Below Intrinsic Value In May 2025

As global markets experience volatility amid renewed tariff threats and fluctuating economic indicators, Asian stock markets are also navigating these challenging conditions. In such an environment, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pansoft (SZSE:300996) | CN¥14.27 | CN¥28.25 | 49.5% |

| Livero (TSE:9245) | ¥1694.00 | ¥3383.28 | 49.9% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥43.44 | CN¥85.01 | 48.9% |

| Devsisters (KOSDAQ:A194480) | ₩38100.00 | ₩76151.09 | 50% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.46 | CN¥26.77 | 49.7% |

| Kolmar Korea (KOSE:A161890) | ₩84600.00 | ₩168491.07 | 49.8% |

| Kanto Denka Kogyo (TSE:4047) | ¥832.00 | ¥1644.44 | 49.4% |

| KG Mobilians (KOSDAQ:A046440) | ₩4255.00 | ₩8288.55 | 48.7% |

| SpiderPlus (TSE:4192) | ¥460.00 | ¥919.15 | 50% |

| Cosmax (KOSE:A192820) | ₩209500.00 | ₩407469.70 | 48.6% |

Here's a peek at a few of the choices from the screener.

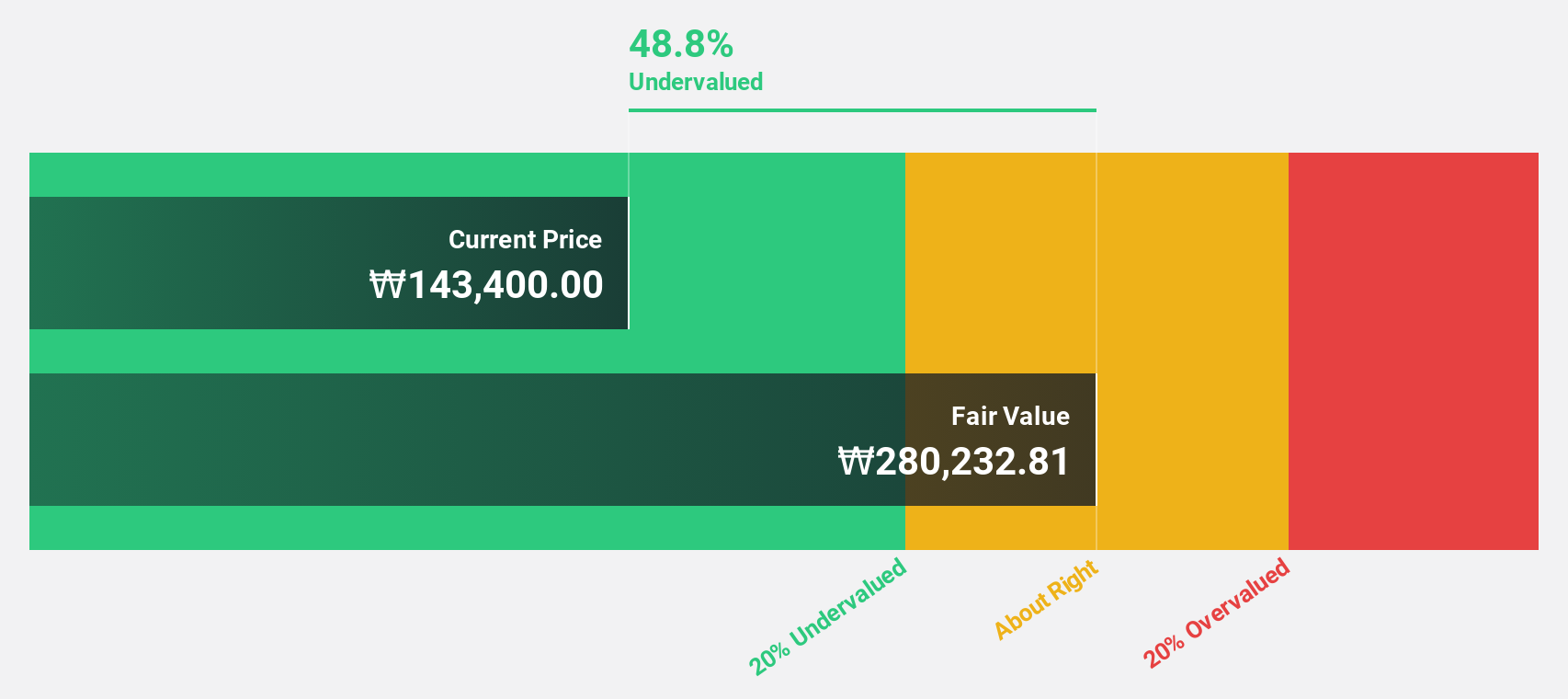

LigaChem Biosciences (KOSDAQ:A141080)

Overview: LigaChem Biosciences Inc. is a clinical stage biopharmaceutical company focused on discovering and developing medicines for unmet medical needs, with a market cap of ₩4 trillion.

Operations: The company generates revenue from two main segments: Pharmaceutical Business, contributing ₩20.54 billion, and New Drug Research and Development, accounting for ₩105.36 billion.

Estimated Discount To Fair Value: 33.3%

LigaChem Biosciences is trading at ₩110,400, considerably below its estimated fair value of ₩165,629.14. Despite recent negative sales figures, the company turned profitable with a net income of KRW 7.8 billion in 2024 and forecasts significant earnings growth of 58.9% annually over three years. The strategic alliance with WuXi XDC enhances ADC development capabilities, potentially boosting cash flows further as LigaChem capitalizes on this partnership for innovative therapies.

- Insights from our recent growth report point to a promising forecast for LigaChem Biosciences' business outlook.

- Unlock comprehensive insights into our analysis of LigaChem Biosciences stock in this financial health report.

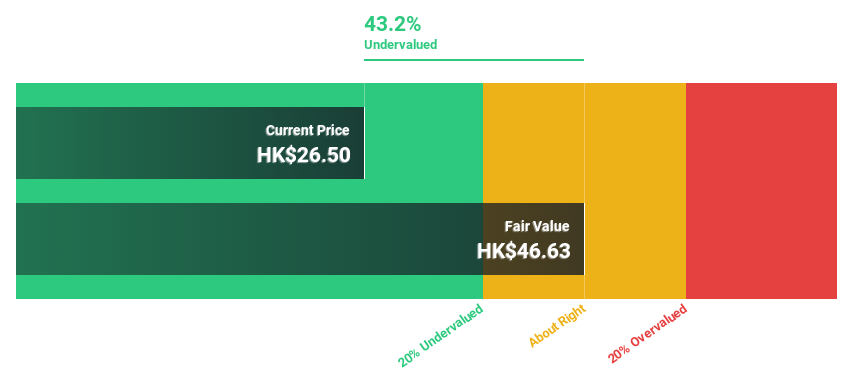

RemeGen (SEHK:9995)

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on the discovery, development, and commercialization of biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$31.70 billion.

Operations: RemeGen's revenue is primarily derived from its biopharmaceutical research, service, production, and sales segment, totaling CN¥1.91 billion.

Estimated Discount To Fair Value: 34.1%

RemeGen's stock, trading at HK$51.2, is significantly undervalued compared to its estimated fair value of HK$77.67. The company's revenue growth forecast of 23.2% annually outpaces the Hong Kong market average and it is expected to become profitable within three years. Recent advancements include successful clinical trials for disitamab vedotin, enhancing its therapeutic portfolio and potential cash flows despite a volatile share price and ongoing net losses reported in Q1 2025 earnings results.

- Our earnings growth report unveils the potential for significant increases in RemeGen's future results.

- Click here to discover the nuances of RemeGen with our detailed financial health report.

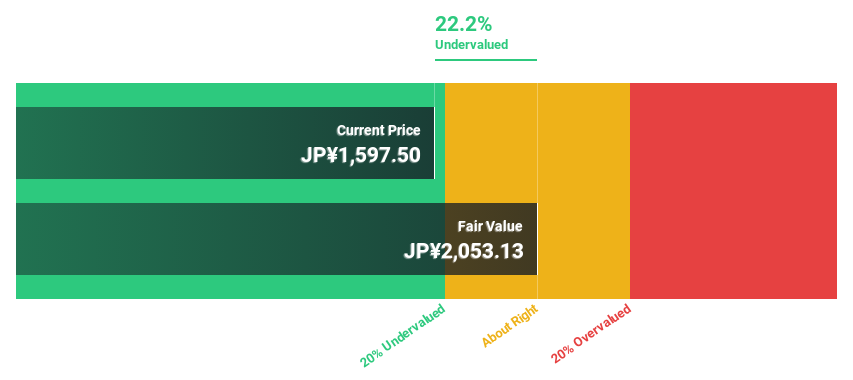

Chugin Financial GroupInc (TSE:5832)

Overview: Chugin Financial Group Inc., with a market cap of ¥307.82 billion, operates through its subsidiary The Chugoku Bank, Limited to offer a range of financial services to both corporate and individual clients in Japan.

Operations: The company's revenue segments include ¥11.73 billion from the Banking segment, ¥14.54 million from the Lease segment, and ¥3.97 million from the Securities Industry.

Estimated Discount To Fair Value: 19.7%

Chugin Financial Group, Inc. is trading at ¥1,720.5, below its estimated fair value of ¥2,141.51. Forecasted revenue growth of 33.1% annually surpasses Japan's market average significantly, while earnings are expected to grow at 14.3% per year. The company announced a share buyback program and increased dividends for fiscal 2026 to enhance shareholder returns despite recent share price volatility and a low return on equity forecast of 7%.

- In light of our recent growth report, it seems possible that Chugin Financial GroupInc's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Chugin Financial GroupInc.

Make It Happen

- Navigate through the entire inventory of 298 Undervalued Asian Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal