Centum Electronics Limited's (NSE:CENTUM) 37% Share Price Surge Not Quite Adding Up

Despite an already strong run, Centum Electronics Limited (NSE:CENTUM) shares have been powering on, with a gain of 37% in the last thirty days. The last 30 days bring the annual gain to a very sharp 38%.

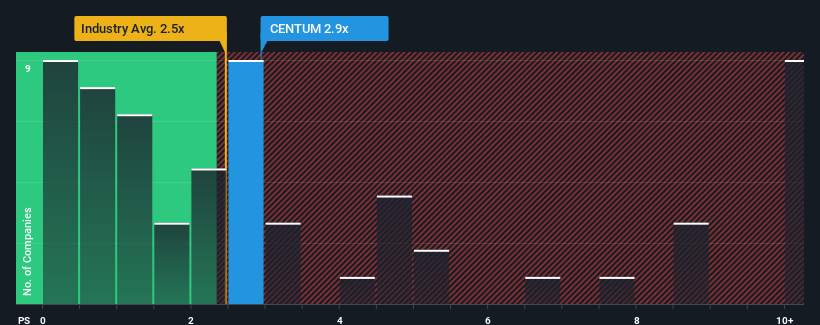

Even after such a large jump in price, it's still not a stretch to say that Centum Electronics' price-to-sales (or "P/S") ratio of 2.9x right now seems quite "middle-of-the-road" compared to the Electronic industry in India, where the median P/S ratio is around 2.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Centum Electronics

What Does Centum Electronics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Centum Electronics has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Centum Electronics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Centum Electronics' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Centum Electronics' to be considered reasonable.

Retrospectively, the last year delivered a decent 6.7% gain to the company's revenues. The latest three year period has also seen an excellent 49% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 3.1% as estimated by the lone analyst watching the company. With the industry predicted to deliver 32% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Centum Electronics is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Centum Electronics' P/S?

Its shares have lifted substantially and now Centum Electronics' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Centum Electronics' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you settle on your opinion, we've discovered 1 warning sign for Centum Electronics that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal