Big Technologies Leads These 3 UK Penny Stocks To Consider

The United Kingdom's FTSE 100 index recently faced downward pressure, influenced by weak trade data from China, highlighting ongoing challenges in the global economic landscape. Despite these broader market fluctuations, investors often look to penny stocks as a potential avenue for growth due to their lower price points and the opportunity they present in smaller or newer companies. While the term "penny stocks" might seem outdated, these investments can still offer significant value when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.87 | £295.98M | ✅ 4 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.17 | £157.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £4.68 | £378.08M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.815 | £429.87M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.205 | £405.35M | ✅ 2 ⚠️ 2 View Analysis > |

| FRP Advisory Group (AIM:FRP) | £1.24 | £306.06M | ✅ 4 ⚠️ 0 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £156.34M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.40 | £43.28M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 400 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Big Technologies (AIM:BIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Technologies PLC, operating under the Buddi brand, develops and delivers remote monitoring technologies for the offender and personal monitoring industry across the Americas, Europe, and Asia-Pacific with a market cap of £311.18 million.

Operations: Big Technologies PLC has not reported specific revenue segments.

Market Cap: £311.18M

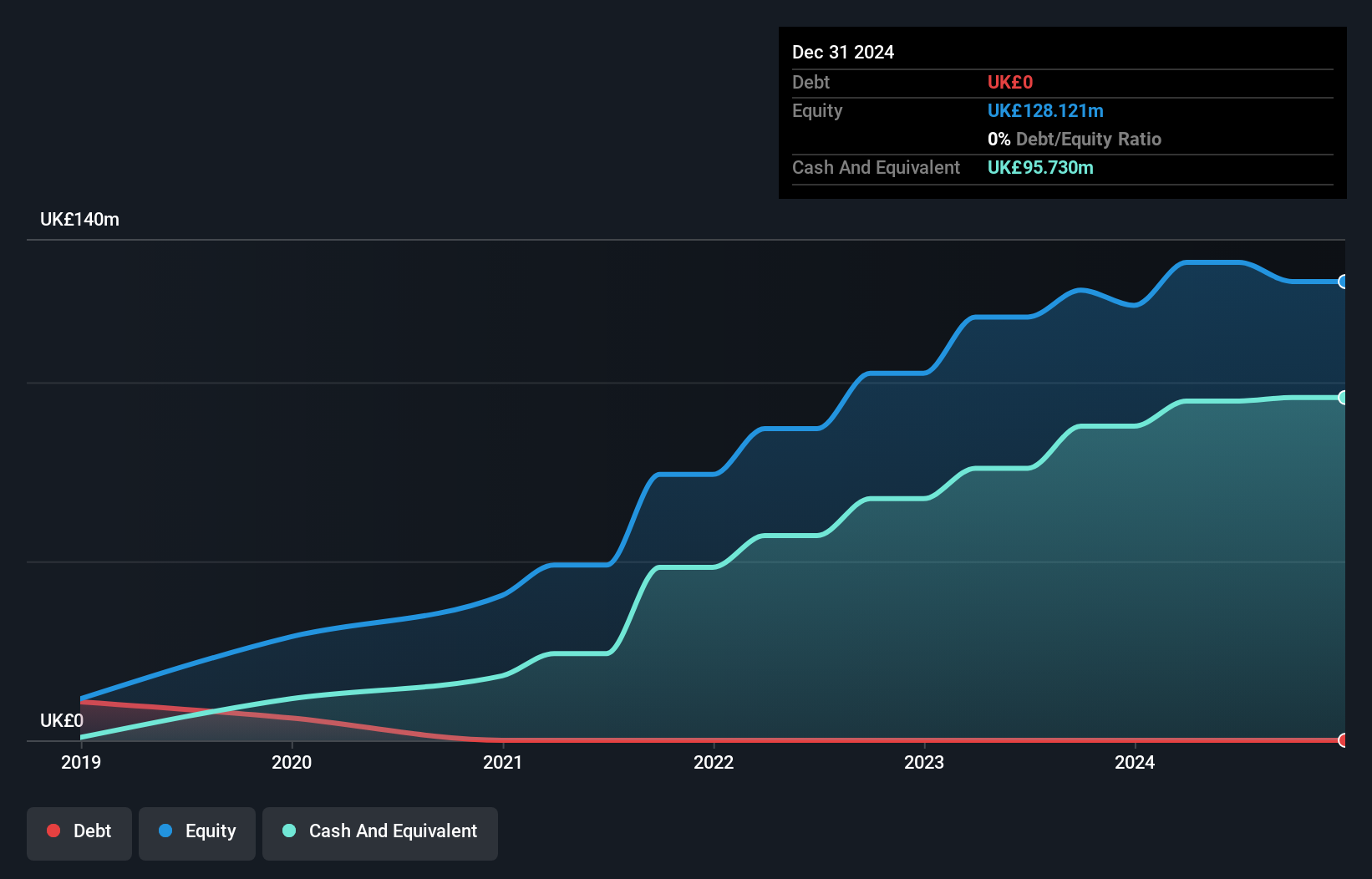

Big Technologies PLC, with a market cap of £311.18 million, recently reported a decline in both sales and net income for 2024 compared to the previous year. Despite being debt-free and having strong short-term assets exceeding liabilities, the company has faced increased volatility and lower profit margins. Management changes have been significant, with new executives stepping into key roles amid strategic shifts. The company's earnings are forecasted to grow substantially at 35% per year, yet recent negative earnings growth poses challenges. Trading below estimated fair value suggests potential opportunities for investors considering its market-leading products in remote monitoring technologies.

- Click here to discover the nuances of Big Technologies with our detailed analytical financial health report.

- Examine Big Technologies' earnings growth report to understand how analysts expect it to perform.

Boku (AIM:BOKU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boku, Inc. offers local payment solutions for merchants across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of £520.47 million.

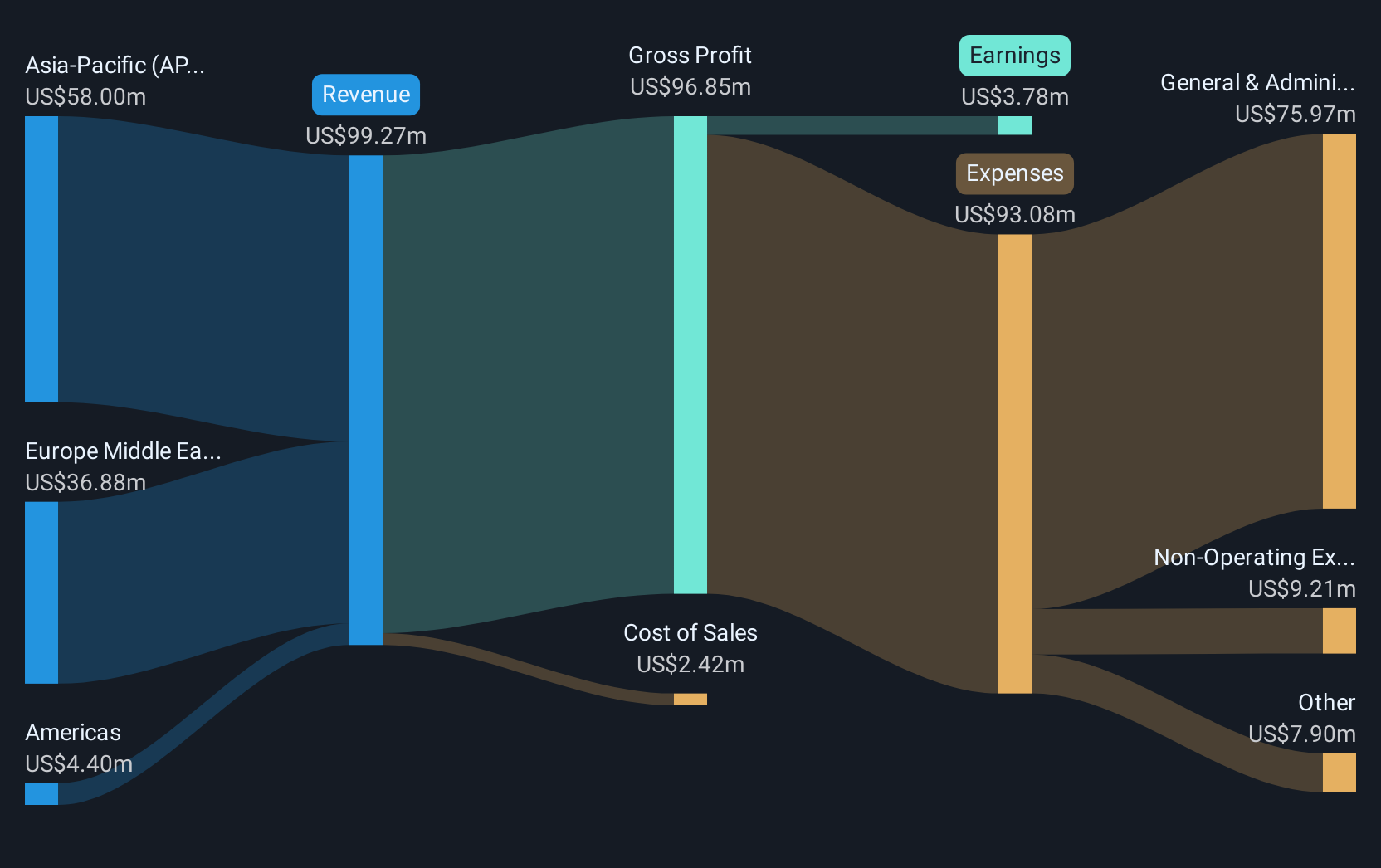

Operations: The company's revenue is primarily derived from its Payments segment, which generated $99.27 million.

Market Cap: £520.47M

Boku, Inc., with a market cap of £520.47 million, has experienced a mixed financial performance recently. Despite being debt-free and having short-term assets exceeding liabilities, the company faced significant challenges such as negative earnings growth (-62.5%) and declining profit margins (3.8% from 12.2%). Recent auditor concerns about its ability to continue as a going concern add further uncertainty. However, Boku reported increased sales of US$99.27 million for 2024 and anticipates over 20% revenue growth in 2025, which may offer potential upside if achieved amidst management changes and recent insider selling activities.

- Dive into the specifics of Boku here with our thorough balance sheet health report.

- Explore Boku's analyst forecasts in our growth report.

K3 Business Technology Group (AIM:KBT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: K3 Business Technology Group plc, with a market cap of £42.16 million, offers computer software and consultancy services across the UK, the Netherlands, Ireland, Europe, the Middle East, Asia, and the United States.

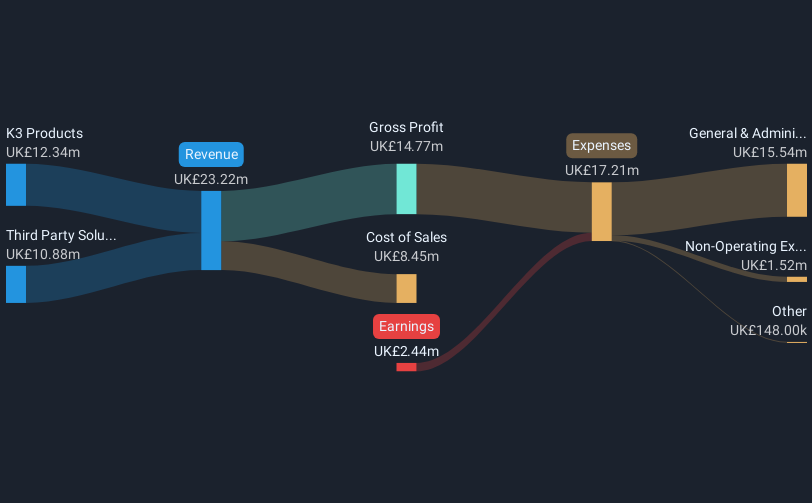

Operations: The company generates revenue from two main segments: K3 Products (£12.34 million) and Third Party Solutions (£10.88 million).

Market Cap: £42.16M

K3 Business Technology Group, with a market cap of £42.16 million, has shown resilience despite its unprofitability. The company maintains a strong financial position with cash exceeding debt and short-term assets covering liabilities. Although K3's revenue decreased to £23.22 million from the previous year, it achieved a net income of £0.574 million, reversing last year's losses. The retirement of CEO Eric Dodd in September 2025 marks significant leadership changes as the company continues its focus on cost management and shareholder value enhancement without appointing a direct successor for the CEO role.

- Click to explore a detailed breakdown of our findings in K3 Business Technology Group's financial health report.

- Assess K3 Business Technology Group's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Jump into our full catalog of 400 UK Penny Stocks here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal