European Value Stocks Including MedinCell That May Be Priced Below Intrinsic Estimates

As European markets experience a boost in sentiment following the de-escalation of U.S.-China trade tensions, major indices such as the STOXX Europe 600 have shown positive performance. In this context, identifying stocks that are potentially undervalued can provide investors with opportunities to capitalize on market conditions where intrinsic value may not yet be fully recognized by broader market participants.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK48.40 | SEK96.31 | 49.7% |

| ILPRA (BIT:ILP) | €4.58 | €8.75 | 47.7% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.935 | €3.71 | 47.9% |

| Lectra (ENXTPA:LSS) | €23.60 | €47.03 | 49.8% |

| adidas (XTRA:ADS) | €218.30 | €434.91 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK219.00 | SEK417.51 | 47.5% |

| Cavotec (OM:CCC) | SEK16.25 | SEK32.35 | 49.8% |

| dormakaba Holding (SWX:DOKA) | CHF735.00 | CHF1401.95 | 47.6% |

| Surgical Science Sweden (OM:SUS) | SEK142.80 | SEK274.02 | 47.9% |

| Arlandastad Group (OM:AGROUP) | SEK26.30 | SEK50.14 | 47.6% |

We'll examine a selection from our screener results.

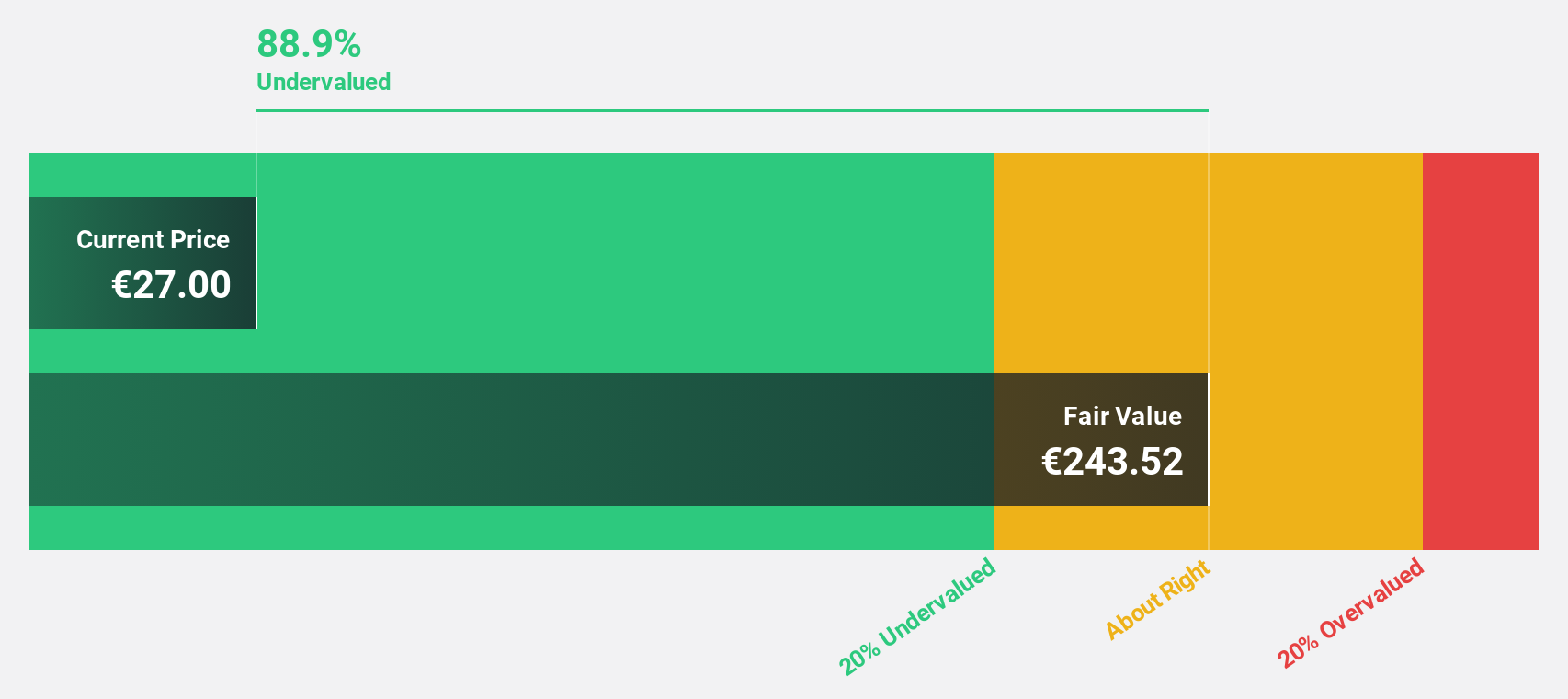

MedinCell (ENXTPA:MEDCL)

Overview: MedinCell S.A. is a pharmaceutical company based in France that specializes in developing long-acting injectables across various therapeutic areas, with a market capitalization of €524.04 million.

Operations: The company's revenue segment is primarily derived from its pharmaceuticals division, which generated €13.20 million.

Estimated Discount To Fair Value: 44.2%

MedinCell, trading at €15.85, is significantly undervalued against its estimated fair value of €28.4. Despite negative shareholders' equity, the company forecasts robust revenue growth of 68.4% annually, outpacing the French market's 5.1%. Recent sales surged to $39 million for Q1 2025—2.6 times higher than Q1 2024—demonstrating strong cash flow potential as it moves towards profitability within three years and anticipates a rise in stock price by analysts' consensus.

- Our earnings growth report unveils the potential for significant increases in MedinCell's future results.

- Take a closer look at MedinCell's balance sheet health here in our report.

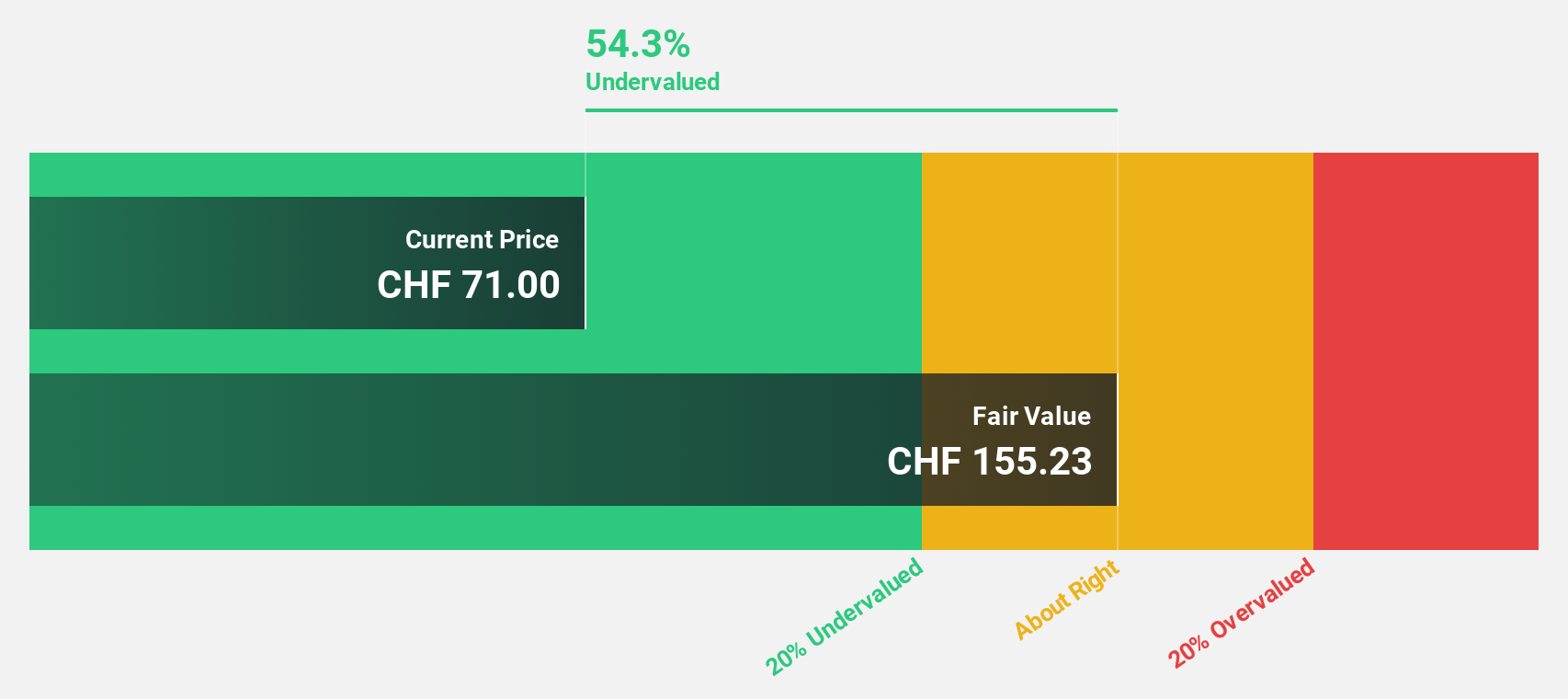

SKAN Group (SWX:SKAN)

Overview: SKAN Group AG, with a market cap of CHF1.62 billion, operates internationally providing isolators, cleanroom devices, and decontamination processes for the pharmaceutical and chemical industries.

Operations: The company's revenue is derived from two main segments: Equipment & Solutions, contributing CHF270.90 million, and Services & Consumables, generating CHF90.39 million.

Estimated Discount To Fair Value: 18%

SKAN Group, priced at CHF 72.1, trades below its estimated fair value of CHF 87.98, reflecting an undervaluation based on cash flows. The company reported a net income increase to CHF 38.8 million for 2024 and anticipates mid-teens revenue growth in 2025. Analysts predict a stock price rise of about 25.8%. Recent dividend approval further enhances shareholder value with a combined payout of CHF 0.40 per share from ordinary dividends and capital reserves distribution.

- Our comprehensive growth report raises the possibility that SKAN Group is poised for substantial financial growth.

- Click here to discover the nuances of SKAN Group with our detailed financial health report.

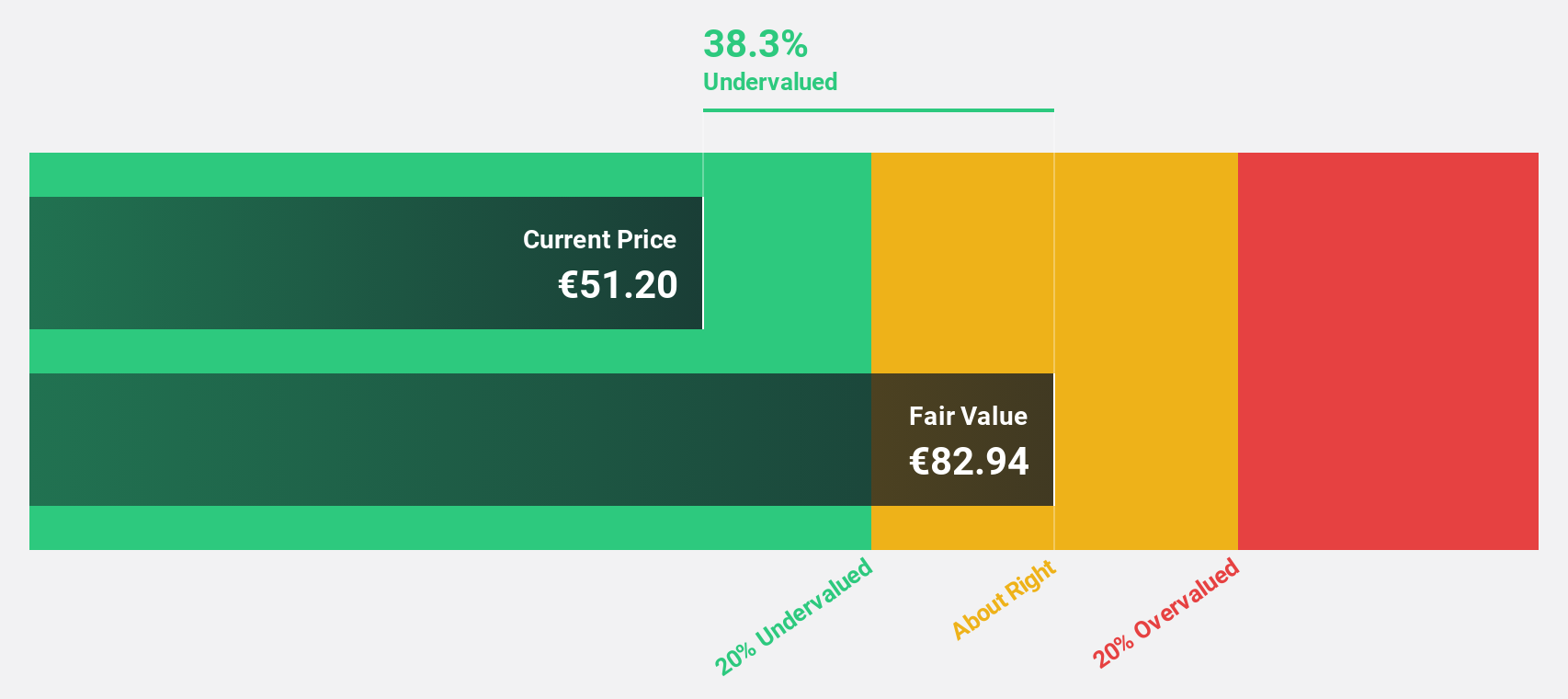

Ströer SE KGaA (XTRA:SAX)

Overview: Ströer SE & Co. KGaA operates in the out-of-home and digital out-of-home advertising sectors in Germany and internationally, with a market cap of approximately €2.85 billion.

Operations: The company's revenue segments include Daas & E-Commerce (€356.69 million), Out-Of-Home Media (€981.11 million), and Digital & Dialog Media (€881.05 million).

Estimated Discount To Fair Value: 37.8%

Ströer SE KGaA is currently trading at €51, significantly below its estimated fair value of €81.97, highlighting an undervaluation based on cash flows. The company reported a notable increase in net income to €8.54 million for Q1 2025 from the previous year's €0.85 million. Despite a high debt level and undercovered dividend yield of 3.63%, earnings are projected to grow annually by 19.1%, outpacing the broader German market's growth rate.

- Our expertly prepared growth report on Ströer SE KGaA implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Ströer SE KGaA.

Summing It All Up

- Explore the 178 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal