Nvidia (NVDA.US) will face results next week, and the stock price may fluctuate 7% after the big test

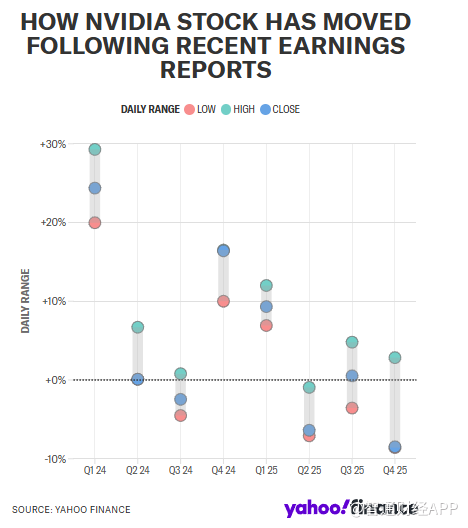

The Zhitong Finance App learned that options traders tracked by Bloomberg predicted that the day after AI chip maker Nvidia (NVDA.US) released its quarterly earnings report on May 28, its stock could rise or fall as high as 7.4%. This figure is lower than the average fluctuation of 11.3% of Nvidia's stock price in the past eight quarters the day after the earnings report was announced.

Nvidia's stock price fell 8.5% in February after the company reported earnings for the fourth quarter of last year that exceeded market expectations, but its gross margin guidance for the first quarter fell short of market expectations. The day after the chipmaker released its earnings report, the stock price rose 2.8% and fell 8.6%. The fluctuation range was 11.4%.

Range of fluctuations after Nvidia's stock performance

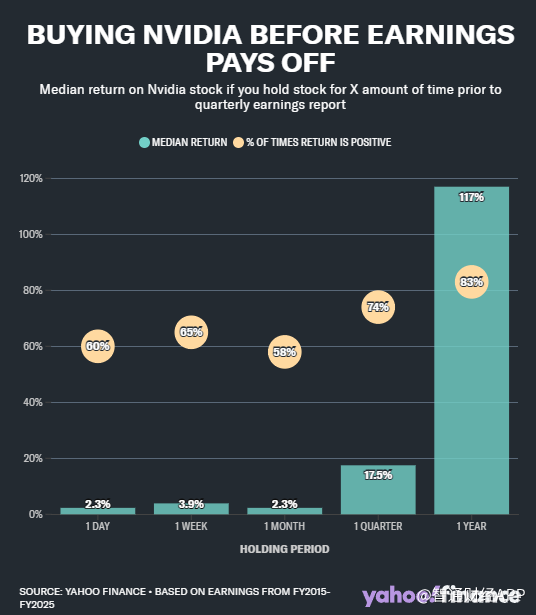

Although Nvidia's stock price has fluctuated a lot on average since the release of earnings reports for the past eight quarters, investors have reaped huge benefits from holding Nvidia shares. According to Yahoo financial analyst Jared Blikre, in the past 10 years, if Nvidia shareholders bought shares and held them for 12 months before the earnings report was released, the average return was close to 120%.

Historical data shows that buying Nvidia shares before the results brought huge returns

Before Nvidia announced its results on May 28, the company's stock price experienced a turbulent year due to the development of artificial intelligence in China and the changing trade policies of the Trump administration.

As the low-cost AI model launched by Chinese startup DeepSeek raised questions about large tech companies' huge AI infrastructure spending and concerns about a slowdown in spending, Nvidia's stock price began struggling in 2025. There are signs that Microsoft, one of Nvidia's biggest customers, may slow down investment in artificial intelligence data centers, further fueling concerns.

The US government's chip export controls and global tariffs have also hit Nvidia stock hard.

However, factors such as the temporary trade truce between the US and China, Nvidia's overseas business prospects (that is, expansion into Saudi Arabia), and Trump's abolition of restrictive chip trade policies in the Biden era boosted stock prices before Nvidia announced its results.

Wall Street analysts expect Nvidia's revenue and earnings to increase significantly in the first quarter of fiscal year 2026 ending in April, although the growth rate is likely to continue to slow.

Analysts expect Nvidia's first-quarter revenue to grow by more than 66% to $43 billion, and adjusted earnings per share will jump 44% to $0.88. In contrast, in the first quarter of last year, Nvidia's revenue increased 262%, and earnings per share increased 461%.

Investors will keep a close eye on the impact of Trump's restrictions on Nvidia's chip sales to China in next week's earnings report. Nvidia CEO Hwang In-hoon said the policy had cost the company $15 billion in sales.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal