Top Glove Corporation Bhd. (KLSE:TOPGLOV) Could Be Riskier Than It Looks

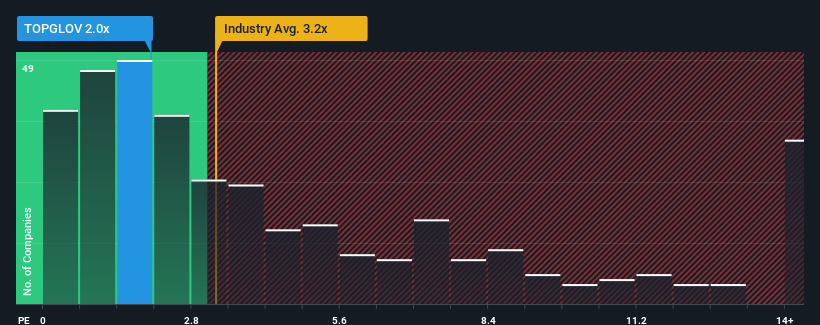

There wouldn't be many who think Top Glove Corporation Bhd.'s (KLSE:TOPGLOV) price-to-sales (or "P/S") ratio of 2x is worth a mention when the median P/S for the Medical Equipment industry in Malaysia is similar at about 2.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Our free stock report includes 1 warning sign investors should be aware of before investing in Top Glove Corporation Bhd. Read for free now.See our latest analysis for Top Glove Corporation Bhd

What Does Top Glove Corporation Bhd's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Top Glove Corporation Bhd has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Top Glove Corporation Bhd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Top Glove Corporation Bhd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 58% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 65% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 29% as estimated by the analysts watching the company. With the industry only predicted to deliver 17%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Top Glove Corporation Bhd's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Top Glove Corporation Bhd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Top Glove Corporation Bhd you should be aware of.

If these risks are making you reconsider your opinion on Top Glove Corporation Bhd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal