The Saudi stock market has become a “bastards” Wall Street high-frequency trading companies are flocking to it

The Zhitong Finance App learned that Saudi Arabia is stepping up efforts to attract high-frequency trading companies with the aim of boosting trading activity in the largest stock market in the Middle East region. The move has already attracted major players such as Castle Securities and Hudson River Trading.

Saudi Tadawul Group Holding Co. is cooperating with some of Wall Street's fastest and most secretive high-frequency trading companies to incorporate feedback from these companies when revising its derivatives market framework, according to sources familiar with the matter. People familiar with the matter said that the operator of the Saudi stock exchange is also expanding the scale of its international roadshow, expanding activities from the US and Europe to Asian markets such as Japan and India.

The momentum is already building. Some people familiar with the matter said that Castle Securities and Hudson River Trading are seeking to expand their business in Saudi Arabia, while market makers such as Tower Research Capital are also testing their algorithms on Saudi exchanges.

The companies have yet to disclose details of their activities on the Saudi Stock Exchange, nor have they appeared on the official list of market makers. Despite this, their participation shows that even the international players most sensitive to delays are deepening their footprint in Saudi Arabia.

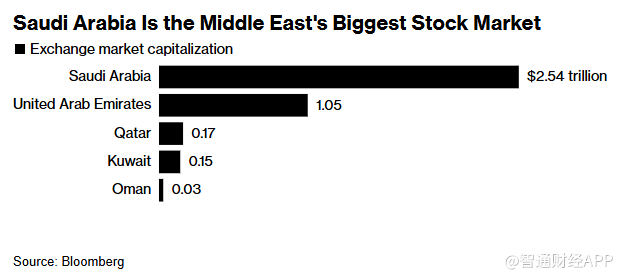

Saudi Arabia is the largest stock market in the Middle East

People familiar with the matter revealed that Saudi Arabia began engaging with trading companies driven by algorithms and quantification before and after oil giant Saudi Aramco launched its US$26 billion IPO in 2019. This cooperation is also in line with Saudi Arabia's “Vision 2030” agenda, which aims to expand its capital market and increase foreign investment participation.

Strengthening infrastructure

In 2023, Wamid, Tadawul's technical division, launched a hosting service that allows trading companies to host servers close to exchange matchmaking engines — a critical infrastructure upgrade for high-frequency strategies. Tadawul also hired financial technology provider Pico to help deploy infrastructure and connect the exchange to other markets.

Mohammed Al-Rumaih, CEO of Tadawul, said the exchange has also set up a dedicated department to manage relationships with international investors, which helps strengthen ties with quantitative investors, hedge funds and high-frequency trading clients.

He said, “Our exchange already has many clients from the US, Europe, and the UK, and we think the biggest growth opportunity currently comes from Asia.”

Tadawul is the largest stock exchange in the Gulf region. As of the end of April, the average daily trading volume of its shares was around $1.7 billion, according to the exchange.

According to exchange officials, high-frequency trading accounts for 25% of Tadawul's daily trading volume, which is far below the average of global exchanges. Nasdaq estimates that 50% of US stock trading volume is driven by high-frequency trading.

By global standards, Saudi market depth and volume are still low, which limits the scalability of large-scale electronic trading strategies. To this end, Tadawul has hired companies such as Morgan Stanley Saudi Arabia Division and Merrill Lynch Saudi Arabia Division as registered market makers to enhance liquidity and price discovery capabilities.

Bringing in more high-frequency trading companies will be key to this effort, as these companies can deploy proprietary trading books without bank restrictions.

Tadawul is also pursuing other initiatives, including launching more exchange-traded funds (ETFs) that track Saudi stocks and working to get more companies listed.

Jarrod Yuster, founder and CEO of Pico, said: “As the infrastructure improves, we expect a significant increase in liquidity. Five years from now, the exchange's trading volume may be completely different.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal