Confidence returns to the global IPO market as tariff shocks ease, and the global IPO market heats up again

The Zhitong Finance App learned that as the stock market rebounds from the interference of US President Trump's abusive tariffs and the global IPO market heats up again, many companies not directly affected by trade are seeking to complete transactions in the summer and before geopolitical tensions rise again.

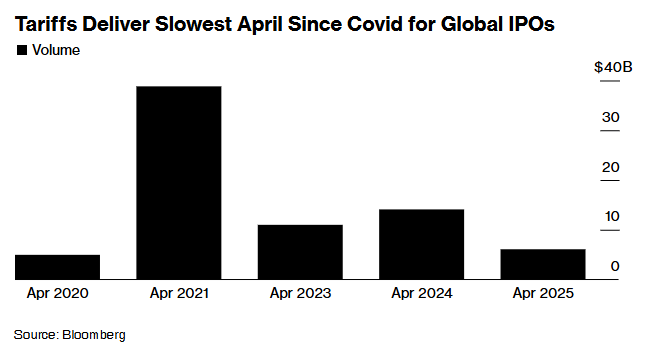

After several years of low IPOs, bankers and investors were looking forward to 2025 while watching the tough remarks made by then-elected President Trump on trade issues. The tariff measures announced by Trump on April 2 validated their concerns. Following its announcement, a series of suspended IPO projects led to the lowest level of IPO financing in April this year since the outbreak of the epidemic in 2020.

Today, with the easing of tension, the 43.6 billion US dollars the IPO has raised so far in 2025 is only slightly lower than the same period last year, and the frozen listing project has finally restarted. Among them is eToro Group (ETOR.US), an Israeli trading and investment platform that was one of the first companies to postpone plans to go public. A few days after the US and China reached a temporary easing agreement, eToro's US IPO price was above the guideline range, and its stock price soared 29% during the first day of trading.

Also in the US market, banking startup Chime Financial is expected to complete its largest IPO this year in the US market just before the summer slackdown. The company, which is valued at $25 billion in 2021, submitted a listing application this Tuesday and is likely to complete pricing in June as soon as possible. The online TV advertising platform MNTN and digital physical therapy company Hinge Health also launched their US IPO this week and are currently promoting them to investors.

Keith Canton, head of US equity capital markets at J.P. Morgan Chase, said: “Recent news has brought more market certainty. The worst tariff fears probably won't happen.”

The cooling of trade tension helps the IPO market recover

The sharp market reaction triggered by Trump's so-called “Liberation Day” raises concerns that the IPO window may close for several months. Most companies that are expected to go public in the spring have put plans on hold. According to reports, the US ticketing platform StubHub Holdings and medical supplies company Medline Industries have both suspended their IPOs. In Europe, investment company Greenbridge SA delayed its Stockholm listing plan.

In Asia, there is news that the Indian subsidiary of South Korea's LG Electronics company's original plan to raise 1.7 billion US dollars has been suspended. A few weeks later, South Korean machine tool manufacturer DN Solutions Co.'s planned $1.1 billion domestic distribution project was also put on hold.

As we enter the first week of May, the chill in the US IPO market began to subside. As the stock market began to pick up intermittently, two insurance companies — Aspen Insurance Holdings (AHL.US) and American Integrity Insurance Group (AII.US) — advanced mid-scale IPOs, and both companies' shares have risen since their listing on May 8.

Steven Halperin, co-head of capital markets at Moelis & Co. said, “As long as the subject is appropriate, investors are willing to participate in the IPO.” He added: “If you plan to do an IPO, you have to prove to some extent that you are not affected by tariffs or the economic downturn. The only question is how much discount is needed.”

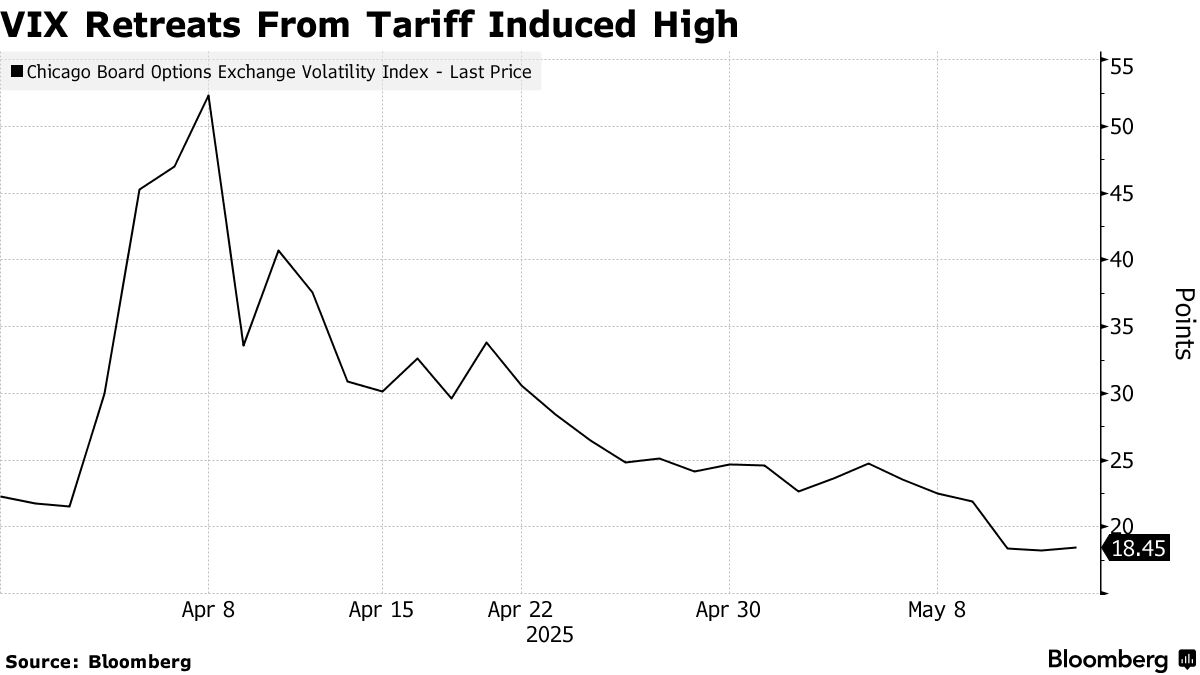

The VIX Panic Index soared above 60 a week before “Liberation Day” and then declined steadily, which also boosted the recovery of IPOs. After China and the US announced the suspension of mutual tariffs for the next 90 days, the index fell below 20. This level is generally regarded as the threshold for investment banks to decide whether to advance an IPO.

Today, as the market stabilizes more, IPOs are returning to their earlier pace, including the restart of eToro's projects, and the listing of MNTN and Hinge Health may be completed this month. Furthermore, the rise in the price of Bitcoin may attract stablecoin issuer Circle Internet Group and the crypto trading platform Gemini to advance their listing plans.

However, for companies hoping to go public in time for the summer holidays, time is running out. The holidays in late May, June, and early July will reduce the operating window, and when the 90-day tariff suspension period between China and the US is approaching, companies preparing to go public will also need to pay close attention to the progress of negotiations.

Tight timelines may force some companies to choose to go public in the last few months of this year. Jimmy Williams, head of equity capital markets for West Coast Technology, Media and Telecom at Jefferies Financial Group, said, “The fall will be an active IPOs period for technology companies. The board discussions we have participated in have clearly taken a more positive view of IPO opportunities, particularly in the short term.” He currently predicts that the US will complete IPOs of about 10 technology companies this year, compared to 15 to 20 at the beginning of the year. But he still believes this year will be better than 2024. “The risk appetite of buyers we are currently seeing is the strongest since 2021,” and that year's IPO fund-raising set a record.

Although some companies have returned to the IPO queue, investment banks have warned that many companies that are more affected by supply chain bottlenecks or the threat of inflation caused by tariffs will remain on hold. According to people familiar with the matter, ticketing platform StubHub and payment giant Klarna Group, which originally planned to go public in April, as well as medical supplies company Medline, which is seeking a valuation of up to 50 billion US dollars in an IPO, have not publicly stated that they have restarted their listing plans.

Keith Canton said, “We will wait and see for the time being on the companies affected by the tariffs, as the management teams of these companies still need to figure out how the cost structure will be affected, and buyers will also need to reflect this new information in their valuations.”

Matt Fry, co-chair of capital markets at Haynes Boone Law Firm, said, “The general expectation we hear is that next year will be better than this year. But as the market improves and the economy may avoid recession, we see that the IPO market is partially unfreezing.”

How are other IPO markets performing?

Of course, some Chinese companies have successfully gone public without fear of tariff shocks from the beginning. The second largest IPO on the US Exchange in April was the Chinese tea chain brand Bawang Chaji (CHA.US), which raised 473 million US dollars. Chinese battery manufacturer Ningde Times is also continuing preparations for its listing in Hong Kong. This listing is expected to increase its total global listing by more than US$4 billion.

Among the companies that are about to go public in Hong Kong, quite a few come from “secondary listings” of companies that have already been listed in mainland China. CITIC Securities analysts wrote in a recent report that since the fourth quarter of last year, 25 A-share companies have prepared to go public in Hong Kong, and they are expected to be concentrated in the second half of the year.

Since they do not rely on exports to the US, some Chinese companies that intend to go public can cope with tariff uncertainty. Richard Wang, head of China's equity market at Freshfields Law Firm, said that most of these companies are consumer companies benefiting from China's expansion of domestic demand.

Dan Ouyang, capital markets partner at Baker McKenzie Law Firm, said, “Technology and new economy companies in mainland China in particular are being attracted by recent successful technology IPOs and the Hong Kong Stock Exchange's favorable policies for these companies.” He added that the China Securities Regulatory Commission recently announced support for local companies to go public in Hong Kong, which will further boost this trend.

Richard Wang said he is “cautiously optimistic” about the prospects for China's IPO for the rest of the year. He said, “The reason for caution is due to fluctuations in the US market. Now we're talking about tariffs, but no one knows what the next issue will be.”

The enthusiasm for IPOs in the Middle East remains high. Saudi low-cost airline Flynas's $1.1 billion IPO was fully subscribed within minutes of launch. Investment banks in the region said that the additional tariffs imposed by the US have yet to have a significant impact on their trading projects.

Compared to the US, the European IPO market has been relatively sluggish in recent years, but there has also been a slight recovery after tariffs were suspended. According to reports, the Portuguese bank Novo Banco SA plans to go public in June, with an estimated valuation of up to 7 billion euros. In London, Cobalt Holdings has applied for a US$230 million IPO, which may become the largest listing in London since 2023. German Autodoc SE and Swedish betting game developer Hacksaw are also planning to launch in the next few months.

India is likely to become another bright spot. Signs of a recovery in trading activity have begun to show, although the scale of fund-raising is currently not close to last year's record. According to the data, so far this year, Indian companies have raised a total of 8.5 billion US dollars through the issuance of new and old shares, down from 19.4 billion US dollars in the same period in 2024.

Pratik Loonker, head of equity markets at Axis Capital and co-head of the Financial Investors Group, said that India may launch large-scale stock issuance in the second half of this year, and even the tension between India and Pakistan does not seem to have an impact on the market. He said, “I don't think the market needs to worry about this for now. It's just a brief fluctuation, and eventually fear will recede and greed will make a comeback.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal