US Stock Outlook | Futures of the three major stock indexes are rising, Wall Street warns that US inflation will kill the “backhorse” next month as soon as possible

Pre-market market trends

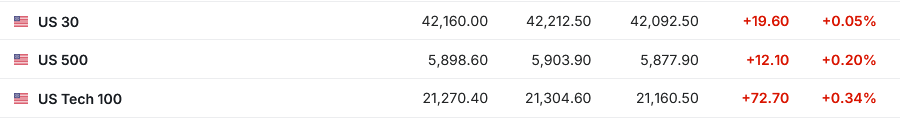

1. On May 14 (Wednesday), the futures of the three major US stock indexes rose sharply before the US stock market. As of press release, Dow futures were up 0.05%, S&P 500 futures were up 0.20%, and NASDAQ futures were up 0.34%.

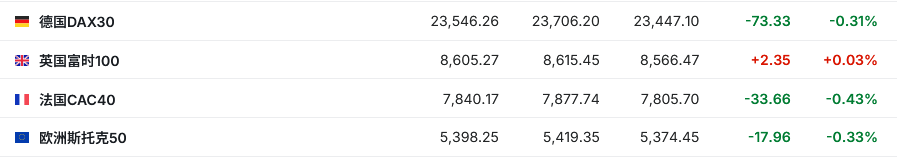

2. As of press release, the German DAX index fell 0.31%, the UK FTSE 100 index rose 0.03%, the French CAC40 index fell 0.43%, and the European Stoxx 50 index fell 0.33%.

3. As of press release, WTI crude oil fell 1.10% to $62.97 per barrel. Brent crude fell 1.04% to $65.94 per barrel.

Market news

The CPI cooling down is just a “blunder”! Inflation will kill the “backhorse” next month as soon as possible. Tuesday's data showed that the consumer price index (CPI) unexpectedly cooled down in April, and the overall inflation rate fell to 2.3% year over year, down from 2.4% in March. However, many Wall Streeters said that the impact of the trade war has not yet been reflected in the data, and the next few months may witness a new sharp rise in prices. Ellen Zentner, chief economist at Morgan Stanley's wealth management department, said, “This (April CPI) data is unimportant because the impact of tariffs will actually begin to show in next month's data.” Rick Rieder, BlackRock's chief investment officer for global fixed income, said he believes the impact of tariffs on inflation will “escalate” during the summer months. He pointed out that at present, apart from a slight increase in car prices, there is little evidence that tariffs have had an impact on inflation. Janus Henderson's US securitization product director and portfolio manager John Kerschner also said that he believes the inflationary pressure brought about by tariffs may begin to show in June. Goldman Sachs estimates that the annual rate of core personal consumption expenditure (PCE), the Federal Reserve's preferred inflation indicator, may rise from 2.6% in March to 3.6% before the end of the year. Bank of America analysts wrote after the release of the CPI data: “There may already be signs of tax impact in the data, as prices of some high-import categories — household goods, pharmaceuticals, IT goods, and toys — accelerated during the month. But we still expect to see more obvious evidence in the coming months.”

Citigroup and Little Mozi shouted: betting on the “worst” US stocks this year will pay off in the short term. As trade tensions ease, the two major Wall Street banks have made equally bold predictions for the US stock market — buying the stocks that have fallen the most this year to make quick short-term profits. The head of stock trading at Citibank and J.P. Morgan Chase said they are particularly optimistic about small-cap stocks, technology hardware stocks, and homebuilder stocks in the next few weeks. The performance of these stocks in the recent round of gains has lagged behind the S&P 500 index. Stuart Kaiser, head of US stock trading strategy at Citigroup, also said that in the current environment, he also favors stocks of companies with weak financial conditions. Andrew Tyler, head of global market intelligence at J.P. Morgan Chase's trading department, said that given the possibility of a shortfall market in the short term, it is reasonable to buy heavily hit sectors (such as retail or optional consumer goods) through derivatives.

UBS and Wall Street peers disagree: downgrading US stock ratings! Although other Wall Street institutions became more optimistic after China and the US adjusted bilateral tariff levels, UBS Wealth still took a wait-and-see attitude towards US stocks — in stark contrast to other institutions on Wall Street that have become more optimistic, and expressed doubts about the recent rebound. Mark Haefele, head of investment at UBS, downgraded the US stock market from “attractive” to “neutral.” He pointed out that he was not bearish on the stock market, nor was he advising customers to sell stocks; rather, he thought the stock market had risen too fast in the past month. In his report to clients, he wrote, “While the 90-day remission period provides a resuscitation, uncertainty is still high, and investors will soon begin to see if this temporary solution can evolve into a lasting agreement. The constructive attitude of the two sides indicates a desire for further negotiations, but the challenges of reaching a lasting agreement may cause market fluctuations.” He recommended that clients maintain a strategic allocation of US stocks, and still expect the stock market to rise within the next 12 months.

The dollar “Xiaoyangchun” can't stop the long “bear road”! Hedge funds warned that the tariff policy would set off a wave of dollar sell-offs. Jens Nordvig, founder of Wall Street's customized investment research company Exante Data, which communicates with the world's largest institutional investors all year round, pointed out that the rebound in the US dollar after the tense trade situation between China and the US eased was only a blip. He said that most large hedge fund clients said that a “dollar bear market” that is likely to last for many years has just begun, and that the trigger was the Trump administration's “US economic transformation actions” that disrupted the global trade system. In particular, the Trump administration's erratic tariff measures have caused large-scale financial market turmoil, and investors' confidence in dollar assets has been irreversibly shaken. His core prediction is that unlike speculators who quickly sold the dollar after imposing tariffs last month, institutional investors who bought trillions of dollars in US stocks and US Treasury bonds over the past ten years are still recalibrating and reducing their US asset portfolios, which is bound to further put huge selling pressure on the US dollar. Although it may take months for them to cut their positions or accumulate significant hedging positions to short the US dollar, Nordwig emphasized that the most painful period for the US dollar is coming soon.

Goldman Sachs reveals Trump's “ideal oil price”: the $40-50 range is most suitable. Goldman Sachs published a research report saying that through an internal analysis of US President Trump's social media tweets on petroleum topics, it was discovered that he seemed to prefer the price of oil between 40 US dollars and 50 US dollars per barrel. Analysts including Daan Struyven said in a report that Trump “has always been concerned about oil and America's energy dominance and has posted nearly 900 related tweets.” They also said, “Inferring from this, Trump's preferred price for WTI seems to be around $40 to $50 per barrel. In this price range, he is least likely to tweet about oil prices.” The analysis shows that when WTI breaks through the $50 mark, “Trump often calls for lower prices (or welcomes the fall). On the contrary, when oil prices are very low (WTI is below $30), in order to protect the US shale oil industry, he will instead support a recovery in oil prices.”

Individual stock news

Nvidia (NVDA.US) and AMD (AMD.US) won big orders in the Middle East! According to reports, Saudi artificial intelligence company Humain said it will build an artificial intelligence factory with Nvidia in Saudi Arabia. Meanwhile, Nvidia CEO Wong In-hoon announced that it will export 18,000 top artificial intelligence chips to Saudi Arabia. Also, according to people familiar with the matter, the Trump administration is considering an agreement to allow the UAE to import more than 1 million advanced Nvidia chips. This amount far exceeds the limit of artificial intelligence chip regulations in the Biden era. AMD (AMD.US), on the other hand, announced that it will cooperate with Humain for a $10 billion partnership to provide chips and software for “extending from Saudi Arabia to the US” data centers. Before the US stock market on Wednesday, as of press release, Nvidia and AMD were both up more than 3%.

It is rumored that Tesla (TSLA.US) will restart the import of Chinese parts for use in US Cybercab and Semi truck production. A source familiar with the matter revealed that after trade tension between China and the US has cooled down, Tesla (TSLA.US) plans to resume shipping parts made in China to the US from the end of this month for the production of Cybercab autonomous taxis and Semi electric trucks. This shows that after negotiations in Geneva last weekend, the easing of trade tension between the world's two largest economies has had an immediate impact on business activities. According to reports last month, after Trump raised tariffs on Chinese goods to 145%, Tesla suspended the parts transportation plan. This move may disrupt Tesla's plans to launch large-scale production of the two highly anticipated models. Previously, Tesla planned to begin trial production of these two models in October and will achieve large-scale production in 2026. As of press release, Tesla's US stocks rose nearly 3% before the market on Wednesday.

SONY.US (SONY.US) had mixed results in Q4, announcing a 250 billion yen share repurchase plan, warning that tariffs would cause 100 billion yen in profit losses. According to financial reports, Sony's Q4 sales were 2.6 trillion yen, down 24% year on year, falling short of market expectations of 3.03 trillion yen; operating profit was 203.6 billion yen, down 11% year on year, better than market expectations; net profit attributable to the company's shareholders was 1977 billion yen, up 5% year on year, better than market expectations of 145 billion yen. Looking ahead to fiscal year 2025, Sony expects annual operating profit of 1.28 trillion yen, and tariffs will have a negative impact of 100 billion yen on full-year operating profit. Even after excluding the impact of tariffs, Sony's operating profit expectations for fiscal year 2025 fell short of market expectations of 1.5 trillion yen. At the same time, Sony announced a stock repurchase plan of up to 250 billion yen and announced a schedule for a partial divestment of Sony's financial division. As of press release, Sony's US stock rose nearly 5% before the market on Wednesday.

A $20 billion cooperation agreement was reached with DataVolt, and ultra-micro computers (SMCI.US) surged ahead of the market. Ultramicrocomputer has reached a multi-year cooperation agreement with DataVolt, a data center company headquartered in Saudi Arabia. Ultramicrocomputer said in a statement issued on Tuesday that the $20 billion agreement is expected to “accelerate delivery of ultra-high density GPU platforms and rack systems for DataVolt's hyperscale artificial intelligence campuses in Saudi Arabia and the US.” As of press release, US stocks of ultra-microcomputers rose more than 14% before the market on Wednesday.

Most popular Chinese securities traded higher before the market. Before the US stock market on Wednesday, as of press release, Tencent Music (TME.US) rose more than 5%, Overlord Chaji (CHA.US), Ideal Auto (LI.US), and GDS.US (GDS.US) rose nearly 3%, Baidu (BIDU.US), Futu Holdings (FUTU.US), Pinduoduo (PDD.US), LEGN.US (LEGN.US), and Good Future (TAL.US) rose nearly 2%.

Key economic data and event forecasts

At 21:10 Beijing time, Federal Reserve Vice Chairman Jefferson delivered a speech on the economic outlook

Beijing time 23:00 US IPSOS main consumer sentiment index PCSI for May

The next day at 05:40 Beijing time, 2027 FOMC voting committee and San Francisco Federal Reserve Chairman Daly attended a fireside conversation

Performance Forecast

Thursday Morning: Cisco (CSCO.US)

Thursday pre-market: Walmart (WMT.US), Alibaba (BABA.US), NetEase (NTES.US), Youdao (DAO.US), Gaotu (GOTU.US), Artes Solar (CSIQ.US), Shell (BEKE.US)

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal