Beijing Tongyizhong New Material Technology And 2 Other Undiscovered Gems In Asia

Amid hopes for tariff de-escalation and the potential for broader negotiations between the U.S. and China, small- and mid-cap indexes have shown resilience, posting gains for the fifth consecutive week. In this environment of cautious optimism, investors are increasingly looking towards undiscovered gems in Asia that offer innovative solutions and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Otec | 8.17% | 3.43% | 1.06% | ★★★★★★ |

| Kanro | NA | 6.67% | 37.24% | ★★★★★★ |

| Korea Ratings | NA | 0.74% | 1.47% | ★★★★★★ |

| Konishi | 0.15% | 0.46% | 12.50% | ★★★★★★ |

| Thai Steel Cable | NA | 3.84% | 18.67% | ★★★★★★ |

| Dura Tek | 4.98% | 42.18% | 94.37% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 30.19% | 1.25% | 4.96% | ★★★★☆☆ |

| Yukiguni Factory | 134.59% | -3.29% | -32.04% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Beijing Tongyizhong New Material Technology (SHSE:688722)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Tongyizhong New Material Technology Corporation focuses on the research, development, production, and sale of ultra-high molecular weight polyethylene fibers and composite materials both in China and internationally, with a market cap of CN¥5.61 billion.

Operations: Tongyizhong generates revenue primarily from the sale of ultra-high molecular weight polyethylene fibers and composite materials. The company's financial performance includes tracking key metrics such as gross profit margin, which is a critical indicator of its profitability.

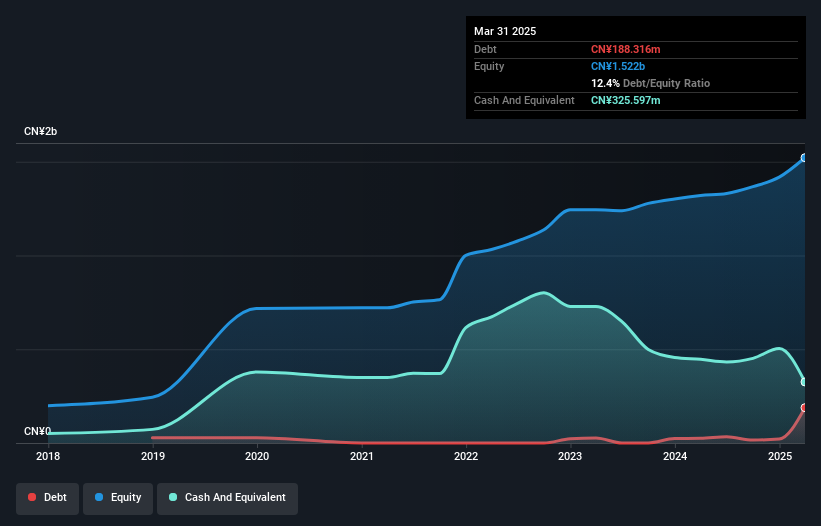

Beijing Tongyizhong New Material Technology, a smaller player in the industry, has shown impressive growth with earnings surging 33% last year, outpacing the broader Chemicals sector. The company reported first-quarter sales of CNY 252.99 million, more than doubling from CNY 111.5 million a year earlier, and net income reached CNY 43.4 million compared to CNY 17.55 million previously. Despite its debt-to-equity ratio increasing from 3% to 12.4% over five years, it holds more cash than total debt, suggesting financial flexibility and resilience amidst market volatility and competitive pressures in the materials sector.

Ongoal Technology (SZSE:301662)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ongoal Technology Co., Ltd. focuses on the research, design, production, and sale of material handling and automation equipment in China with a market capitalization of CN¥5.06 billion.

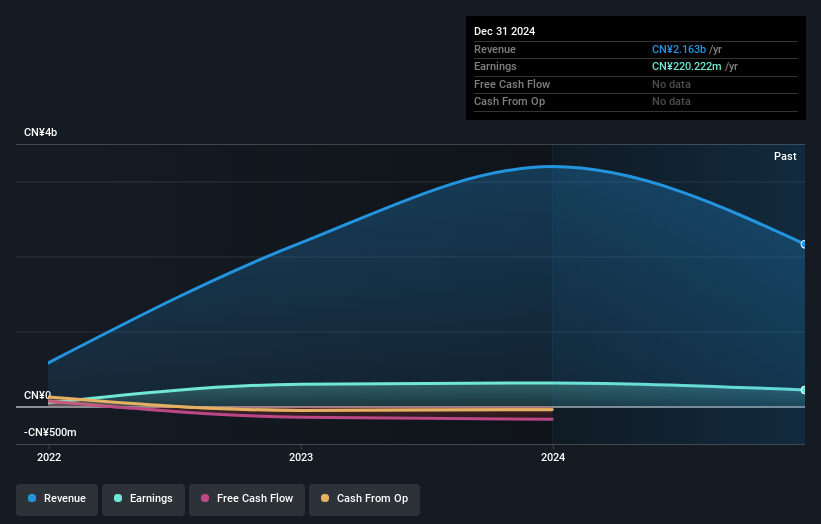

Operations: The primary revenue stream for Ongoal Technology comes from its Industrial Automation & Controls segment, generating CN¥2.16 billion.

Ongoal Technology, a notable player in the Asian market, recently completed an IPO raising CNY 532 million. Despite a dip in annual sales to CNY 2.16 billion from CNY 3.20 billion, net income stood at CNY 220 million for 2024. The company boasts high-quality earnings and has its interest payments well covered with EBIT at 19 times interest expenses. However, earnings growth faced challenges with a negative rate of -30% compared to the industry average of 1.6%. Ongoal's inclusion in major indices like the Shenzhen Composite Index highlights its growing recognition despite liquidity concerns.

- Click here and access our complete health analysis report to understand the dynamics of Ongoal Technology.

Evaluate Ongoal Technology's historical performance by accessing our past performance report.

WinWay Technology (TWSE:6515)

Simply Wall St Value Rating: ★★★★★★

Overview: WinWay Technology Co., Ltd. specializes in designing, processing, and selling optoelectronic product test fixtures and integrated circuit test interfaces globally, with a market cap of NT$34.53 billion.

Operations: WinWay Technology generates revenue primarily from the sale of optoelectronic product test fixtures and integrated circuit test interfaces across various regions including Taiwan, the Americas, China, Asia, Europe, and Canada. The company has a market capitalization of NT$34.53 billion.

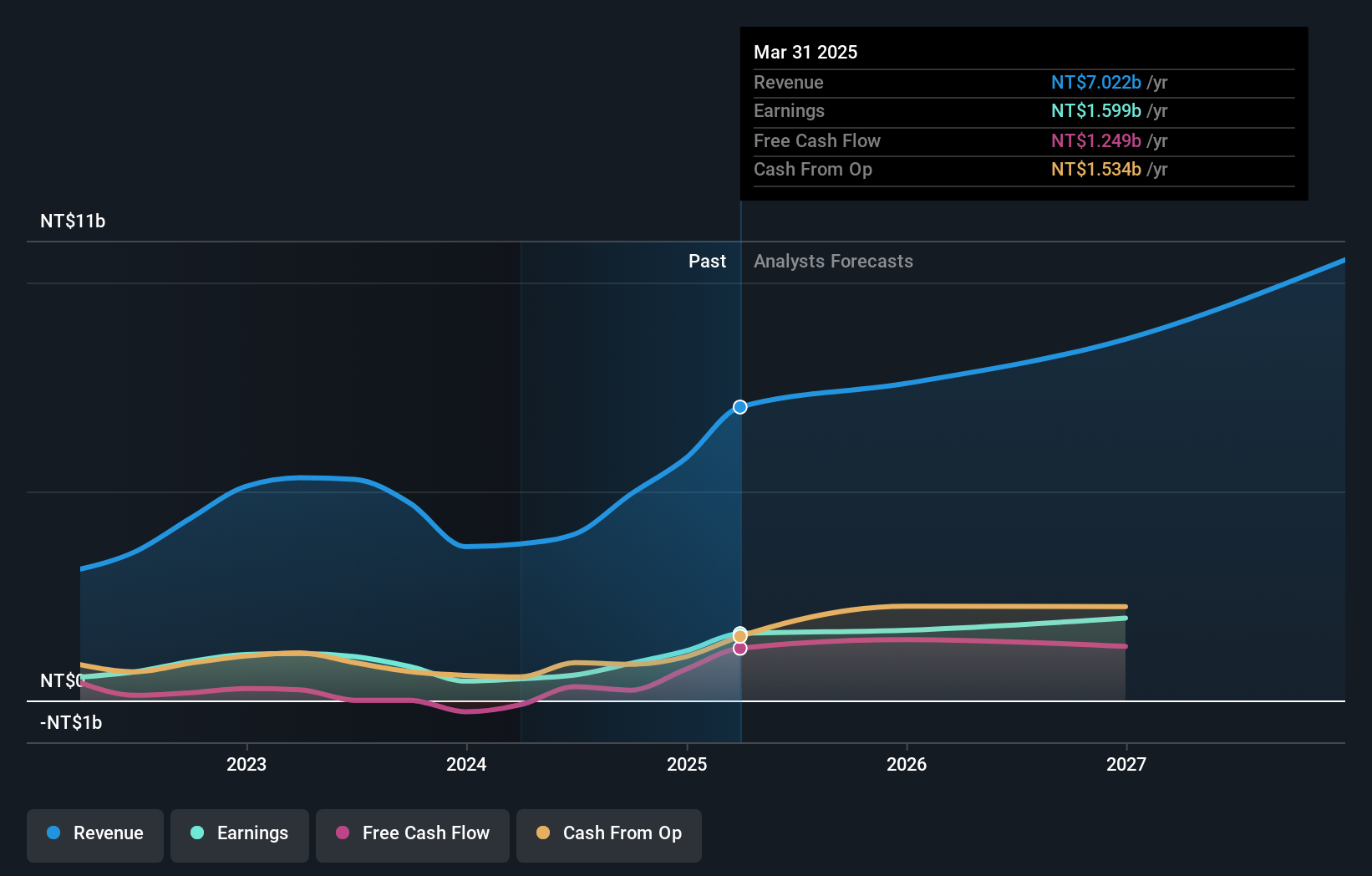

WinWay Technology, a nimble player in the semiconductor space, has seen its earnings skyrocket by 207% over the past year, outpacing the industry's 17% growth. The company's price-to-earnings ratio of 21.6x is attractive compared to the sector's average of 24x. Despite recent share price volatility, WinWay remains financially sound with more cash than total debt and a reduced debt-to-equity ratio from 3.9% to 2.8% over five years. Recent quarterly sales reached TWD 2.3 billion, nearly doubling from last year, while net income hit TWD 612 million up from TWD 200 million previously reported for Q1 last year.

- Click here to discover the nuances of WinWay Technology with our detailed analytical health report.

Gain insights into WinWay Technology's past trends and performance with our Past report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 2666 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal