Tariffs are shocking, and it's hard to shake the streaming hegemon! Netflix's (NFLX.US) growth engine continues to roar

The Zhitong Finance App learned that even in the face of the potential risk of high tariffs on imported films, the strong business performance of Netflix (NFLX.US) still gives investors full confidence in its prospects.

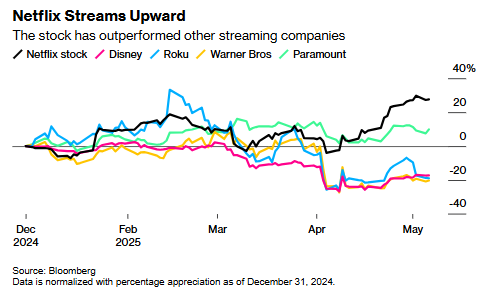

The streaming giant has performed well this year. The latest earnings report shows that it has set profit records and gave performance guidelines that exceeded expectations, further consolidating its leading position in the entertainment industry. Investors continue to look for its stock and are optimistic about its strong growth potential — users are unlikely to unsubscribe from the service even if the economy declines, and this anti-recession characteristic further enhances its appeal.

Although Trump recently announced that he will levy 100% tariffs on films produced overseas and sees this as a national security threat, the market generally believes that Netflix is limited by the tariff war. The policy did pose an immediate risk, but investors reacted lackluster. Its stock price fell only 1.6% this week, and it had just hit the best performance in history, with a cumulative increase of 20% over 11 consecutive trading days.

“This is not a major risk for Netflix,” said Brian Frank, president and portfolio manager of Frank Funds. “As an industry hegemon, it can absorb tariff pressure by pressuring suppliers or raising prices, which is difficult for small to medium competitors. More importantly, Netflix's excellent operating capabilities and return on content investment provide it with room for continued growth and stock price increases.”

In terms of industry comparison, Disney (DIS.US)'s latest earnings report exceeded expectations and raised its full-year guidance. The pre-market stock price rose sharply, but still fell 17% during the year; Roku (ROKU.US) had a cumulative decline of 19%, and the streaming video platform company also gave unoptimistic performance guidance last week; Warner Bros. Discovery Channel (WBD.US) fell 20%, while PARA.US (PARA.US) rose about 10%. The two companies' financial reports will be released later this week.

According to Bloomberg Intelligence quoting Ampere data, half of Netflix's $18 billion content budget this year will be used for original and licensed content outside of North America. In view of this, tariffs are a potential risk.

Citibank analyst Jason Bazinet warned that in the worst case scenario, tariffs could reduce Netflix's earnings per share by about 20%, and its “tariff haven” status is being challenged. But he also pointed out that the company has a variety of coping tools.

However, since the details of the policy are still unclear — including the scope of applicable films, whether TV dramas are included, how film tariffs are calculated, etc. — it is difficult to estimate the actual impact. California Governor Newsom has called for tax incentives to attract the return of film and television production.

According to compiled data, Netflix's profit forecast for 2025 has remained stable over the past week, which indicates that analysts have yet to take tariff risks into account.

Frank pointed out, “Wall Street began to see Trump as the boy who came from the wolf because the administration had already withdrawn many remarks and said some things that were later denied. News headlines may cause confusion, but we don't know what the White House will actually do; investors should wait to see if actual policies will be introduced.”

This view was widely shared by Wall Street.

Morgan Stanley analyst Benjamin Swinburne said, “It's almost impossible to measure the impact on an industry or a specific company with just one social media post.” Barclays Bank's Kannan Venkateshwar wrote, “There are currently no specific details other than a social media post from President Trump, so it's unclear how this will be implemented.”

If the tariff policy is implemented and affects Netflix's earnings, its stock valuation may make it vulnerable to stock price pullbacks. The price-earnings ratio of the company's shares is close to 42 times. Although this is far below the company's long-term average price-earnings ratio of nearly 70 times — which reflects the company's improvement in profitability and cash flow over time — it is already a significant jump from last month's price-earnings ratio as low as 32.5 times. Netflix's price-earnings ratio is also much higher than Disney's 16 times that of Disney.

Joe Saluzzi, co-head of stock trading at Themis Trading, said, “Taxing services is a different concept than taxing products, so I'm not too worried about movie tariffs right now. This seems like just a random idea.”

“However, some of the proposals we thought were outrageous at first, but eventually became policy. I think if this issue becomes a more specific priority, there will be more volatility as investors assess risk.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal