US stock outlook | Futures of the three major stock indexes fell sharply, Goldman Sachs: Technology stock pullback is a good opportunity to buy AI stocks

1. On May 6 (Tuesday), the futures of the three major US stock indexes fell sharply before the US stock market. As of press release, Dow futures were down 0.77%, S&P 500 futures were down 0.93%, and NASDAQ futures were down 1.21%.

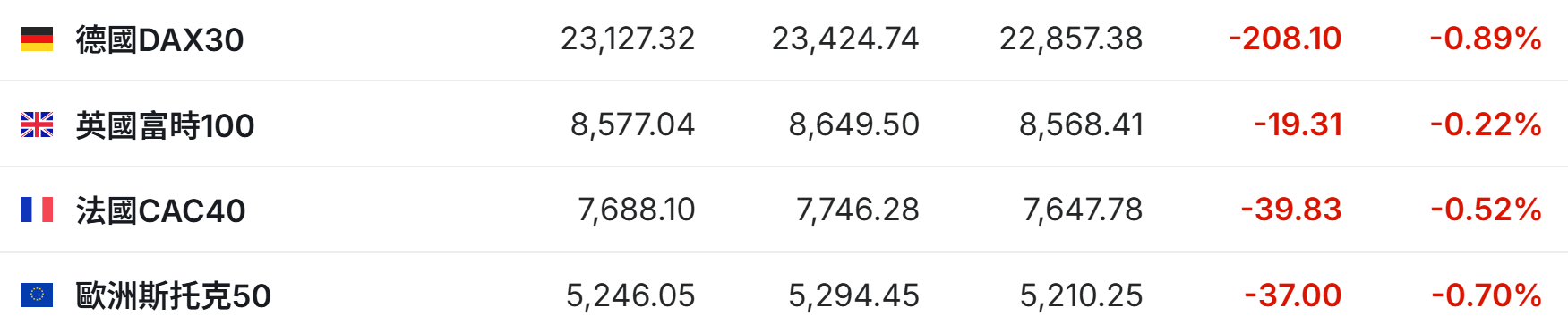

2. As of press release, the German DAX index fell 0.89%, the UK FTSE 100 index fell 0.22%, the French CAC40 index fell 0.52%, and the European Stoxx 50 index fell 0.70%.

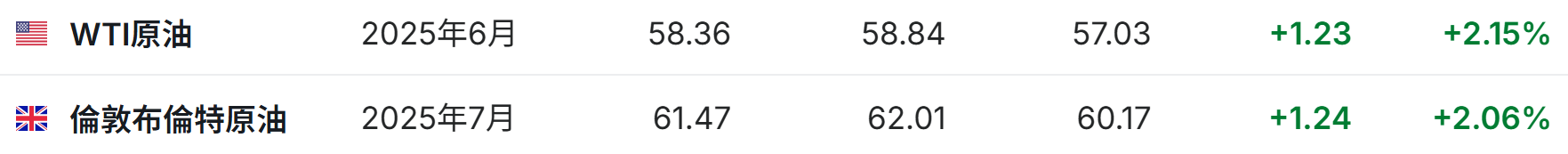

3. As of press release, WTI crude oil rose 2.15% to $58.36 per barrel. Brent crude rose 2.06% to $61.47 per barrel.

Market news

Goldman Sachs: Tech giants' performance boosted confidence, and the recent pullback provided a good opportunity to buy the AI sector of US stocks. Goldman Sachs analysts said that the performance reports issued by some large technology companies involved in the field of artificial intelligence (AI) at the end of last month were better than expected, indicating that investors have an opportunity to rearrange this sector after the recent pullback. The artificial intelligence sector, which has driven the market rise in the past two years, performed poorly after entering 2025. In January of this year, the advent of DeepSeek raised questions about the need for US companies to invest billions of dollars to build AI systems, and chipmakers and AI-related stocks plummeted as a result. Recently, the trade war initiated by US President Trump has raised concerns about America's economic growth slowing down or even falling into recession.

Goldman Sachs: Under multiple problems such as high inflation and tariff wars, the Fed's “patience” signal continues to strengthen. Goldman Sachs released a report saying that Federal Reserve officials have recently shown a high degree of caution about monetary policy adjustments, stressing the need to wait for more data to support them before taking action. Overall, high inflation, uncertainty about tariff policies, and potential risks such as the labor market are central considerations in current decisions. Goldman Sachs pointed out that since the March Federal Open Market Committee (FOMC) meeting, many officials have agreed with Chairman Powell and believe that the current policy is “in a good position” and that they will have to wait for more clear economic data before deciding whether to adjust interest rates. Cleveland Federal Reserve Chairman Hamak said, “I would rather move slowly but in the right direction than move quickly and make mistakes.”

Is the rebound in US stocks over? Cantor Fitzgerald sounded the alarm: Multiple gaps have accumulated. In a recent investor report, Cantor Fitzgerald maintained a bearish stance on the US stock market. The agency warned that the recent market rally, mostly driven by investor positions, may be over. The company anticipates severe economic and corporate challenges over the next three to nine months due to multiple adverse factors. Cantor Fitzgerald said in the report: “We are still bearish on the stock market and believe that we believe a possible rebound based on multiple factors is now over.”

External pressure paid off, and OpenAI promised “the right to take the helm” for non-profit organizations. Under pressure from community leaders and former employees, OpenAI announced in a blog post on Monday that even if the company is restructured as a public service enterprise, its non-profit organization will retain control of the company. The company, which is supported by Microsoft Investments, was valued at as high as 300 billion US dollars in a recent round of financing led by SoftBank. OpenAI said the decision was made after discussions with the attorneys general of California and Delaware. OpenAI Board Chairman Brett Taylor said in an interview: “According to the structure we envision, non-profit organizations will continue to control OpenAI. We will turn a limited liability company that is a subsidiary of a non-profit organization into a public benefit corporation (PBC).

Individual stock news

DoorDash (DASH.US)'s first-quarter revenue increased 20% year over year, and EBITDA exceeded expectations. DoorDash's revenue for the first quarter increased 20.7% year over year to US$3.03 billion (lower than market expectations of US$60 million), and the net profit margin remained flat at 13.1%, and the share of contributed profit fell slightly from 4.5% to 4.4%; adjusted EBITDA reached US$590 million (up 59% year over year, and surpassed market expectations of US$588.5 million). The company expects adjusted EBITDA of 600 million to 650 million US dollars for the second quarter (median value of 625 million, slightly lower than market expectations of 638 million), which indicates fluctuations in consumer demand and exchange rate risks. According to reports, the company's Marketplace GOV (total transaction volume) reached 23.1 billion US dollars (up 20% from the previous year; the supermarket expected 22.9 billion US dollars). Among them, the number of consumers in the grocery category and the customer unit price (especially perishable food expenses) all reached record highs.

The impact of tariffs peaked, and Philips (PHG.US) lowered its annual profit forecast. Dutch medical technology company Philips said that despite “extensive tariff mitigation measures”, US tariffs will still have a net impact of 250 million to 300 million euros (about 283 million to 340 million US dollars), and the company will lower profit margin expectations for 2025. According to the data, the company's sales for the first quarter were 4.1 billion euros, down 2% year on year in terms of comparable caliber, but higher than analysts' average expectations of 4.02 billion euros. The US is Philips' largest market and is expected to account for around 40% of sales and one-third of tax payments in 2024. The company imports various products from China, including equipment such as ventilator masks, electric shavers, toothbrushes, etc., and also purchases medical equipment from Europe. Despite slightly higher sales than expected in the first quarter, Philips lowered its full-year core profit forecast.

Palantir (PLTR.US) Q1 results were in line with expectations, raising revenue expectations for 2025 due to “surging demand” for AI. Palantir's first-quarter revenue surged 39% to $884 million, higher than analysts' average estimate of $863 million; adjusted earnings per share were 13 cents, in line with market expectations. Palantir described the surge in demand for artificial intelligence software as a “steep wave,” and raised its revenue forecast for 2025 from about $3.75 billion to about $3.9 billion, an increase of 36% over the previous year. In the mainland of the US, sales of its commercial customers increased 71% this quarter to reach US$255 million; as of March 31, sales to the US government increased 45% to US$373 million. This was due to new orders brought about by the restructuring of government spending. Analysts previously estimated an average of US$358 million.

Ford Motor Company (F.US) Q1 performance exceeded expectations, but withdrew its full-year profit guidance. Ford's Q1 revenue fell 5% year over year to $40.7 billion, but far exceeded analysts' average expectations of 36 billion US dollars because consumers are worried that tariffs will cause car prices to rise and are snapping up. The company is also one of the few car manufacturers that use incentives to seize market share in the car buying frenzy. Adjusted earnings per share were 14 cents, lower than 49 cents in the same period last year, but better than analysts' average expectations of 2 cents. Ford's Pro division (commercial vehicle division) revenue fell 16% year over year to US$15.2 billion, and profit before interest and tax fell from US$3.06 billion in the same period last year to US$1,309 billion, which is basically in line with expectations. The Model e division, which includes software and electric vehicles, had revenue of $1.2 billion.

A well-known reporter broke the news: Apple (AAPL.US) AI may be launched in the Chinese market with iOS 18.6, and Alibaba and Baidu provide technical support. Apple Apple Intelligence was officially launched in some overseas markets as early as last year, but it has been slow to launch in the Chinese market. However, well-known Apple whistleblower Mark Gurman revealed that Apple AI is expected to enable some features for the first time in the iOS 18.6 system in mainland China, with technical support from Alibaba (BABA.US) and Baidu (BIDU.US). According to reports, Baidu's Wenxin Big Model will be the core cloud intelligence engine for Apple's AI in the Chinese market. At the same time, in order to ensure that AI content complies with domestic regulations, Apple will also introduce a review mechanism provided by Alibaba to conduct local compliance reviews for AI-generated content.

Wenyuan Zhixing (WRD.US) expands strategic cooperation with Uber (UBER.US). Wenyuan Zhixing and Uber jointly announced on Monday that they will expand their strategic cooperation and plan to deploy additional autonomous robotaxi services in 15 cities in Europe and the Middle East over the next 5 years. According to reports, in this expanded strategic cooperation, the two sides promised to add a number of partner cities every year in markets other than China and the US, and deploy autonomous Robotaxi fleets on a large scale. At that time, users can call Wenyuan Zhixing's Robotaxi service through the Uber app, and Uber will be responsible for fleet operation and management. The partnership between the two parties dates back to last year. In September 2024, Wenyuan Zhixing signed a strategic cooperation with Uber, and in December 2024, the Robotaxi service was publicly launched in Abu Dhabi. In April of this year, the two sides extended their cooperation to Dubai.

The US Department of Justice wielded a monopoly: the Google (GOOGL.US) advertising business may be forcibly split. The US Department of Justice submitted documents to the federal court requiring Google to divest two core assets in its online advertising business—ad trading platform ADx and publisher ad servers. This mandatory split requirement stems from an anti-monopoly ruling handed down by Federal District Court Judge Leonie Brink in Alexandria, Virginia this month, which found that Google had an illegal monopoly in the digital advertising exchange market and ad server sector. The Ministry of Justice emphasized in court documents that Google has formed a closed loop ecosystem of “self-preferential treatment” through long-term abuse of its dominant position in the market. Specifically, Google is accused of providing special rights for its own advertising products, including prioritizing access to ad trading platform data and artificially restricting competitors' technology access, forcing advertisers and website publishers to rely heavily on its service system.

Key economic data and event forecasts

20:30 Beijing time: US trade balance for March (100 million US dollars).

The next day at 01:00 a.m. Beijing time: US 10-year treasury bond auction on May 6 - total amount (100 million US dollars).

The next day at 04:30 a.m. Beijing time: US API crude oil inventory changes for the week ending May 2 (10,000 barrels).

The next day at 00:00 a.m. Beijing time: The EIA releases the monthly short-term energy outlook report.

Performance Forecast

Wednesday morning: AMD (AMD.US), ultra-microcomputer (SMCI.US)

Wednesday pre-market: Novo Nordisk (NVO.US), Uber (UBER.US), Disney (DIS.US), Barrick Gold (GOLD.US)

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal