The performance resilience of leading companies is prominent. When will the restaurant sector wait to evaluate the inflection point?

Recently, as export-related sectors are under pressure and the focus of policy shifts to expanding domestic demand, the consumer sector has shown a clear recovery trend. Since April 22, the Hong Kong Stock Food and Beverage Index (LIST1083) has rebounded more than 20% to around 787 points, and many catering companies such as Xiabuxiabu (00520), Jiumaojiu (09922), and Tehai International (09658) have flourished.

Thanks to a combination of positive factors, market confidence gradually recovered, and the Chinese consumer market continued to heat up in the first quarter. According to the data, the offline consumption popularity index increased 14.2% year on year in the first quarter, up 9.1 percentage points from the previous quarter. Among them, the lifestyle service consumption popularity index increased 18.3% year on year, and the restaurant industry increased 14.5% year on year.

Under the general trend of stabilizing consumption and expanding domestic demand, the valuation appeal of the restaurant sector is increasing after a correction over the past few years, and the annual returns of many listed catering companies have also shown strong performance resilience.

Both revenue and profit achieved double-digit growth, and performance resilience was highlighted

Driven by a package of consumer promotion policies, the domestic catering industry has shown a relatively rapid recovery trend in the past year. According to data from the National Bureau of Statistics, the gross domestic product for the full year of 2024 was 134.9 trillion yuan, an increase of 5% over 2023; the total retail sales of social consumer goods was 48.78 trillion yuan, an increase of 3.5%. Among them, the country's food and beverage revenue was 5571.8 billion yuan, an increase of 5.3%; the food and beverage revenue of units above the limit was 1529.8 billion yuan, an increase of 3%.

Looking at the growth rate, the country's total food and beverage revenue increased by 5.3% in 2024, up 2.1 percentage points from the previous year, and significantly higher than the GDP growth rate during the same period, and the growth rate of total retail sales of social consumer goods during the same period. However, at the same time, the year-on-year growth rate of food and beverage revenue above the limit was only 3.0%, indicating that the growth rate of small and medium-sized catering enterprises and individual households is more active, while the growth rate of leading companies is slowing down due to external pressure.

According to the Zhitong Finance App, Jiuqian Zhongtai data shows that compared with the same period in 2023, most food and beverage stores generally experienced a single-digit decline in efficiency. There was only a slight increase in Western food (+6%), bread and dessert (+5%), and North Korean cuisine (+1%); at the same time, the number of restaurant market closures climbed to 4.09 million in 2024, with a closing rate of 61.2%, all exceeding the same period in 2023. The industry is clearly experiencing an accelerated reshuffle trend.

According to statistics from Guoxin Securities, the overall revenue of 17 listed catering companies increased 11% year on year in 2024, better than the average performance of catering companies above the national limit in 2024; overall profit increased 10% year on year, close to revenue growth. The adjusted net interest rate was 10.2%, a decrease of 0.3 percentage points.

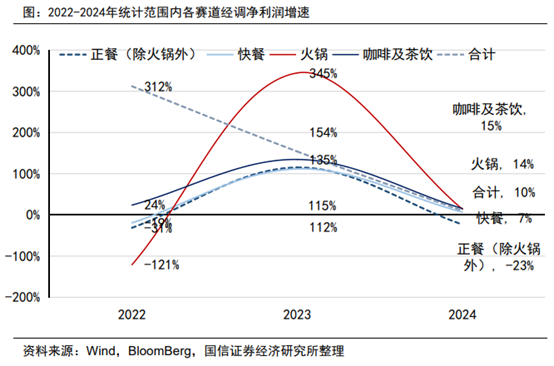

While both revenue and profit achieved double-digit growth, the performance of various food and beverage segments was divided.

According to the restaurant chain operated by the company, it is divided into the four major categories of coffee and tea, fast food, hot pot, and Chinese meal (other than hot pot) (Jiumaojiu's dining brand Taier accounts for the highest revenue share, divided into the meal category. The pot circle is a hot pot supermarket, which is divided into the hot pot category for convenience). In terms of revenue, the revenue growth rate of the coffee and tea circuit reached the highest, 22.5%; the growth rates were 6.3% and 5.6%, respectively. Dao, on the other hand, is at the bottom of growth.

In terms of adjusted net profit, coffee and tea, hot pot, fast food, and Chinese meal (excluding hot pot) increased 15%, 14%, 7% year over year, and decreased by 23% year over year, respectively. Thanks to a marked increase in store operating efficiency, adjusted net profit for hot pot and fast food grew rapidly; only Chinese meal (other than hot pot) experienced a decline in profit.

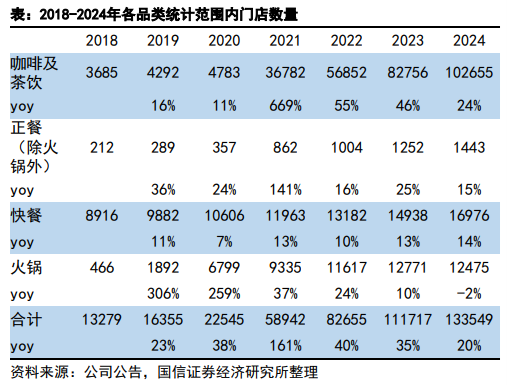

Thanks to the franchise model with low single-store investment and high standardization, coffee and tea drinks also topped the list in store expansion. According to the data, in 2024, the total number of listed catering companies increased 20% year on year to 133,500. Among them, the number of coffee and tea stores increased by 24% to 102,700, regular food (other than hot pot) and fast food increased 15% and 14% respectively, while hot pot decreased by 2% year on year.

Over the past year, speeding up store expansion has become the key word of the year for many coffee and tea brands. According to data from a narrow door restaurant, the number of Cudi Coffee stores opened in 2024 reached 4,153, and recently announced a strategic target of 20,000 global stores in 2025, which is double the target of 10,000 stores in three years proposed at the beginning of the company's establishment; Starbucks China added a net of 790 stores in fiscal year 2024, an increase of 12% over the previous year, a record high.

The fast food and Chinese meal (except hot pot) track also performed very well. Among listed fast food companies, Dashi Co., Ltd. (01405) has achieved 31 consecutive quarters of sales growth as of 2025Q1, with a net opening of 240 stores throughout the year; Laoxiang Chicken's turnover rate increased in the first three quarters of 2024, but there was a slight decline in corresponding customer unit prices (customer unit prices for direct-run stores and franchisees fell 2.1% and 2.7%, respectively).

Among Chinese restaurant companies, the share of takeout business of many enterprises has generally increased. For example, Jiumaojiu and Little Vegetable Garden (00999)'s share of takeout business in 2024 increased by 3 percentage points to 17.2% and 6 percentage points to 38.5%, respectively. Green Tea Group's share of takeout business also increased by 3 percentage points to 17.8% in the first three quarters of 2024.

However, at the hot pot circuit, even the “first stock in the hot pot chain”, which has been in business for more than 20 years and has been on the market for more than 10 years, has not been spared from the cold winter of the industry. In 2024, Xiabuxiabu's annual net loss was 401 million yuan, of which 138 Xiabu Xiabu brand restaurants were closed and 65 new ones were opened throughout the year. At the end of the year, the number of restaurants dropped from 833 the previous year to 760, a net decrease of 73; in the first 5 months of 2024, the number of Nan Hot Pot stores closed to 57, over the whole of 2023. Recently, media also revealed that the main branch of Nan Hot Pot Chongqing has closed.

Sinking markets, internationalization, and new business formats have become key words in the industry

Entering 2025, the food and beverage sector, which is already in the undervalued range, is expected to receive another positive boost. Since April, Guangdong, Shanghai, Heilongjiang and other provinces and cities have introduced special action plans to boost consumption and promote consumption of food and other lifestyle services.

According to the Zhitong Finance App, the latest data from the National Bureau of Statistics shows that food and beverage revenue in March was 423.5 billion yuan, an increase of 5.6%. Of these, food and beverage revenue above the limit was 134 billion yuan, up 6.8% year on year, and continued to accelerate month-on-month after January-February. Among them, the growth rate above the limit exceeded the overall growth rate for the first time in nearly 12 months. As the effects of policies to promote domestic demand gradually become apparent, the prosperity of the catering industry is expected to improve marginally.

At the same time, in the face of increasingly fierce competition in the industry, various catering companies have made surprising moves, and market sinking, internationalization, and price for volume have become popular keywords in the industry.

According to data from the white paper, in June 2024, the share of restaurants in third-tier cities and below in the country increased to 52.0%, an increase of 1.1 percentage points over the previous year, and catering companies are penetrating the sinking market at an accelerated pace.

Since March '24, Haidilao (06862) has made major adjustments to its business model, introduced a franchise model, and controlled the quality of franchisees with a higher franchise threshold and strong management model. This is seen as another step for the company to expand into a declining market. In the 2024 annual performance report, Haidilao revealed that since the launch of the franchise model, the sinking market has shown stronger demand. More than 70% of franchise applications have come from third-tier cities and below, and many of them are from counties.

In terms of global expansion, Xiao Caiyuan proposed an overseas market expansion strategy for the next three years, focusing on Southeast Asia in the first phase and planning to open 1-2 overseas stores within 2025; the tea chain brand Jasmine Milk White chose a different approach. As of February 2025, it has successfully entered the five countries of the United States, Canada, Australia, Thailand, and the United Kingdom. The company said that overseas stores will double in 2025.

In addition to speeding up horse racing, some food and beverage brands have chosen to continue refining their business and “write articles” in existing stores. For example, Domino's Pizza's exclusive general franchisee in China, in 2024, store operating profit increased 48.7% year-on-year to 624 million yuan, and store EBITDA increased 44.2% to 831 million yuan. By improving store-level operating efficiency, profit performance improved significantly.

Catering brands such as Cudi Coffee and Pot Circle (02517) choose to explore new business formats frequently to find more opportunities for growth. In February of this year, Cudi Coffee announced the launch of an upgraded store format, convenience stores, with coffee as the theme, and selected some product categories from regular convenience stores, such as popular drainage categories such as ice cream, Western-style freshly made egg tarts, and Western-style sausage, as well as regular convenience store hot food products including Chinese noodles and bento boxes.

According to the company's expectations, Cudi's store model will be flexibly transformed according to different city levels. For example, in high-tier cities with greater potential for convenience stores, Cudi will mainly be coffee convenience stores; while in low-tier cities, it will appear as coffee snack shops.

The former hot pot grill brand Guan is transforming into a new strategic position of “community central chef” and has launched a new “24-hour self-service” store type. The store model uses an unmanned self-service shopping model from 21:00 to 8:00 the next day. After scanning the code, consumers can self-purchase the products they need, and scan the code for self-service payment. By extending business hours, this store type is expected to cover more family dining scenarios and drive average daily sales growth.

The CITIC Securities research team pointed out that the consumer sector is currently showing the characteristics of undervaluation and high returns. Sectors such as popular restaurants are expected to take the lead in stabilizing operations, and the second quarter of 2025 is expected to bottom out pressure for most consumer industries. Furthermore, as the temperature rises and the peak season approaches, the restaurant sector is also likely to undergo valuation and fundamental restoration. Looking ahead to the future market, restaurant companies with strong supply chains and member operating capabilities, such as Michelle Ice City (02097) and Dashi Co., Ltd., established restaurant leaders with proven long-term value, such as Haidilao, Yum China (09987), and the cooking industry, which is undergoing active transformation, deserve close attention.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal