Potential Upside For BlueScope Steel Limited (ASX:BSL) Not Without Risk

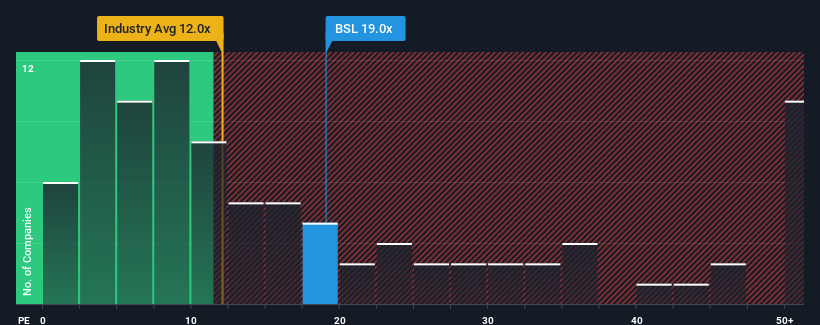

There wouldn't be many who think BlueScope Steel Limited's (ASX:BSL) price-to-earnings (or "P/E") ratio of 19x is worth a mention when the median P/E in Australia is similar at about 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We've discovered 1 warning sign about BlueScope Steel. View them for free.While the market has experienced earnings growth lately, BlueScope Steel's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for BlueScope Steel

How Is BlueScope Steel's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like BlueScope Steel's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 75% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 24% per year over the next three years. That's shaping up to be materially higher than the 15% per annum growth forecast for the broader market.

In light of this, it's curious that BlueScope Steel's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From BlueScope Steel's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of BlueScope Steel's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for BlueScope Steel that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal