Can Palantir (PLTR.US) earnings report “walking a tightrope at high altitude” AI military and government ambition support 70 times the market sales rate?

The Zhitong Finance App notes that investors in Palantir (PLTR.US) are betting that the results announced after Monday's market will once again surprise the market, but the recent sharp rise in stock prices has set a very high threshold for meeting the standards for this financial report.

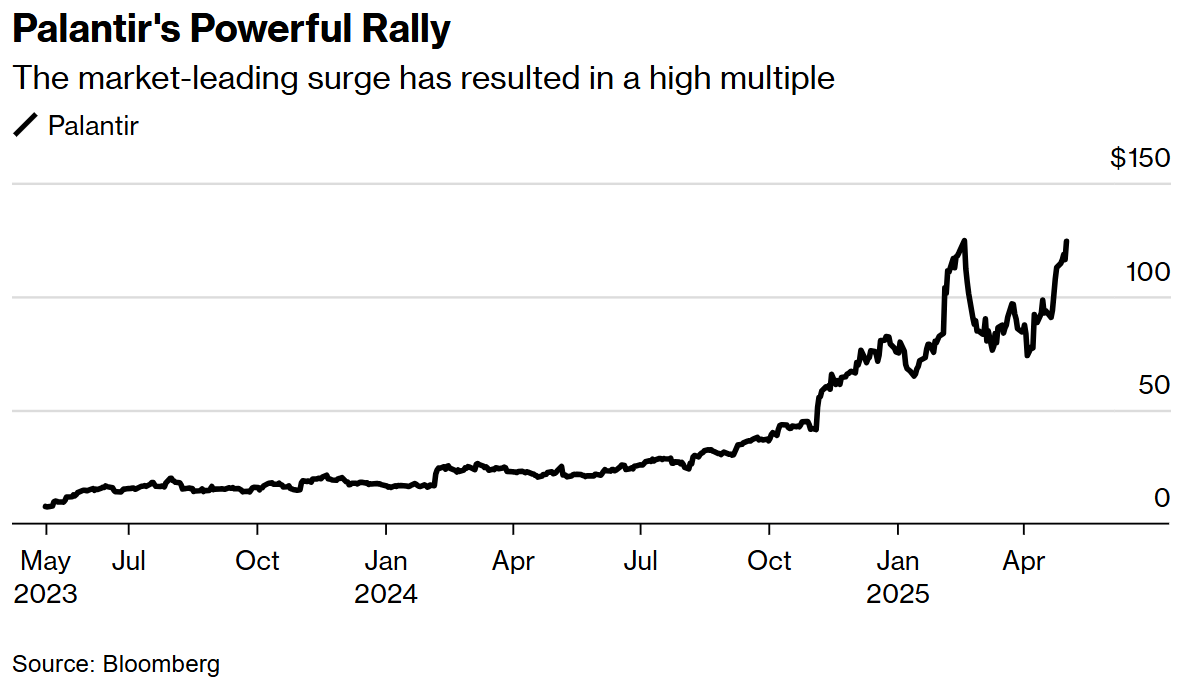

While other AI companies and momentum stock darlings stalled due to tariff-related uncertainty, Palantir continued its 340% surge last year. This stock is not only the best-performing stock since President Trump announced tariffs about a month ago, but also the component stock with the biggest increase in the S&P 500 index this year (up 64%). Currently, it is only slightly below the historical high set in February.

The data shows that the company's software is widely used in the military and government fields, and analysts are increasingly optimistic about its prospects. In the past quarter, the market raised its 2025 adjusted profit expectations by nearly 15%, and revenue expectations increased by more than 6% over the same period.

However, these expected increases failed to keep up with the rise in stock prices, leading to an overall expansion in valuations. The stock has a price-earnings ratio of more than 200 times the expected profit, making it the most expensive constituent stock in the Nasdaq 100 Index; the price-sales ratio based on expected sales is over 70 times, second only to Bitcoin agency Strategy Inc.

“Valuation has always been a difficult part to explain. When fundamentals start to slow down, it's very risky to hold high-priced stocks because the influx of hot money may be withdrawn at the same speed,” said Kevin Landis, chief investment officer at Firsthand Capital Management. “I've been reducing my positions, but I'm hesitant because I always regret it in the end. If the only negative evaluation of a stock is the valuation, that in itself explains the problem — it's like the opposite of a value trap.”

A burgeoning tradition

The company has a tradition of far exceeding expectations, often triggering sharp increases in stock prices. The stock price increased by more than 20% after the release of the past two financial reports, and achieved double-digit increases in seven of the past nine financial reports. The options market is expected to fluctuate sharply again this quarter, implying a single-day fluctuation of nearly 13%. But now, if the gains are to continue, another spectacular performance may be needed.

“Palantir must completely crush revenue expectations,” said Ted Mortonson, managing director of Robert W Baird & Co., “The results of the next three years must now be used to justify the valuation. They have no choice but to hand over explosive revenue figures.”

There is reason to believe that the company will continue to excel. Despite widespread uncertainty about the future of military and government spending under the Trump administration, Palantir is expected to benefit from budget reallocation. NATO purchased the company's AI military system last month, and its intelligence gathering vehicle just received high praise from the US military. The upcoming earnings report is expected to show revenue growth of 36% and adjusted earnings growth of more than 60%.

“The growth story is not only intact, but it is also growing at an accelerated pace. The strong background of fundamental demand overshadowed all other factors, such as tariffs,” Landis said.

But valuations are still the focus of controversy among analysts, even those who are optimistic about its fundamentals. Nearly 60% of analysts tracked by Bloomberg gave a “hold” rating, which is an unusually high percentage. Five agencies gave a “sell” rating, and six suggested “buy”. The stock currently has a premium of more than 25% over the average target price, which has the worst implied return among NASDAQ 100 constituent stocks.

Peer differentiation

Palantir's software industry peers have had mixed results so far this earnings season. According to Bloomberg data, 78% of software companies' profits have exceeded expectations so far this quarter, but only 44% have exceeded expectations. The overall technology sector exceeded expectations by 91% and 75%, respectively.

However, there is no shortage of outstanding performances in the software industry, including well-known companies with AI concepts such as Microsoft and ServiceNow.

“We are seeing AI dividends shifting from chips to on-chip applications, and Palantir is becoming a global standard with its AI platform,” said Tim Pagliara, chief investment officer at Capwealth Advisors.

Like Landis, Pagliara recently reduced its position and said that the strength of the stock makes it a natural choice for investors to profit from market fluctuations. He added that he would not buy the stock above $75, which closed at $124.28 last Friday.

“If any company can justify sustainable growth, it's Palantir, because its long-term demand ceiling is difficult to predict,” he said. “But the market may push stock prices to unsustainable levels, and I'm worried this will happen this quarter.”

Positive technical signals suggest that the S&P 500 IT Index may continue to lead its small-cap peers: compared to the Russell 2000 Tech Index, a breakthrough is being made, and its gains may accelerate, BI strategists Gina Martin Adams and Anthony Feld wrote in the report.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal