3 Promising European Penny Stocks With Market Caps Below €70M

European markets have shown resilience, with the pan-European STOXX Europe 600 Index rising by 2.77%, buoyed by easing trade tensions between the U.S. and China. In this context, penny stocks—typically smaller or newer companies—remain a niche but intriguing investment area for those seeking growth opportunities at lower price points. These stocks can offer potential upside when they are backed by strong financial health and solid fundamentals, making them worth exploring even in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.17 | SEK2.08B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.70 | SEK248.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.76 | SEK281.94M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.63 | PLN123.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.59 | €54.63M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.9746 | €32.64M | ✅ 3 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.12 | €61.49M | ✅ 1 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.07 | €23.56M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €294.77M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 434 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Transferator (NGM:TRAN A)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Transferator AB (publ) is a public private equity and venture capital firm with a market cap of SEK248.31 million.

Operations: The firm's revenue segment is entirely derived from Sweden, amounting to SEK55.17 million.

Market Cap: SEK248.31M

Transferator AB (publ) presents a mixed investment case within the European penny stock landscape. The company boasts high-quality earnings and an impressive Return on Equity of 74.6%, alongside a reduction in its debt-to-equity ratio over five years. Its financial health is supported by short-term assets exceeding liabilities, and operating cash flow covering debt effectively. However, despite trading significantly below estimated fair value, the firm faces challenges with highly volatile share prices and unsustainable dividend coverage by earnings. Recent results indicate declining sales but improved net income year-over-year, reflecting potential for profitability momentum amidst volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Transferator.

- Gain insights into Transferator's past trends and performance with our report on the company's historical track record.

Airthings (OB:AIRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Airthings ASA is a hardware-enabled software company that develops products and systems for monitoring indoor air quality, radon, and energy efficiency internationally, with a market cap of NOK273.04 million.

Operations: The company's revenue is primarily driven by its Consumer segment, generating $30.19 million, followed by the Business segment at $6.31 million and the Professional segment contributing $2 million.

Market Cap: NOK273.04M

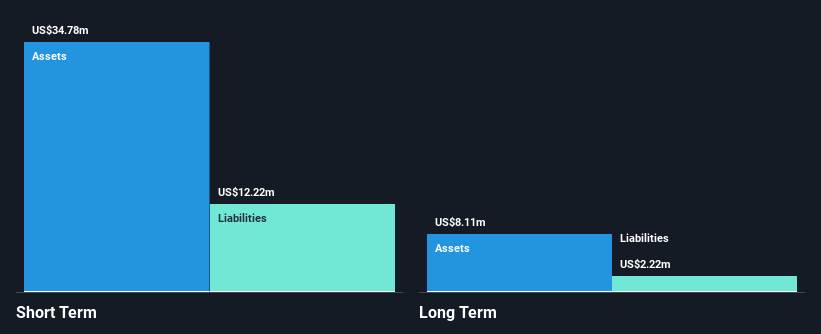

Airthings ASA presents a challenging yet intriguing investment case in the European penny stock realm. The company, with a market cap of NOK273.04 million, is unprofitable and has seen its net loss widen to US$17.69 million for 2024 despite revenue growth to US$38.5 million. Its short-term assets comfortably cover both short- and long-term liabilities, suggesting financial stability amidst operational challenges. While trading at an attractive valuation compared to peers, the firm faces high share price volatility and lacks experienced management and board members. Revenue guidance for Q1 2025 indicates potential growth between $9 million and $11 million.

- Dive into the specifics of Airthings here with our thorough balance sheet health report.

- Assess Airthings' future earnings estimates with our detailed growth reports.

Nykode Therapeutics (OB:NYKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nykode Therapeutics AS is a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies, with a market cap of NOK806.57 million.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, totaling $9.16 million.

Market Cap: NOK806.57M

Nykode Therapeutics AS, with a market cap of NOK806.57 million, operates in the biopharmaceutical sector focusing on novel immunotherapies. Despite generating US$9.16 million in revenue primarily from its Pharmaceuticals segment, the company remains unprofitable with a net loss of US$38.82 million for 2024. The firm boasts strong financial positioning as short-term assets exceed both short- and long-term liabilities significantly, and it carries no debt burden. Recent executive stability following withdrawn resignations may support strategic continuity, while ongoing developments in immune therapy platforms highlight potential future growth avenues amidst high share price volatility.

- Navigate through the intricacies of Nykode Therapeutics with our comprehensive balance sheet health report here.

- Gain insights into Nykode Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Get an in-depth perspective on all 434 European Penny Stocks by using our screener here.

- Interested In Other Possibilities? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal