Fonix Plc's (LON:FNX) Shares Climb 26% But Its Business Is Yet to Catch Up

Fonix Plc (LON:FNX) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.2% isn't as impressive.

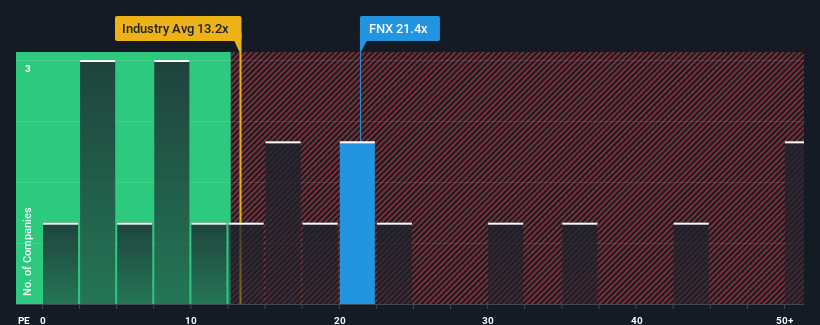

After such a large jump in price, Fonix may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 21.4x, since almost half of all companies in the United Kingdom have P/E ratios under 15x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's superior to most other companies of late, Fonix has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Fonix

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Fonix's to be considered reasonable.

Retrospectively, the last year delivered a decent 15% gain to the company's bottom line. The latest three year period has also seen an excellent 45% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 1.6% as estimated by the two analysts watching the company. Meanwhile, the broader market is forecast to expand by 19%, which paints a poor picture.

In light of this, it's alarming that Fonix's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Fonix's P/E

Fonix's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Fonix's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 2 warning signs for Fonix (1 shouldn't be ignored!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal