Is the options market warning a long and short reversal, and the myth of a sharp rise in gold is now torn?

The Zhitong Finance App learned that gold's rise this month dominated all major asset classes — even compared to Bitcoin by some investors — as Trump's tariff war reshaped the global economic order, and safe-haven funds continued to pour into the gold market. However, changes in options positions are causing some market observers to be wary.

As spot gold prices hit a record high last week, the trading volume of gold ETF-SPDR (GLD.US) options contracts surpassed 1.3 million, setting a new historical record. Meanwhile, the ETF's bearish hedging costs remained at their lowest level since August last year, while implied volatility soared sharply, creating an abnormal market pattern.

Tanvir Sandhu, chief global derivatives strategist at Bloomberg Intelligence, said, “Gold and Bitcoin have recently shown the characteristics of simultaneous rise in spot and volatility, similar to the performance of the 'Big 7” in US stocks in recent years. ' He added that demand for bullish gold options has surged, and the recent pullback in gold prices has made the distribution of implied volatility of each execution price more balanced.

According to the latest data, as some trade tensions showed signs of easing, the price of gold has fallen by more than 5% from last week's intraday high. According to data from the US Commodity Futures Trading Commission, hedge fund managers have cut net long positions in gold futures and options to their lowest level in more than a year.

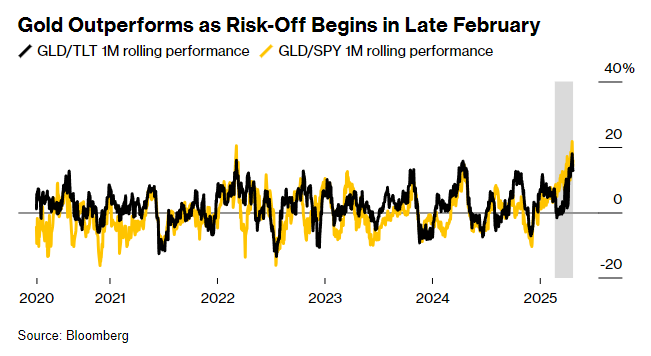

This month's safe-haven trend triggered by tariff policies and with the theme of “the end of American exceptionalism” drove gold's performance far surpassing other asset classes such as treasury bonds and US stocks.

However, Barclays strategists believe that the current price of gold is no longer supported by fundamentals. They pointed out in last week's report that the recent monthly data on the central bank's continuous gold purchases is not abnormal compared to the long-term trend.

Barclays Bank's Stefano Pascale pointed out that the sharp rise in gold prices triggered a large amount of speculation. Gold ETF bullish options trading surged after Trump's “Liberation Day” remarks, causing the skewed index to be inverted. Combined with the reduction in hedge fund positions and the recent correction in gold prices, strategists believe that caution is needed at least in the short term.

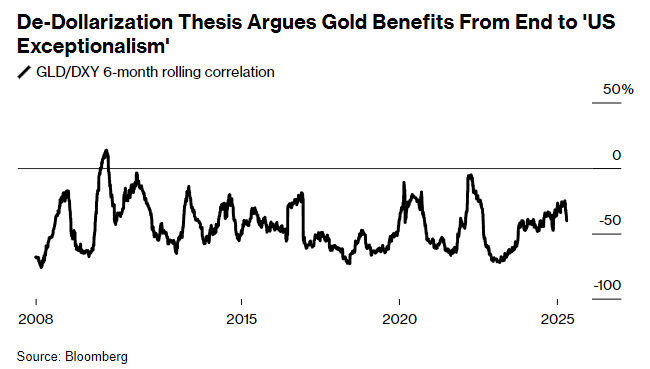

In an interview, Pascale said, “We think the price of gold will fall.” He added that the current price of gold is out of touch with “fundamental drivers” such as the US dollar exchange rate and real interest rates, and “the technical side has begun to show signs of being overbought.”

Garrett DeSimone, head of quantitative analysis at OptionMetrics, believes that gold is similar to Bitcoin. In his view, as long as implied volatility and bias indices remain within a long-term historical range, both types of assets are likely to continue to rise.

“From the perspective of the options market, the possibility of a rise and fall is roughly equal,” he said.

Although Barclays proprietary indicators show that the market is still bullish on gold, its strategists suggest constructing a zero-cost risk reversal combination by selling June call options and buying bearish options.

Pascale said, “Obviously, this trading strategy is mainly based on directional judgments, so for this strategy to really work, the price of gold must fall.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal