High Growth Tech Stocks In Europe For April 2025

In April 2025, European markets have shown resilience with the pan-European STOXX Europe 600 Index rebounding by 3.93%, buoyed by the European Central Bank's rate cuts and a temporary reprieve from higher tariffs. In this environment of cautious optimism, identifying high-growth tech stocks involves looking for companies that can leverage favorable monetary policies and adapt to trade uncertainties while maintaining robust innovation and market adaptability.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 23.66% | 40.07% | ★★★★★★ |

| Bonesupport Holding | 29.47% | 48.13% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.54% | ★★★★★★ |

| Ascelia Pharma | 46.06% | 66.78% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Skolon | 29.76% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Xbrane Biopharma | 33.71% | 82.67% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

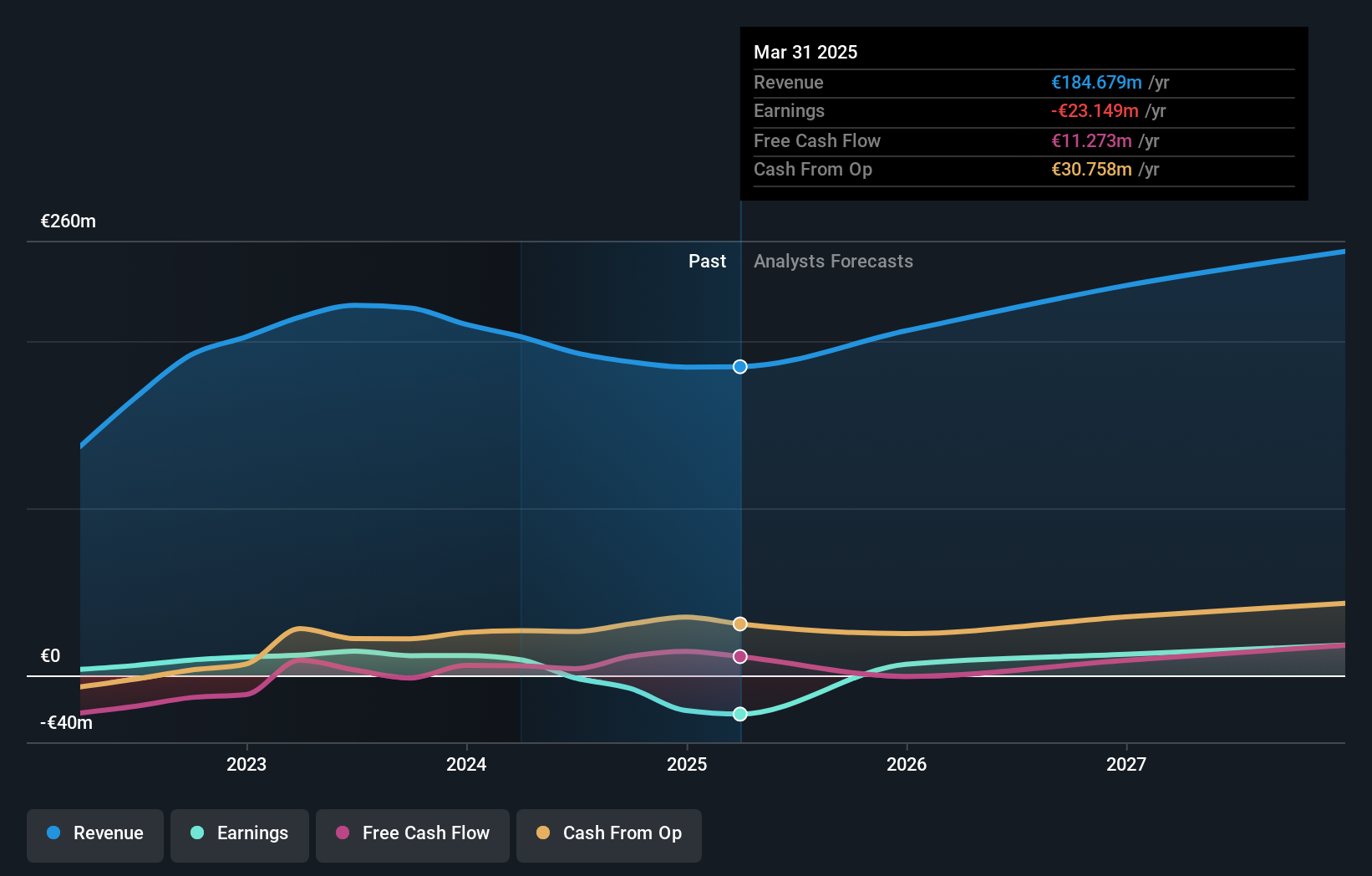

Seco (BIT:IOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seco S.p.A. is a technology company that specializes in creating innovative solutions for the digitization of industrial products and processes across various regions, with a market cap of €250.07 million.

Operations: Seco generates revenue primarily through its divisions, with Seco contributing €128.02 million and Seco NE adding €83.05 million, while Seco Mind US contributes a smaller portion at €1.09 million.

Seco's strategic partnership with Nayax, announced in January 2025, positions it uniquely within the IoT and AI-driven payment solutions sector. This collaboration is set to integrate Nayax's payment systems into Seco’s products, enhancing automated retail machines with smart capabilities. Highlighting its innovation trajectory, Seco presented at the Euronext Milan STAR Conference in March 2025, underscoring its commitment to embedding advanced technologies in everyday devices. Financially, Seco is on a promising path with expected revenue growth of 10.7% annually and an anticipated surge in earnings by 82.7% per year as it moves towards profitability within three years. This growth trajectory coupled with a volatile share price suggests dynamic market engagement but also calls for cautious optimism among investors monitoring these developments.

- Delve into the full analysis health report here for a deeper understanding of Seco.

Explore historical data to track Seco's performance over time in our Past section.

Bouvet (OB:BOUV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bouvet ASA is an IT and digital communication consultancy firm serving both public and private sectors in Norway, Sweden, and internationally, with a market cap of NOK7.73 billion.

Operations: The company generates revenue primarily from IT consultancy services, totaling NOK3.92 billion.

Bouvet ASA's strategic maneuvers, including a recent share repurchase program and proposed amendments to its bylaws, underscore its commitment to fostering shareholder value and corporate agility. With a 7.8% annual revenue growth and an 8.2% increase in earnings per year, Bouvet is outpacing the Norwegian market average growth rates of 2.1% in revenue and 7.8% in earnings respectively. The company's robust financial health is further evidenced by its positive free cash flow and a forecasted exceptional Return on Equity of 99.6% in three years' time, positioning it as a resilient contender amidst Europe's tech landscape despite not leading the high-growth tech sector.

- Get an in-depth perspective on Bouvet's performance by reading our health report here.

Evaluate Bouvet's historical performance by accessing our past performance report.

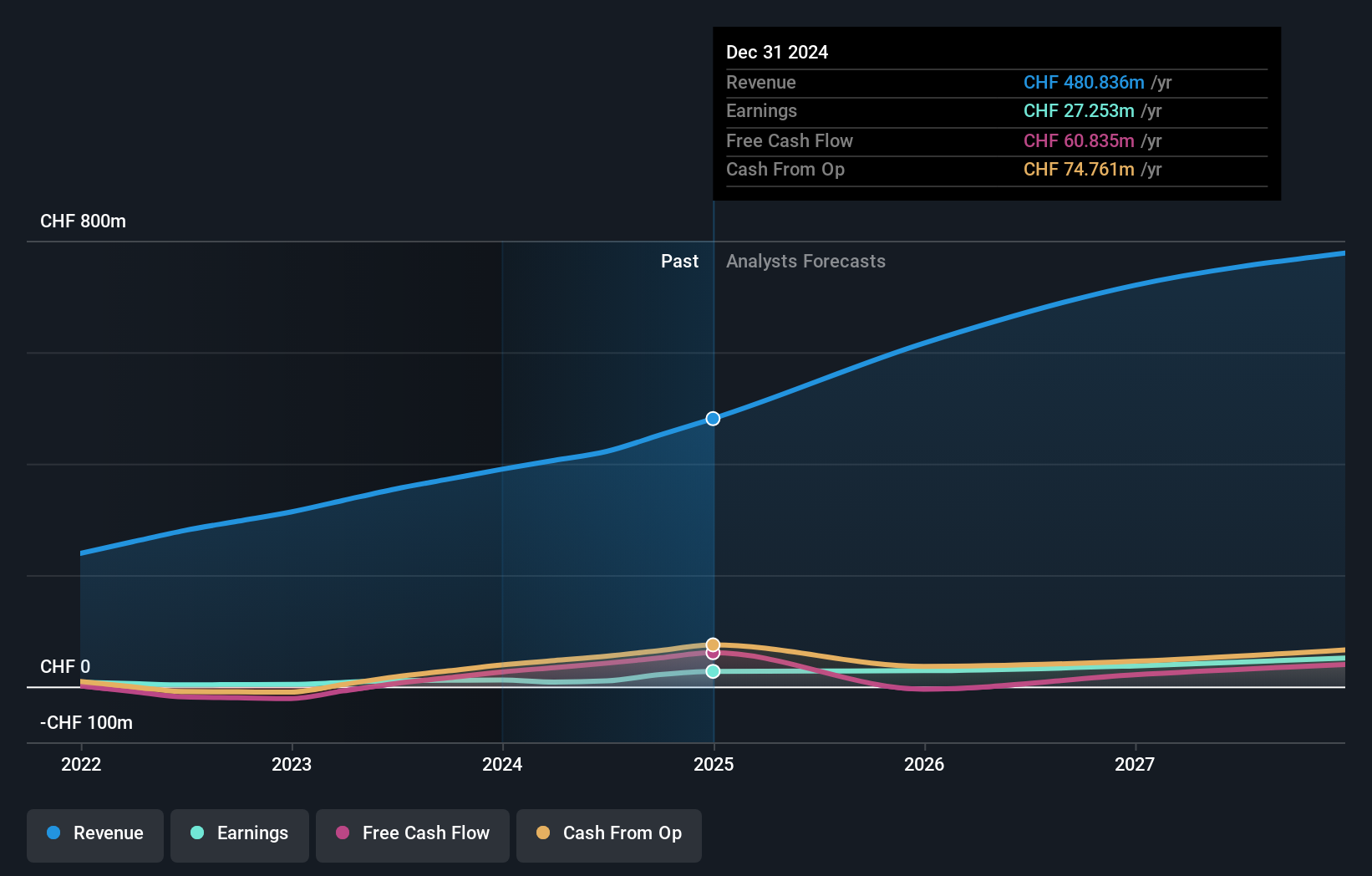

Cicor Technologies (SWX:CICN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cicor Technologies Ltd., with a market cap of CHF431.95 million, develops and manufactures electronic components, devices, and systems on a global scale through its subsidiaries.

Operations: The company generates revenue primarily from its Electronic Manufacturing Services (EMS) Division, contributing CHF347.90 million, and its Advanced Substrates (AS) Division, adding CHF43 million. The EMS Division is the major revenue driver, reflecting the company's focus on large-scale electronic manufacturing solutions.

Cicor Technologies, with a striking earnings growth of 348.8% over the past year, significantly outperformed the electronic industry average of 69.5%. This surge is supported by robust strategic initiatives like the recent acquisition of a manufacturing operation from Mercury Mission Systems, which positions Cicor as a key player in Europe for aerospace and defense electronics. The company's R&D expenditure aligns with its revenue growth at 9.6% annually, underscoring its commitment to innovation and expansion in high-stakes markets. Moreover, Cicor's forecasted Return on Equity of 20.1% signals strong future profitability potential amidst challenging economic conditions.

- Click to explore a detailed breakdown of our findings in Cicor Technologies' health report.

Gain insights into Cicor Technologies' past trends and performance with our Past report.

Turning Ideas Into Actions

- Access the full spectrum of 223 European High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal