European Insider Buying Highlights 3 Undervalued Small Caps

In recent weeks, European markets have shown resilience with the pan-European STOXX Europe 600 Index rising by 3.93%, buoyed by the European Central Bank's decision to cut rates amid trade uncertainties. This positive sentiment has extended to smaller-cap stocks, which are often seen as opportunities for growth in a recovering market environment. In this context, stocks that demonstrate strong fundamentals and potential for growth can be particularly appealing to investors looking for value in Europe's small-cap sector.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.4x | 0.5x | 44.10% | ★★★★★★ |

| Tristel | 26.0x | 3.7x | 31.17% | ★★★★★☆ |

| Savills | 23.8x | 0.5x | 42.95% | ★★★★☆☆ |

| Byggmax Group | 27.8x | 0.5x | 44.51% | ★★★★☆☆ |

| Speedy Hire | NA | 0.2x | 0.02% | ★★★★☆☆ |

| Axactor | NA | 0.8x | 13.05% | ★★★★☆☆ |

| Norcros | 24.2x | 0.6x | 28.45% | ★★★☆☆☆ |

| FRP Advisory Group | 12.6x | 2.2x | 9.02% | ★★★☆☆☆ |

| Italmobiliare | 10.9x | 1.4x | -258.24% | ★★★☆☆☆ |

| Arendals Fossekompani | 20.6x | 1.6x | 48.72% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

EL.En (BIT:ELN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: EL.En is a company that designs, manufactures, and sells laser systems for medical and industrial applications, with a market cap of approximately €1.45 billion.

Operations: EL.En's revenue streams have shown fluctuations, with the latest reported revenue at €565.85 million. The company's cost of goods sold (COGS) and operating expenses are significant, impacting its net income margins. Notably, the gross profit margin has varied over time, reaching 42.20% in the most recent period.

PE: 10.6x

EL.En. stands out in the European market with its small-cap status, drawing attention for potential value despite a volatile share price over the past three months. Insider confidence is evident as Alberto Pecci acquired 15,000 shares for €145,198 in March 2025. The company recently announced a dividend increase to €0.22 per share and is considering selling a majority stake in its Laser Cut Division, which could reshape its future strategy amidst anticipated revenue growth of 5.3% annually.

- Get an in-depth perspective on EL.En's performance by reading our valuation report here.

Review our historical performance report to gain insights into EL.En's's past performance.

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hollywood Bowl Group operates a chain of ten-pin bowling centers across the UK, focusing on providing recreational activities, with a market capitalization of approximately £0.65 billion.

Operations: The company generates revenue from recreational activities, with a recent reported figure of £230.40 million. Over time, the gross profit margin has shown variability, most notably decreasing to 63.15% by September 2024. Operating expenses and cost of goods sold have increased alongside revenue growth, impacting net income margins which stood at 12.98% during the same period.

PE: 15.8x

Hollywood Bowl Group, a notable player in the leisure sector, is capturing attention as an undervalued investment opportunity. With insider confidence evident from Peter Boddy's purchase of 100,000 shares for £320,000 in early 2025, there's a clear belief in the company's potential. The firm has initiated a share repurchase program authorized to buy back up to 10% of its issued capital until March 2026. Despite relying on external borrowing for funding, earnings are projected to grow by 11% annually.

- Take a closer look at Hollywood Bowl Group's potential here in our valuation report.

Explore historical data to track Hollywood Bowl Group's performance over time in our Past section.

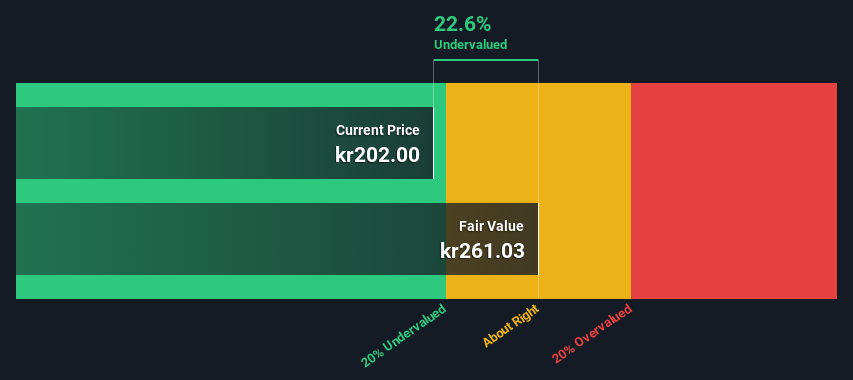

Sparebanken Sør (OB:SOR)

Simply Wall St Value Rating: ★★★☆☆☆

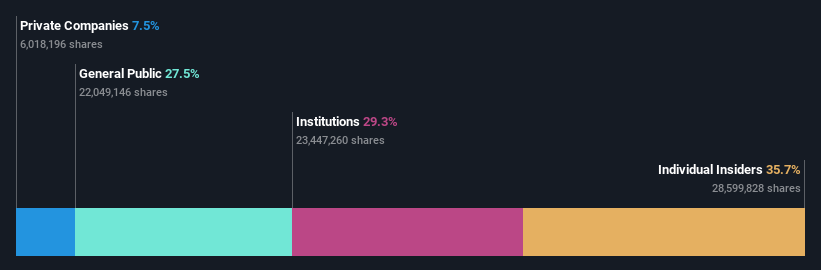

Overview: Sparebanken Sør is a financial institution that provides banking services across corporate and retail markets, with a market capitalization of NOK 10.65 billion.

Operations: The company generates revenue primarily from the Retail Market (NOK 1.68 billion) and Corporate Market (NOK 1.32 billion). Operating expenses are a significant cost component, with general and administrative expenses reaching NOK 724 million in recent periods. The net income margin has shown a notable upward trend, reaching approximately 20.29% by September 2024.

PE: 10.7x

Sparebanken Sør, a smaller player in the European financial sector, demonstrates potential value through its recent performance and strategic moves. Reporting a net income of NOK 1.99 billion for 2024, up from NOK 1.77 billion last year, it shows financial growth with basic earnings per share rising to NOK 18.2 from NOK 16.4. Insider confidence is evident as they purchased shares between January and March 2025, indicating belief in future prospects despite reliance on riskier funding sources like external borrowing over customer deposits.

- Click here and access our complete valuation analysis report to understand the dynamics of Sparebanken Sør.

Examine Sparebanken Sør's past performance report to understand how it has performed in the past.

Where To Now?

- Delve into our full catalog of 64 Undervalued European Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal